Hello Community,

Time and again I see investors trying to value fast-growing tech or SaaS (Software-as-a-Service) companies with a traditional P/E ratio. This is often a fatal mistake. The P/E ratio looks at past profits and is absolutely useless for companies that immediately reinvest every euro earned in growth.

Professional investors and venture capitalists therefore use a different set of tools to assess the health and potential of these companies. Let me introduce you to the three most important ones:

🧠 Key figure #1Net Retention Rate (NRR)

Perhaps the most important key figure for any subscription model. It answers the question: Is the company growing even if it is not acquiring new customers?

The NRR shows what percentage more (or less) the existing customers compared to the previous year. A value above 100% means that the company earns more money through upgrades and additional sales than it loses through cancellations.

- Elite level: Anything above 120% is world class.

- Examples: Companies like Snowflake ($SNOW) or CrowdStrike ($CRWD) often shine with values of 120-130%+.

- What it tells us: A high NRR is the ultimate proof of a superior product with high switching costs. The company is growing on autopilot.

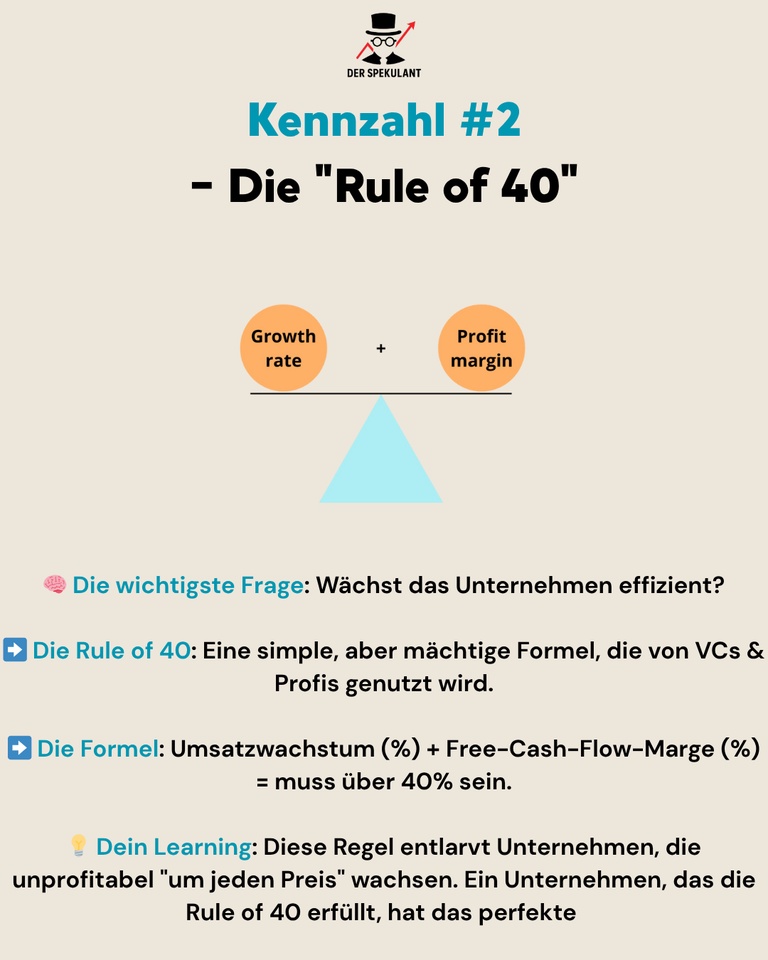

⚖️ Key figure #2The "Rule of 40

This rule is a quick but extremely powerful efficiency check. It answers the question: Is the company growing in a healthy way?

The formula is simple: Sales growth (%) + free cash flow margin (%)

The result must exceed 40% be achieved.

- Example: A company grows at 30% and has an FCF margin of 15%. The result is 45% -> Rule of 40 fulfilled! ✔️

- What it tells us: The Rule of 40 separates the wheat from the chaff. It exposes companies that grow unprofitably "at any cost". A company that fulfills this rule has found the perfect balance between aggressive growth and financial discipline. A champion like Cloudflare ($NET) often fulfills this rule.

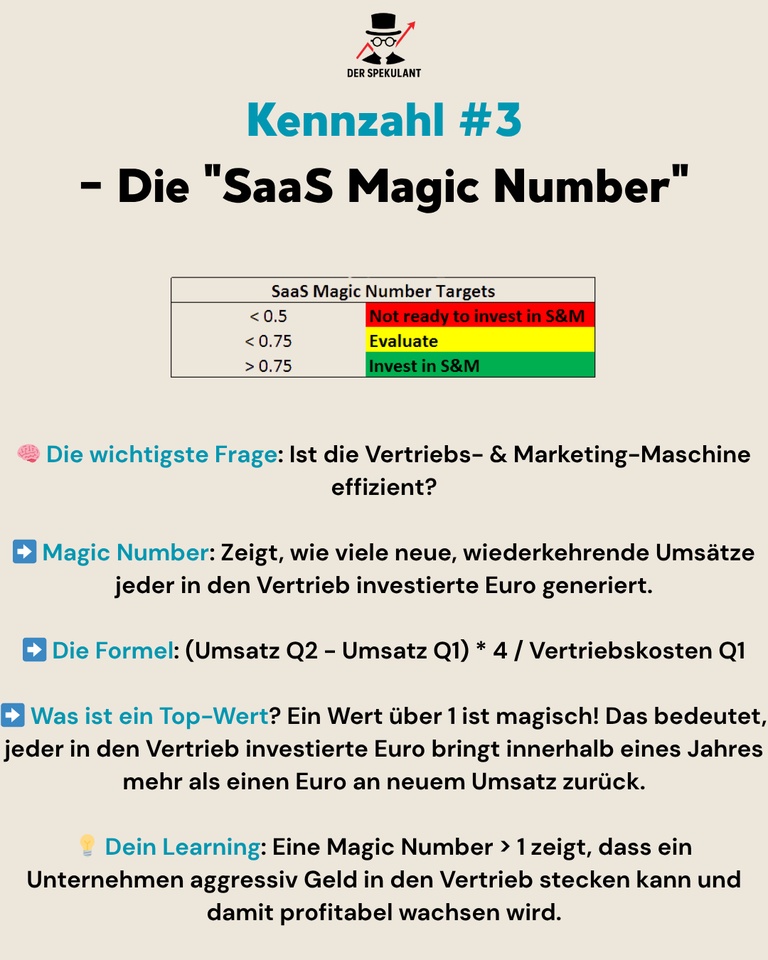

✨ Key figure #3The "SaaS Magic Number"

This key figure is like looking into the engine compartment of the sales machine. It answers the question: Is every euro spent on marketing & sales well invested?

It measures how many new, recurring sales each euro invested in sales generates.

- Magic level: A value above 1 is fantastic.

- What it tells us: A Magic Number of over 1 means that the company can accelerate its growth profitably. It's the green light to step on the gas pedal aggressively in sales.

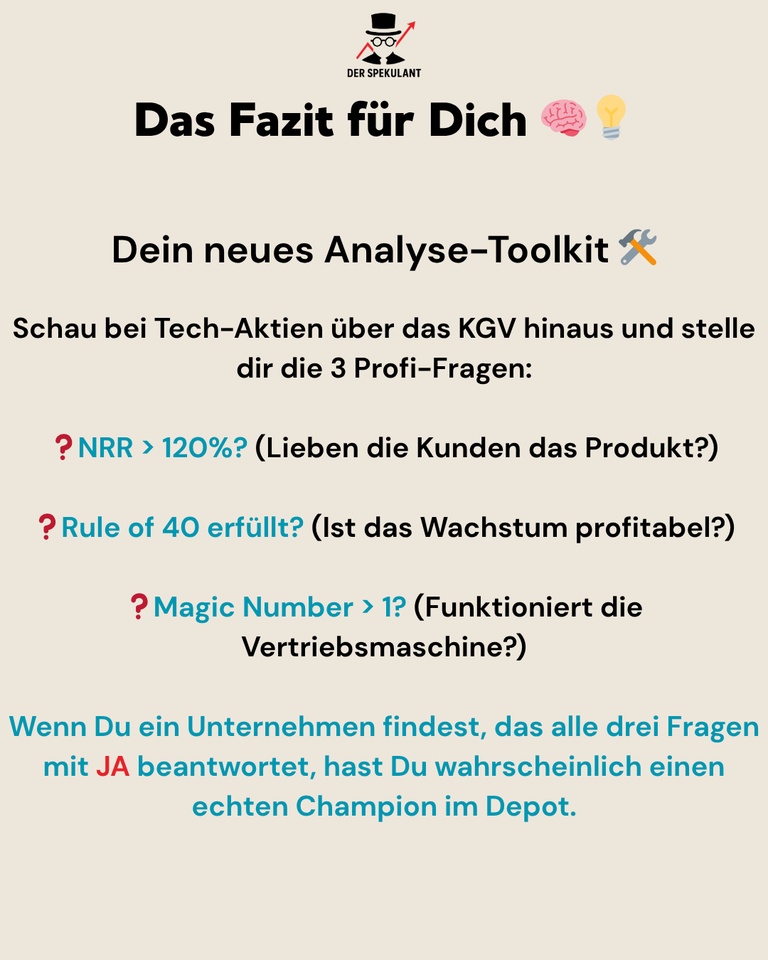

Bottom line for you:

Next time you're analyzing an exciting tech stock, forget the P/E ratio. Ask these three pro questions instead. If you find a company that shines on all three metrics, you're likely to have a real long-term winner in your portfolio.