So... is a stock really cheap - or just a trap for investors?

There are many ways to recognize a value trap but most of the time it's about stocks that look look cheap visually -for example, with a low P/E ratio or a high dividend yield - but which fundamentally lose substanceif you take a closer look.

Such traps often emerge when an entire industry is in in upheaval is in upheaval:

- Newspapers before the internet

- video stores before Netflix

- or cabs - before Uber came along

Today we take a look at 2 companies that could fit exactly into this category.

🎧 1. SiriusXM $SIRI (-6,38 %)

Since the big merger in 2008 between Sirius and XM, the company has been the absolute top dog in its field.

Through close partnerships with car manufacturers SiriusXM is now pre-installed in almost every new car in the USA.

This was a smart move - and the company was able to increase its turnover by a whopping 13 % per year per year between 2008 and 2022.

But... times are changing.

Because with Spotify, Apple Music and the like, more and more people prefer to listen on demand -

cheaper, more flexible and with a better selection.

The problem:

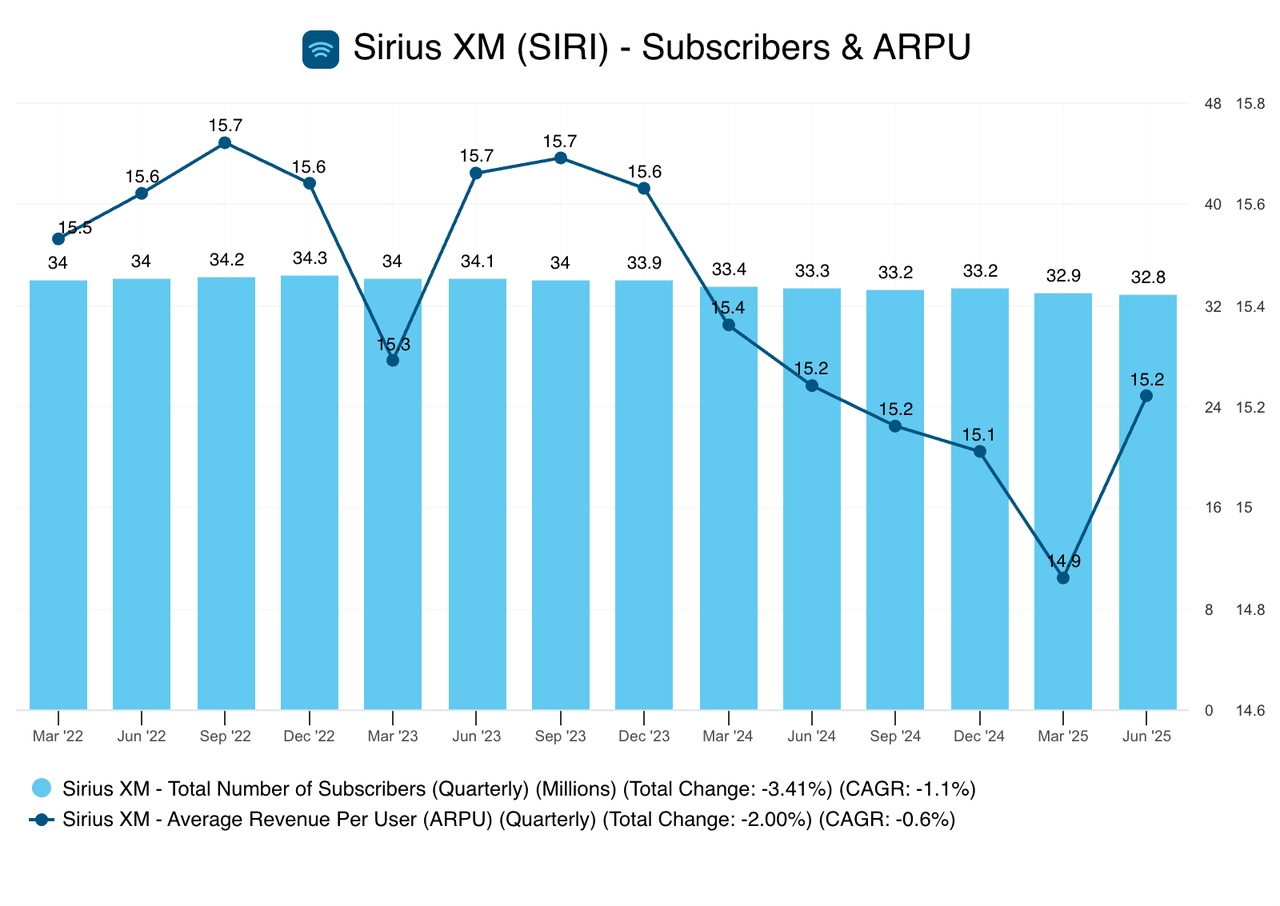

More and more users are canceling their satellite subscriptions, and even the remaining customers are bringing in less revenue.

The average revenue per user is falling - despite the seemingly attractive valuation:

an EV/FCF of 16.2 sounds good on paper, but the trend is clearly pointing downwards.

In short:

SiriusXM is fighting against an entire industry that has long since arrived in the streaming age.

And that's exactly what makes it dangerous - a classic value trap in slow motion.

💸 2. western union $WU (-2,58 %)

Let's move on to Western Union - a share with a really fat dividend yield dividend yield of over 11 %.

Sounds tempting at first, doesn't it?

But just because it looks like a lot of cash doesn't mean that the business is healthy.

Western Union has been over 100 years one of the largest providers of money transfers worldwide - but it is precisely this model that is currently under massive pressure.

Because the world has changed:

More and more people are sending their money digitally,

instead of physically via Western Union branches.

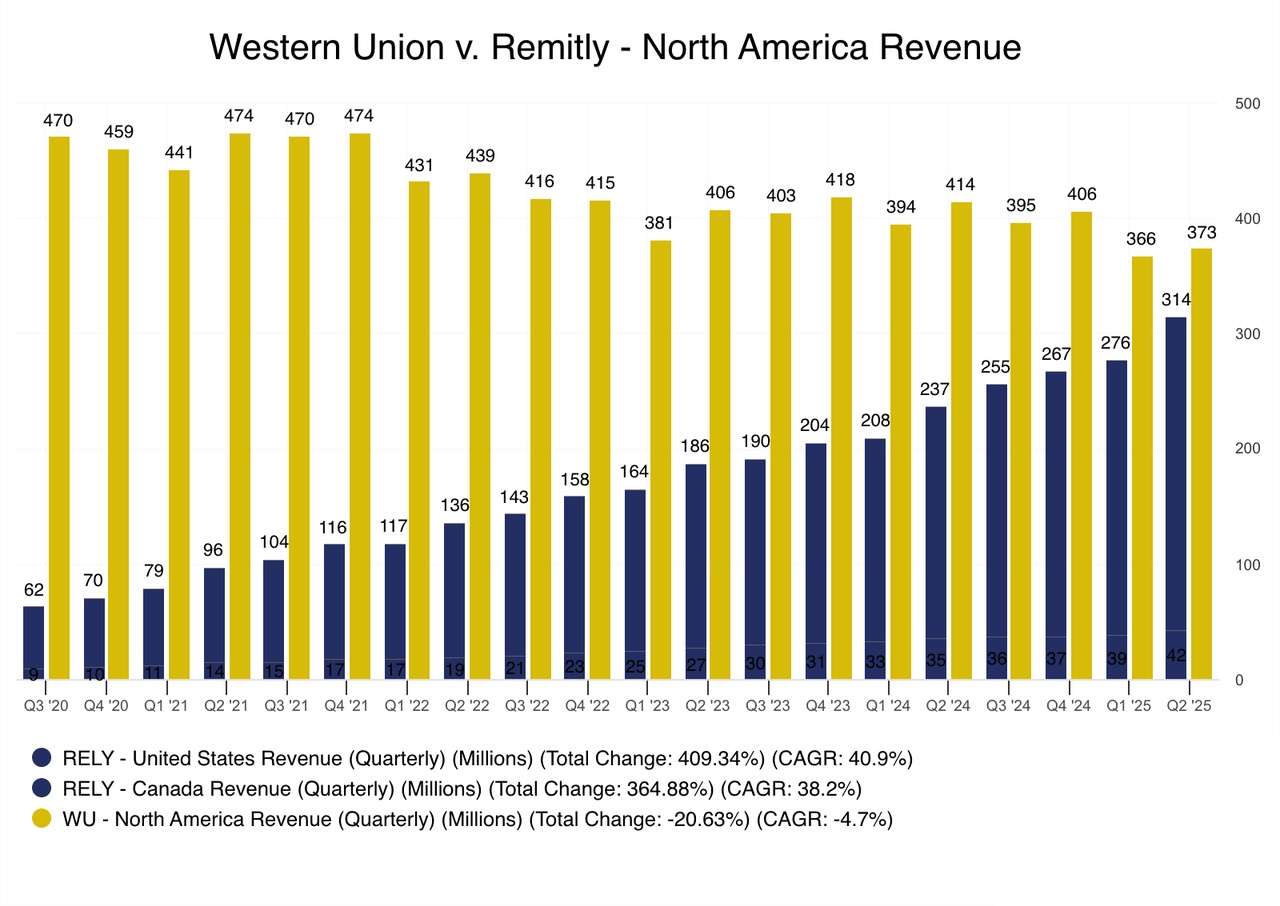

New players such as Remitly, Wise or Revolut are faster, cheaper - and much more convenient.

And that is precisely why more and more customers are deciding against Western Union.

Of course, at first glance the share looks favorably valued but the truth is:

The entire business model is in the midst of change.

And as long as Western Union doesn't really catch up here, this is likely to continue to weigh heavily put pressure on profits in the future.

💬 Conclusion:

Just because a share looks cheapdoes not mean that it is cheap is cheap.

Because if the business model is crumbling, even a low P/E ratio won't help.

So always check:

Is the company undervalued - or outdated?

Because: The boundary between value play and value trap is often only a fine line.

My Youtube channel for more stock analysis: www.youtube.com/@Verstehdieaktie