I bet you've heard this rule many times before. In any case, I don't know any "finance influencer" who doesn't pray this rule up and down and it goes down well with their audience... why? Because it seems achievable. 100k in the portfolio is within the imagination, while portfolio sizes beyond millions seem too far-fetched for many!

👉🏻 In order to convince people of the importance of the rule, all kinds of statistics are brought out. First and foremost, the time until the "next 100k" as proof of the compound interest effect, which makes the work from then on virtually by itself.

And for those who are still not completely convinced, the quote from Charlie Munger (Warren Buffett's No. 2) is thrown around: "Accumulating the first 100,000 is the most difficult and the most important part!". And who wants to contradict one of the most successful investors of all time? 😅

But let's take a closer look at the details:

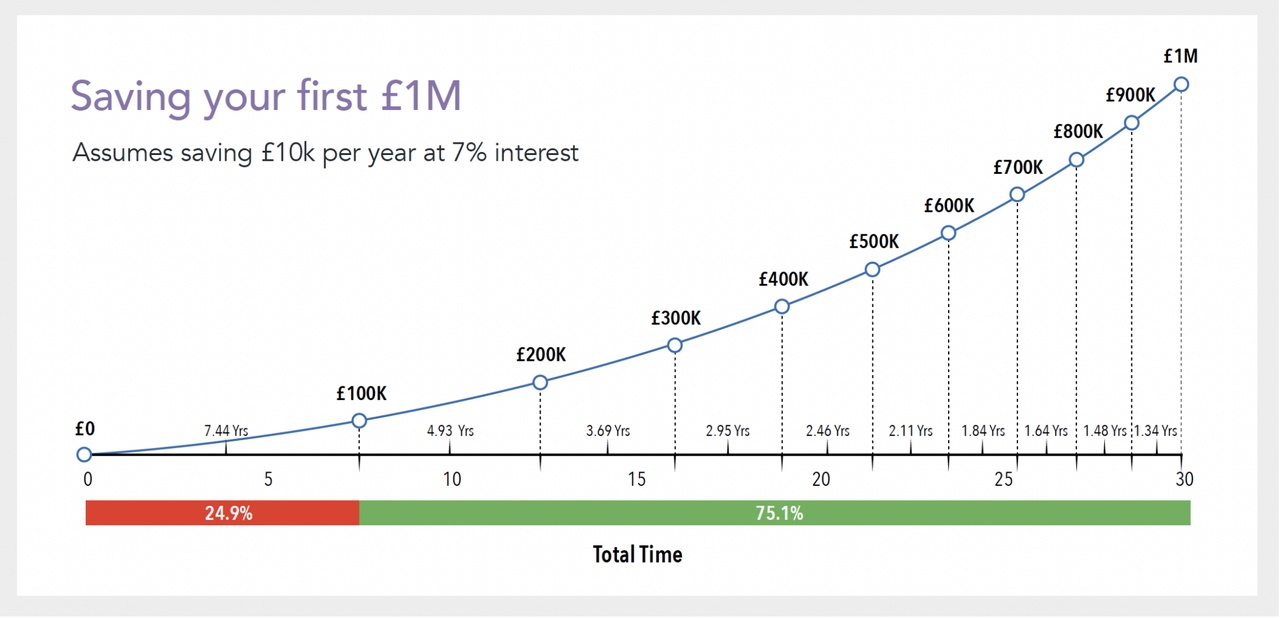

Let's assume we are able to save 10,000 euros per year...

Deposit value start: -> end -> of which saved: -> in years

0 -> 100k -> approx. 70k saved -> 7.44 years

100k -> 200k -> approx. 120k saved -> 12.37 (+4.93) years

200k -> 300k -> approx. 160k saved -> 16.06 (+3.69) years

300k -> 400k -> approx. 190k saved -> 19.01 (+2.95) years

400k -> 500k -> approx. 215k saved -> 21.47 (+2.47) years

...

It's true, after the first 100k, the investment income just exceeds the deposits under the given assumptions.

But there are two things to consider...

➡️ 0 taxes: Here it is assumed that you will never receive dividends and / or realize capital gains and therefore have to pay tax. All profits are reinvested. In reality, this will apply to very few people.

➡️ Real return: In addition, 100k in 7 years is not worth 100k today. The real return (adjusted for inflation by approx. 3% p.a.) on the MSCI World is closer to 5%, at least since 1970. This chart assumes a very optimistic case. If we take the 5% as a basis, we will only reach the first 100k after well over 8 years.

In addition to the obvious shortcomings of this glorified rule, there are also very practical disadvantages over such a long period of time:

If you start at 30, in theory you reach your first half million at around early 50-55. For most people, there is a gap in between:

👉🏻 Starting a family

👉🏻 Buying / financing a property

👉🏻 Strokes of fate, caring for parents in old age, etc.

This means that very few people will be able to keep up this kind of saving and will have to start saving earlier. This means that all the magic is gone.

And what about Charlie Munger's statement? Well, he made the statement in the 1960s. 100k back then is equivalent to around 1 million euros today. 💵

And that's exactly the point. The 100k shouldn't be an end in itself, it should have a noticeable positive effect on your everyday life. That's what they had in the 1960s ... Today, you need at least 1 million euros, if not more.

However, this message is no longer so sexy, because for many people this is unattainable, especially in their early years (Buffett had his first million dollars at around 30!!!). -> that corresponds to at least 4-5 million euros today). But this message doesn't generate likes and clicks... 😉

What is your opinion on this?

$MSCI (-0,12 %)

$CSPX (+0,76 %)

$BTC (+0,05 %)