Hello Community,

Warren Buffett once said: "The key to investing is not assessing how much an industry will impact society or how much it will grow, but determining the competitive advantage of a particular company and, more importantly, the durability of that advantage."

It is precisely this competitive advantage that he called the "moat". In this article, we break down the most important concept for long-term stock market success in detail.

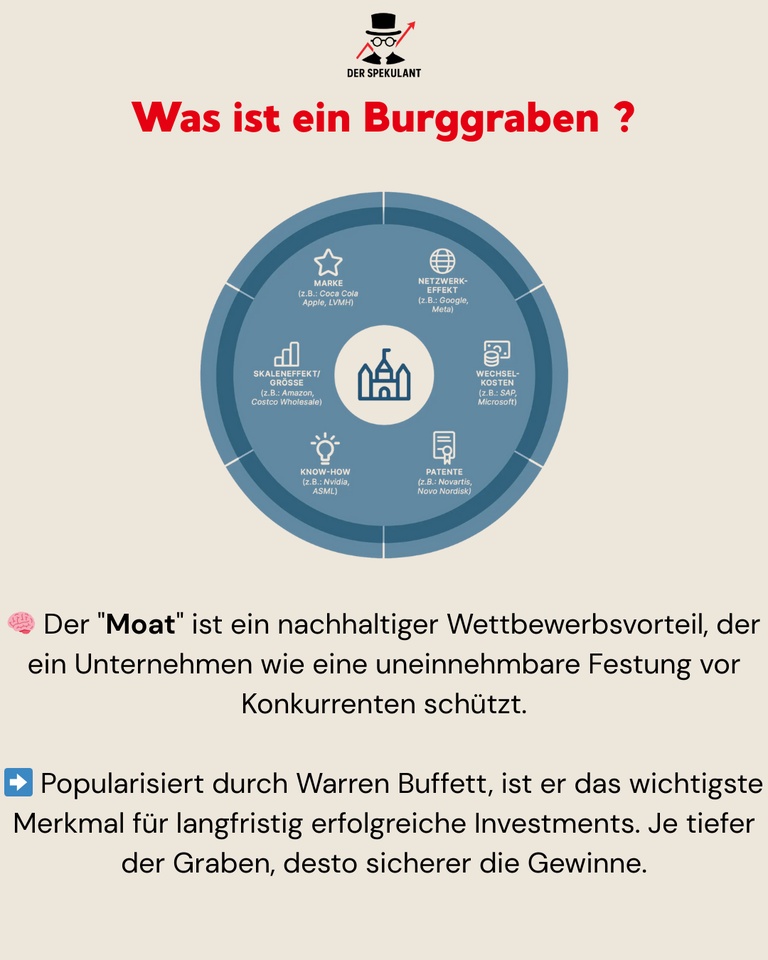

The 4 types of impregnable moats:

👑 1. intangible assets:

These are invisible but extremely powerful assets. They include brands that create an emotional bond and pricing power (as with $RACE (-0,19 %) ), or patents that lock out competitors for years (as with $NOVO B (-0,1 %) in the pharmaceutical sector). Companies with this moat can often charge higher prices and thus achieve higher margins.

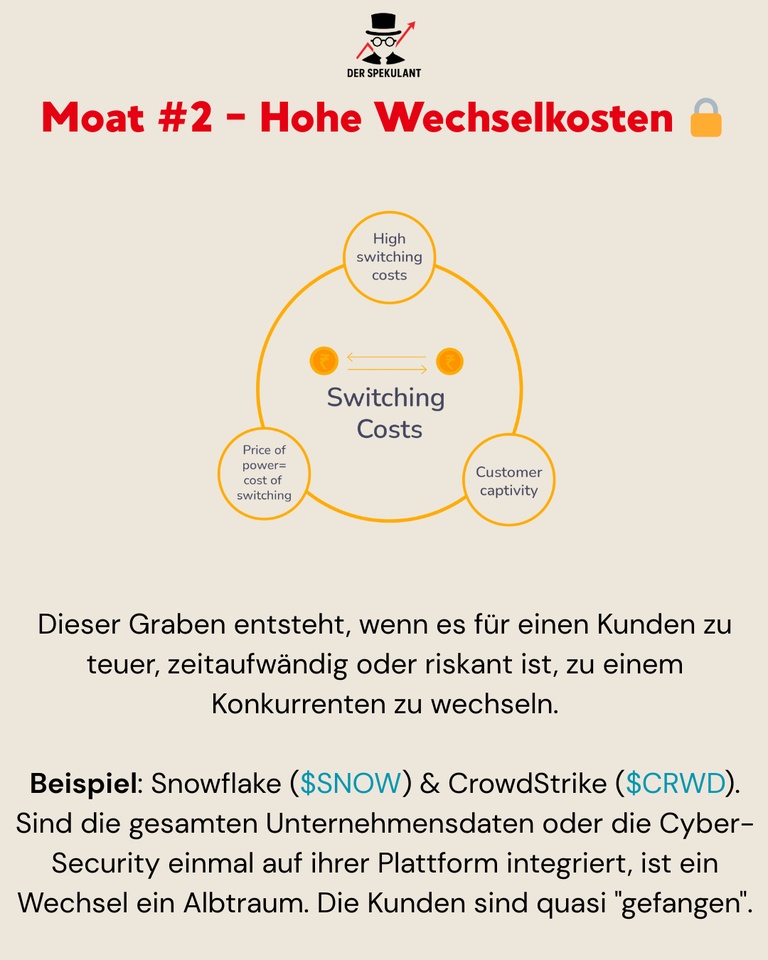

🔒 2. high switching costs:

Perhaps the most underestimated moat. A company has this moat if the customer would have to put up with massive disadvantages to switch providers. My AI infrastructure cluster is full of them: $SNOW (-0,12 %) , $CRWD (+0,92 %) and $DDOG (-0,43 %) integrate themselves so deeply into their customers' IT systems that switching would be tantamount to operational hara-kiri. Customers stay, even if prices rise. The "net retention rate" is the key figure here.

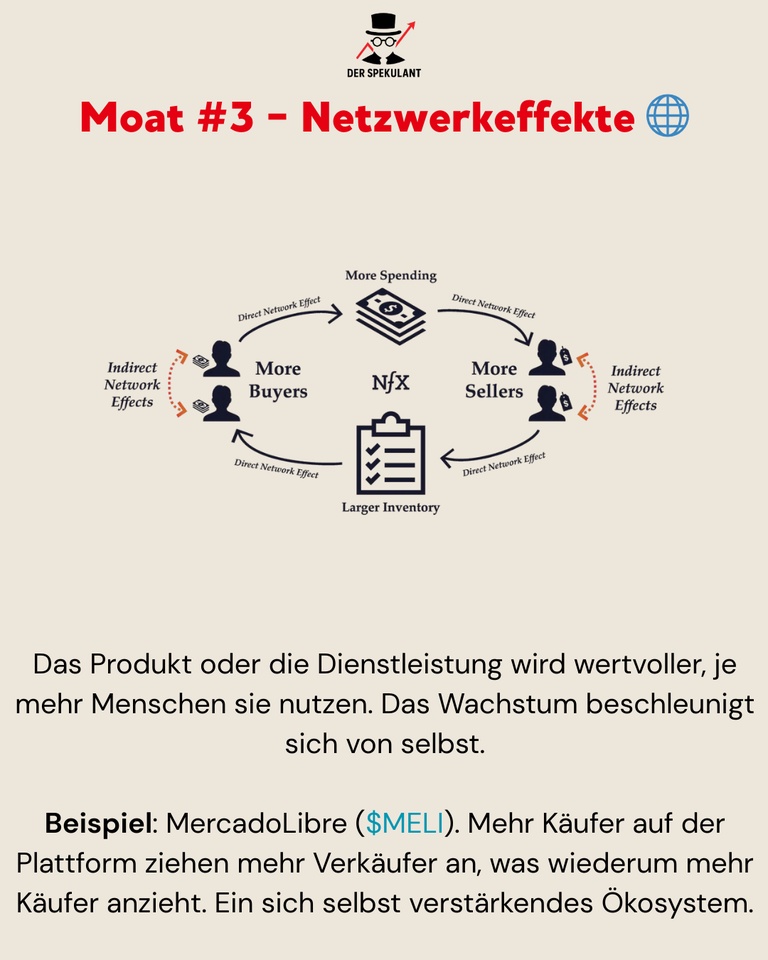

🌐 3. network effects:

The business model becomes exponentially stronger with each new user. My best example of this is $MELI (-0,24 %) . Every new seller makes the platform more attractive for buyers, and every new buyer makes it more attractive for sellers. Mercado Pago, the payment system, amplifies this effect. This moat is extremely difficult to attack once a critical mass is reached.

📉 4. cost advantages:

The ability to consistently produce or deliver at a lower cost than the competition. This can be achieved through economies of scale or, as in the case of $1211 (-0,96 %) through superior vertical integration. Because BYD manufactures its own batteries, the company can wage price wars that are ruinous for the competition.

Conclusion for your strategy:

Analyzing the moat should be the first step in any stock analysis. Before you look at quarterly figures or the P/E ratio, ask yourself the question:

"What's stopping a competitor from doing exactly the same thing tomorrow, only cheaper?"

If you can't find a good answer, the company probably doesn't have a moat.

#Burggraben

#Moat

#WarrenBuffett

#Investieren

#Aktienanalyse

#Qualitätsaktien

#Wettbewerbsvorteil

#DerSpekulant

#Ferrari

#Snowflake

#MercadoLibre