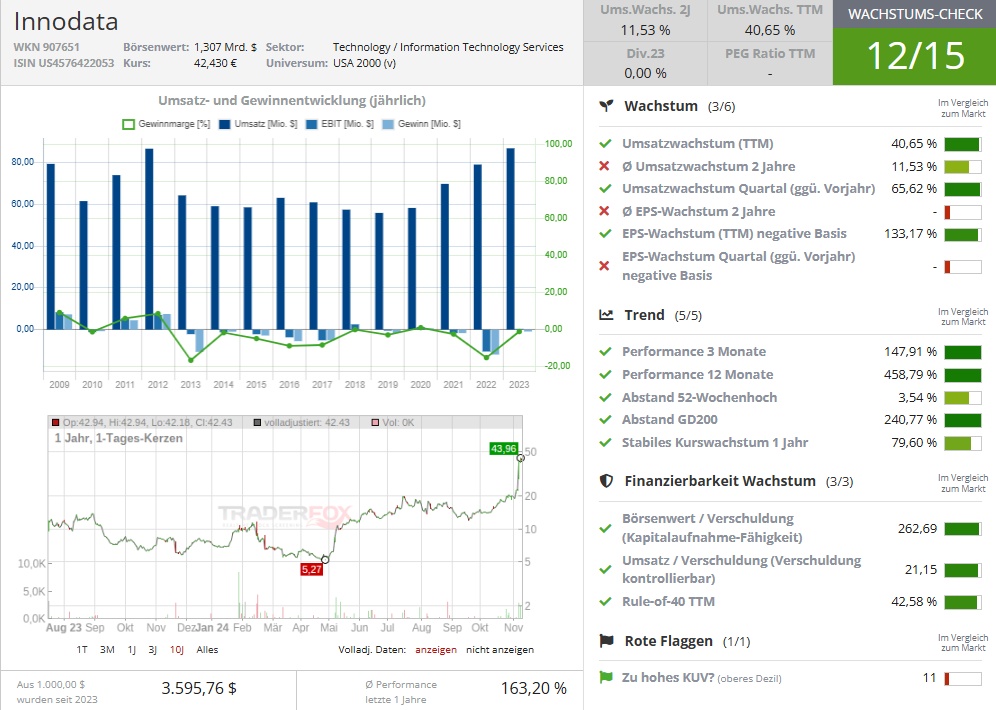

INODATA (ONOD) SAYS IT IS NOW READY TO SUPPORT FOUR OF THE FIVE LARGEST GLOBAL TECHNOLOGY COMPANIES IN THE DEVELOPMENT OF GENERATIVE KI!

Innodata (ISIN: US4576422053)

Innodata is a company that provides specialized data solutions and AI-powered services. It supports companies in structuring, analyzing and refining large amounts of data and develops technologies to make information from complex content efficiently usable. The company was founded in 1988. The IPO took place in 1993.

With a focus on the IT, healthcare and financial services sectors, Innodata optimizes business processes for its customers and helps them make well-founded decisions based on data analysis. As the demand for data-driven strategies and AI-supported decision-making is becoming increasingly crucial for competitiveness, Innodata has enormous growth potential.

On November 7, 2024, Innodata delivered its figures for the past Q3 2024, with revenue of USD 52 million up a whopping 136% on the previous year. The net profit of USD 0.51 also exploded compared to the previous year's result of USD 0.01. As a result, management raised its forecast for the full year 2024 to revenue growth of between 88% and 92% compared to the previous year.

The chart clearly shows the significance of the latest quarterly report for the company. The share price rose by almost 76%. The trading volume was at a record level. The gap-up can be interpreted as a technical indication of how much appetite major investors have for Innodata shares.

Conclusion: Innodata is a data analytics company that offers specialized solutions and AI services. In Q3 2024, it achieved impressive results with revenue growth of 136% and raised its full-year guidance. The strong quarterly figures led to a share price increase of almost 76%, which shows that institutional investors are very interested in the stock.

https://mobile.aktien-mag.de/blog/welche-3-aktien-lieferten-die-starksten-quartalsberichte/id-130650