The financial markets have provided us with some exciting developments this week. Today's newsletter brings you the most important events in a compact and understandable way:

From DeepSeekthe Chinese AI start-up that has surprised the technology sector with an innovative approach, to the latest interest rate decisions of the central banks, to the mixed quarterly quarterly figures from Tesla - it was a week full of headlines.

Enjoy reading!

DeepSeek: China's new AI player and its consequences

The Chinese AI start-up DeepSeek has caused quite a stir with its new model DeepSeek R1. The AI chatbot, launched on January 20, is now one of the most downloaded apps worldwide. In the USA, it currently occupies 1st place in the iPhone app storeeven ahead of ChatGPT or Google's Gemini. The app is also one of the top downloads in Germany. Users can chat with the AI, upload files or carry out web searches - and the basic version is free.

What makes it special: DeepSeek's chatbot is said to require significantly less computing power than comparable models from large US companies such as OpenAI or Google $GOOGL (+0,08 %) . According to reports, around 2,000 Nvidia H800 graphics processors were used to train DeepSeek-R1, resulting in costs of around 6 million US dollars. By comparison, OpenAI invested around USD 100 million in the development of GPT-4 in 2023. This efficiency calls into question the previous assumption that high-performance AI models necessarily require investments in the billions and specialized high-performance chips. If these figures prove to be true, this could increase the pressure on US companies to rethink their cost structures and investment strategies.

This surprising development and the associated uncertainty triggered a significant reaction on the stock market on Monday. The US tech index Nasdaq 100 lost around 3%, and Nvidia in particular $NVDA (+0,24 %) - the leading provider of chips for AI applications, which has benefited enormously from the AI trend in recent years - fell by almost 17%. Companies such as Broadcom $AVGO (+0,32 %) , AMD $AMD (+0,34 %) , ASML $ASML (+0,89 %) and Microsoft $MSFT (+0,17 %) also came under pressure in the meantime. Most tech stocks stabilized somewhat over the course of the week. This is because some experts are questioning the transparency of DeepSeek's data from China and are urging caution when assessing the actual performance and efficiency of the model. It is already becoming apparent that DeepSeek's actual cost advantages could be lower than initially assumed - further developments remain to be seen.

What you as an investor can learn from the DeepSeek turmoil:

- #1: Don't panic - markets often tend to exaggerate in both directions: Tech stocks are sensitive to sensationalized headlines. Share prices can move rapidly up or down in the short term, regardless of the substance of the news. Sharp price losses happen again and again - and are often followed by a quick recovery. It is important to remain calm and not be tempted to sell rashly.

- # 2: Corrections bring opportunities: Sharp price falls like those on Monday often offer good buying opportunities - especially for quality companies with long-term potential and reasonable valuations, e.g. ASML $ASML (+0,89 %) . As long as companies are fundamentally sound, short-term setbacks are usually no cause for concern.

- #3: AI competition is getting tougher - this is positive for innovation and adoption: DeepSeek shows that AI development does not necessarily have to be extremely expensive. More competition and the supposedly new, innovative approach could lead to AI models becoming even more efficient and widely available.

- #4: The technology sector is constantly changing: The technology sector is one of the most rapidly changing markets. Companies that are considered market leaders today can be challenged or displaced by new innovations within a few years. As an investor, you should therefore regularly check whether your technology investments will remain competitive in the long term. Do you only have quality companies in your portfolio with sustainable competitive advantages and attractive future prospects? Or is their market position crumbling, e.g. due to the introduction of new technologies?

Interest rate decisions: What the ECB and Fed mean for the market

This week there were two landmark interest rate decisions - one in Europe, one in the USA.

A brief reminder: Developments and expectations regarding key interest rates are a decisive factor for the stock market. Falling interest rates make loans cheaper and boost investment and consumption. This often causes share prices to rise. Rising interest rates, on the other hand, slow down growth and make alternative investments such as bonds more attractive - this can put pressure on shares.

- ECB lowers key interest rate to 2.75 percent - potential stimulus for the economy: The European Central Bank (ECB) has lowered its key interest rate for the fifth time since the monetary policy turnaround at the end of 2023. The monetary authorities decided to lower the deposit rate by 0.25 percentage points to 2.75%. ECB chief Christine Lagarde justified the move with the weakening economy. The EU statistics office reported zero growth in the last quarter of 2024, with growth of just 0.7% for the year as a whole. The aim of the interest rate cut: cheaper loans for companies and private individuals to boost investment and consumption.

- US Federal Reserve remains firm - no interest rate cut (yet): While the ECB is cutting interest rates, the US Federal Reserve (Fed) is standing firm. Despite political pressure from Donald Trump, the Fed has decided to leave the key interest rate in the range of 4.25% to 4.50%. The reason: the US economy remains strong - growth is continuing and inflation has not yet been conquered. Fed Chairman Jerome Powell made it clear that a premature interest rate cut could jeopardize the fight against rising prices.

Hot phase of the reporting season for many companies in the S&P 500

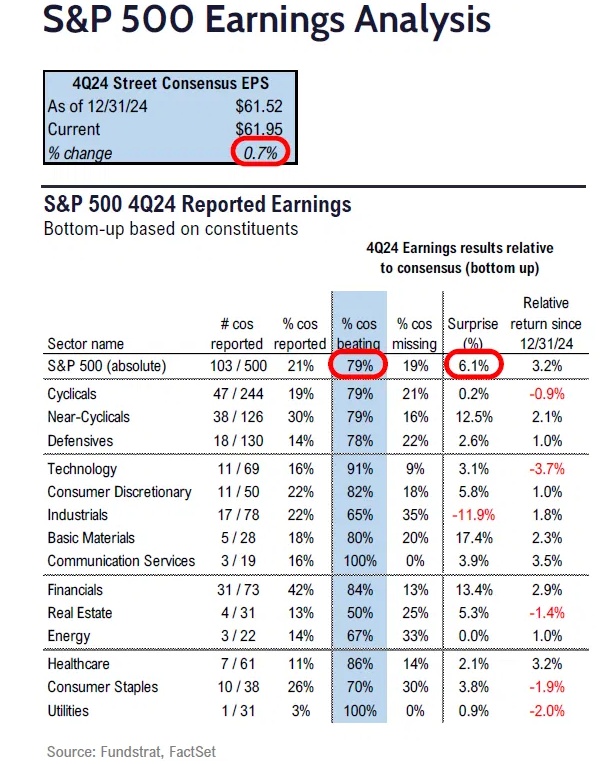

We are currently in the middle of the phase in which many US companies publish their figures for the last quarter. The following chart from Fundstrat provides an overview of the results so far and how they have been received by the market:

As of Wednesday this week, 103 of the 500 companies in the S&P 500 have reported their quarterly results for Q4 2024. 79% of the companies have beaten exceeded earnings estimateswhich indicates an overall strong operating performance. The positive surprise factor of 6.1% shows that companies are performing better than analysts had expected. The S&P 500 is up 3.2% since 12/31/2024, also indicating positive market sentiment. The solid earnings season so far therefore appears to be boosting investor confidence in corporate earnings.

The reports and forecasts of some heavyweights such as Meta $META (+0,1 %) , ASML $ASML (+0,89 %) , Netflix $NFLX (-0,1 %) , Mastercard $MA (-0,17 %) and Intuitive Surgical $ISRG (+0,05 %) were well received by investors mostly well well received by investors. Microsoft $MSFT (+0,17 %) on the other hand, showed a rather subdued share price reaction to the results presented and the short-term outlook. Tesla Tesla $TSLA (-0,22 %) a company in my portfolio, also presented its figures this week for Q4 2024 with mixed results. The most important findings are summarized here in a compact and understandable way:

- Tesla has in 2024 around 1.8 million vehicles delivered in 2024 - an increase of 36% compared to 2022, but no further increase compared to 2023. With sales of 25.7 billion US dollars in Q4, Tesla achieved a slight increase of 2% compared to the previous year, but still fell short of analysts' high expectations. Margins and profits also fell due to price cuts and financing options. The positive ray of hope was once again the solar systems and energy storage division, where sales doubled to more than USD 3 billion and are expected to grow by >50% growth in 2025. Another positive aspect is the rising cash position, which now stands at USD 36 billion - as far as I know, only the big tech companies such as Alphabet (Google), Amazon, Microsoft, Meta (formerly Facebook), Apple and Nvidia have a higher value.

- Despite the mixed results, Tesla shares remained surprisingly stable after CEO Elon Musk reiterated his vision for the coming years. Tesla announced that from June 2025 a fully autonomous driving service without a human driver in Austin, Texas, from June 2025 - and is expected to roll it out in other US cities by the end of the year. Cheaper e-models are planned for the first half of 2025 with the aim of making electric mobility accessible to even more people. Tesla also plans to produce several thousand of the humanoid robot "Optimus" and put them to good use in its own factories. Ideally, the first robots should be sold to external customers by the end of 2026 - an idea that is arousing the curiosity of many, as it could be used not only in companies but also in private households in the future.

To put things in context: The company is 2024/25 in a transition phase between two growth cycles. The first phase began at the end of the 2010s with the scaling of electric cars, while a new boost is expected from 2026/27/28 due to the introduction of autonomous driving and humanoid robots.

Finally, some noteworthy quotes from the earnings call from Elon Musk - as always, to be interpreted with caution. Tesla's current high valuation is not based on measurable sales and earnings growth, but above all on ambitious plans for the future, which are fraught with uncertainty:

- At the Launch of autonomous driving in the USA: "We live at this unbelievable inflection point in human history. We're going to be launching unsupervised full self-driving as a paid service in Austin in June."

- On the scenario of other car manufacturers licensing Tesla's software license "At this point, we're seeing significant interest from a number of major car companies about licensing Tesla full self-driving technology."

- The prospect of Tesla becoming the most valuable company in the world in the long term: "I've said this before and I'll stand by it. I see a path of Tesla being the most valuable company in the world by far. There is a path where Tesla is worth more than the next top five companies combined. It's a difficult path but it is an achievable path. And that is overwhelmingly due to autonomous vehicles and autonomous humanoid robots."

- Musk also gave a few details on the development and production of the humanoid robot"The normal internal plan calls for roughly 10,000 Optimus robots to be built this year. So the current line that we're designing is for roughly 1,000 units a month. The next line would be for 10,000 units a month. The line after that would be for 100,000 units a month. My very rough guess is that we start delivering Optimus robots to companies that are outside of Tesla in maybe the second half of next year. I'm confident at 1 million units a year, that the production cost of Optimus will be less than $20,000."

- On the Significance of the year 2025 in Tesla's company history: "2025 really is a pivotal year for Tesla. And when you go look back on 2025 and the launch of unsupervised full self-driving, I think we may regard it as the most important year in Tesla's history. There is no company in the world that is as good at real-world AI as Tesla. I don't even know who's in second place."

I bought my last Tesla shares in August 2024 at €196 - I only plan to buy more when the valuation becomes more realistic and attractive again. I consider a fair valuation to be a price/sales ratio in the range of 8-12x (currently 13x), below that an entry would be much more interesting.

Thank you for reading.

Stay informed and invest wisely.