In the last quarter, sales increased by 5% over the year to USD 8.3 billion.

However, as profitability improved, operating profit increased by 13% to USD 1.6 billion.

As treasury shares were bought back on a large scale, earnings per share even increased by 20% to USD 1.29 per share.

At USD 1.40 per share, earnings were well above expectations of USD 1.30. With sales of USD 8.29 billion, the company also exceeded analysts' estimates of USD 8.10 billion.

However, the measures have also led to growth picking up again, particularly at Venmo.

In a television interview, the CEO explained that "Pay with Venmo" grew by 50% in the last quarter. The Venmo debit card is also experiencing particularly strong growth and is becoming increasingly popular.

Venmo becomes a growth driver

In addition, the company is actively working on creating real-world use cases for stablecoins from which customers can benefit directly. The CEO also emphasized that PayPal played an important role in the drafting of the recently passed stablecoin law.

Venmo's total revenue increased by more than 20% in the last quarter. The transaction volume even climbed by more than 45%. Venmo now accounts for almost a fifth of the Group's total transaction volume.

In addition, the new PayPal debit card appears to be meeting with great interest. In the second quarter, the number of users increased by more than 2 million.

Since the introduction of a contactless wallet in Germany in May 2025, the number of users has jumped to more than 3 million in a very short space of time.

Germany was the first country after the USA to make this service available. The rollout in other countries will take place soon.

Share buybacks as a game changer

PayPal has therefore significantly increased its earnings expectations for the current financial year from USD 4.95 - 5.10 to USD 5.15 - 5.30 per share.

Free cash flow is expected to remain at USD 6 - 7 billion, with USD 6 billion to be used for share buybacks.

In the current situation, this is the smartest thing PayPal can do with the money. PayPal is currently valued at a P/FCF of 9.9 - 11.6.

At this level, share buybacks lead to a significant increase in earnings per share - as we have seen again this quarter.

At the end of June 2025, there were still 969 million PayPal shares. A year ago, there were 1.042 billion. In this short period of time, the number of outstanding shares was reduced by 7%.

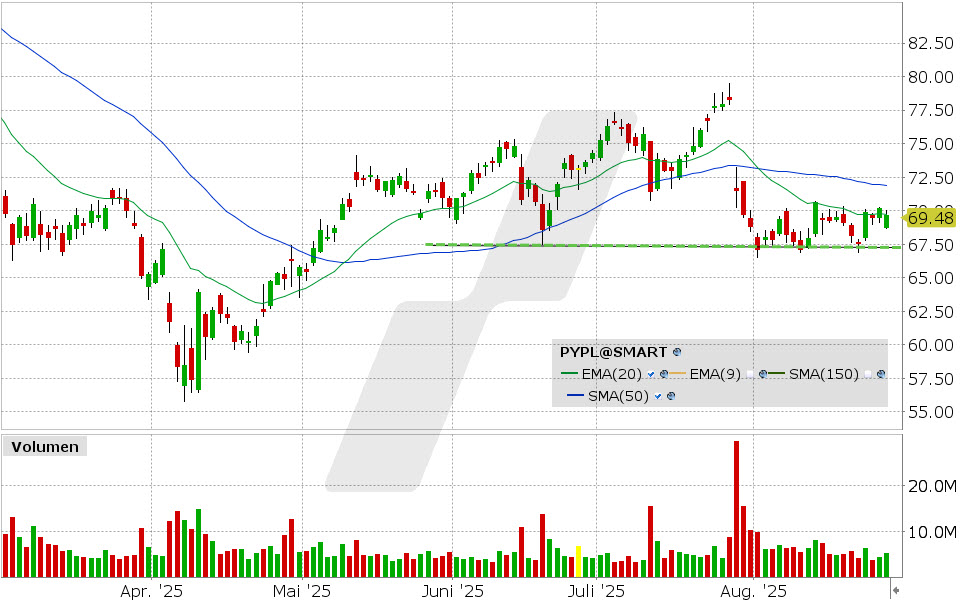

PayPal share: Chart from July 30, 2025, price: USD 71.45 - symbol: PYPL | Source: TWS

PayPal nevertheless slumped after the quarterly figures, despite exceeding expectations and raising its forecast. As a long-term investor, you should be happy about this, because the lower the share price, the more shares PayPal can collect and the higher the EPS will rise.