Who is in the red today? $V (+1,22 %)

$SOFI (+9,03 %)

$O (+2,65 %)

$NVDA (-0,03 %)

$MA (+0,88 %)

$F (+0,87 %)

$QQQ

$VOO (+1,16 %)

$VUSA (+1,03 %)

Vanguard 500 Index Fund;ETF Foro

ETFETFDebate sobre VOO

Puestos

18$VOO (+1,16 %) Monthly buy + $SCHD Monthly buy (3 shares)

Keeping it up 📈

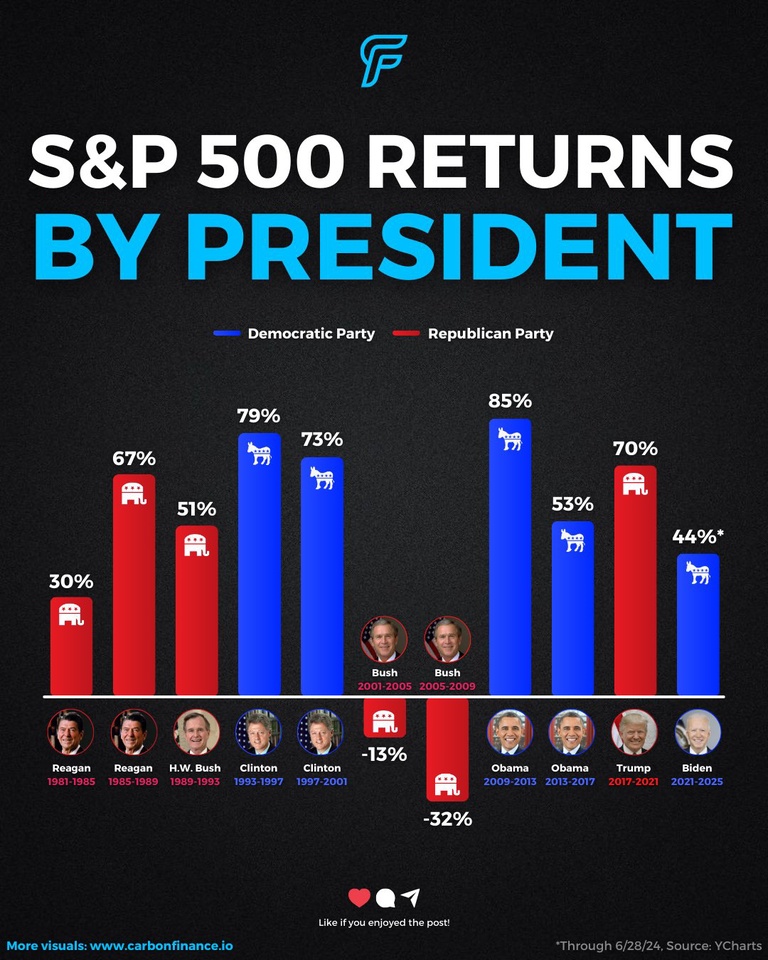

Does the stock market really care whose in office?👇

Based on historical data, the answer is not really.

Over the long term, the stock market has done well under both Democratic and Republican administrations, per data from The Motley Fool.

From a mean perspective, the S&P 500 $SPX has grown annually at 9.8% under Democratic presidents, outpacing the 6% under Republicans since 1957.

However, looking at median growth rates, the market has seen 10.2% growth under Republicans and 8.9% under Democrats.

While either party could make the case that the stock market performs better during their party, the direct impact of policy remains hard to quantify.

Furthermore, presidential terms are susceptible to unforeseen events like the dot-com bubble, the 2008 financial crisis, and Covid-19, to name a few.

As always, the name of the game is time in the market, not the president’s political party.

The S&P 500’s compounded annual growth rate of 10.26% is a clear testament to that.

Dear fellow investors,

This month I will reach another milestone in my investment journey, breaking 800$ in monthly dividend payments for the very first time. I couldn't be more excited....

Wooohooo 💲💲💲

This is due to receiving payouts for the following assets:

641 x $SCHD

281 x $O (+2,65 %)

311 x $JEPI

211 x $JEPQ

179 x $SPLG

89 x $MAIN (+0,69 %) (two payouts this month!)

137 x $EFC (+0,43 %)

67 x $EPR (+1,76 %)

67 x $SPYI

13 x $QQQI

Looking ahead, it seems like September might be my first 1k$ dividend month 🤪🤪🤪.

Fingers crossed 🤞🤞🤞

For those among you who follow my story, know that I just started (again) in Dec 2023 and already had to upgrade my goals to 150k$ invested and average dividends of >500$/month. Both goals are within reach and very likely to be achieved before 2024 comes to an end.

I am very happy with sticking to the plan (DCA-ing into a selected few ETFs and stocks) in hopes for #fire (Financial Independence Retire Early).🔥🔥🔥

I am planning on making some adjustments to the portfolio over the next couple of weeks and months and hopefully later this summer I will share my whole portfolio with more information about my investment strategy as well as the (as of recent) popular Sankey diagram of monthly money flow here on getquin for scrutiny and further constructive feedback. So stay tunes for that.

The list of updated key take-aways are as follows:

1. Select your ETFs and stick with them

- Core:

$SPLG (alternatives are $SPY (+1,17 %) and $VOO (+1,16 %) ), chosen because of slightly lower expense ratio and lower prices (hope for more inflow), trading volume is not a concern as this was bought for the looooong "buy and hold"

- Dividend 💸:

$SCHD (alternatives are $VIG (+1,42 %) and $VYM (+1,3 %) ), chosen because seemed undervalued at the time of purchase, great dividend and decent dividend growth

- Growth 📈:

Still not chosen, open to suggestions

I maintain that it will probably be $QQQM (alternatives are $VGT (+0,71 %) , $SCHG , $SPGP , $DGRW , $VUG (+1,06 %) )

- REITs 🏠:

Not yet chosen, as here I am not even sure any longer if I actually want to invest in REIT ETFs or not just keep my exposure to the few REITS I already own ($O (+2,65 %) , $VICI (+1,98 %) , $MAIN (+0,69 %) , $EPR (+1,76 %) , $EPRT (+3,87 %) ...)

If I decide to venture into this field, it will probably be $SCHH (alternatives are $XLRE and $VNQ (+2,3 %) )

- Misc 🗠:

$O (+2,65 %) The Monthly Dividend Stock

$JEPI / $JEPQ for monthly dividends in the covered call space

$SPYI / $QQQI to potentially replace $JEPI and $JEPQ

$VICI (+1,98 %) / $MAIN (+0,69 %) for additional monthly dividends in the REIT / finance space

I might also entertain the idea of investing in some individual stocks like $AMZN (-0,02 %) . $NVDA (-0,03 %) , $MSFT (+0,15 %) , but that will depend on the constitution of the growth ETF I will buy.

2. Learn 🎓

Educate yourself and don't simply "trust" Youtubers. Read investment books (e.g. 'The Intelligent Investor' by Ben Graham, 'The Little Book Of Common Sense Investing' by John C. Bogle, 'Patient Capital' by Victoria Ivashina and Josh Lerner) and listen to many different voices in the investment arena. Be curious, but cautious... If it says: "100% win rate guaranteed!", it's probably best to stay away from it.

3. Don't try to time the market ⌚️

As one youtuber says: "Time in the market beats timing the market." I am sure we are all guilty of trying to buy at the best price on a particular day/week... If you are in for the long haul, it doesn't matter. DCA (Dollar Cost Averaging) for the win. 🏆

4. ETF over stock picking

Of course you can have huge winners if you pick individual stocks and if you have some insights that allow you to buy before the hype, great, I am very happy for you. Who wouldn't want to have invested in $KO (+1,1 %) , $TSLA (+9,97 %) , $AMZN (-0,02 %) , $GOOG (-0,66 %) or $NVDA (-0,03 %) in their early days?! But that doesn't happen very often. If you invest in solid ETFs covering a wide array of markets, you will do just fine (especially with a long investment horizon). I have certainly tried to "pick' some stocks that looked promising for their upward potential, but only two have given me solid returns ($NEP and $CFLT (-5,26 %) ), whereas so far there are many losers (e.g. $IONQ , $OTLK , $SACH , $EPR (+1,76 %) ).

That being said, I am not against holding individual stocks and I am sure that the likes of $NVDA (-0,03 %) , $MSFT (+0,15 %) , and $AMZN (-0,02 %) will continue to deliver amazing returns, but these are also top of the list in weighted S&P500 or Nasdaq ETFs... ($SPLG , $VOO (+1,16 %) or $QQQM , $SPGP etc.). Just saying!😉

5. Tailored investing

We are all different and our your time horizon, risk appetite, age, income and other factors most likely vary massively. My life, 47yo, being single without kids, being in a somewhat safe and well-paid job, having paid off properties that generate a decent income stream, wanting to retire in 3-5 years and not needing much is very different to someone who just starts their investment career and/or have a family or are already retired or or or.

Make a plan of what you want the investment to do for you and work towards it. In my case, I want to achieve #fire (Financial Independence Retire Early) as soon as possible, being able to live off dividends entirely. I recon I will need about 50k/ year (lots of safety built in). So building a strong dividend portfolio is my main goal. Sprinkle in some growth opportunities and we have a party. 🥳

Let me know what your goals are and how you plan to achieve those. Also if you have some input on which other ETFs and/or stocks to pick, I am all ears 👂👂.

In the best case scenario I never need the extra money (apart from a home) and I have just more money when I get old.

After calculating what payout I could get, if I kept investing till retirement age and what payout rate I could achieve, I it’s a nobrainer.

Even though I know that I need to up my spending on some point (family etc) and have a lower monthly amount to invest, it’s even more motivation for me to have a kickoff start.

Adding another 20 shares of $SPLG to my portfolio. I just recently started adding this ETF to my portfolio and I see this as a cornerstone of my investment strategy and I am happy to DCA continuously. This latest purchase puts me at only 157 shares, but you gotta start somewhere, right?! Waiting for a dip to further load up on this puppy.

Alternatives to this ETF are mainly $SPY (+1,17 %) and $VOO (+1,16 %) , but I've chosen $SPLG because of a slightly lower expense ratio and lower prices, which I hope will lead to for more inflow into this ETF. The lower trading volume is not a concern of mine as this was bought for looooong haul.

Happy compounding everyone!

Hello everyone!

As I'm running towards my long-term goals (FIRE numbers) and trying to improve my consistency and discipline I thought that maybe it will be a good idea to start every week since this week with some thoughts on my goals, investment decisions and feelings.

First and foremost I'm waiting for my salary to arrive next week, then I will be able to buy some more shares. As everyone knows consistency is the key, so I hope I will be able to stack some more dollars. My goal has changed over couple of years as now I invest only around 20-40% of my salary compare to 70-80% before. My needs are growing and I think it's totally natural and understandable, so I don't push myself too much.

I don't want to invest more in crypto as I expect it to grow this year, but as I understand it we're in the middle of the bull-run and I was lucky enough to buy all of my crypto in 2022-2023.

What I want to buy is $VOO (+1,16 %)

$SPYW (-0,46 %)

$VTI (+1,24 %) and maybe some single stocks (don't know which exactly tbh).

The main goal for this year is to cross 100k mark and sell mostly all of my crypto and reinvest this money in ETFs.

I hope I will be able to provide more info on my background story next week as I want this so-called blog to be some sort of a unique story of myself.

Feel free to comment your experience and share your thoughts on my portfolio. Have a good week!

I reached 100k$ invested on 2024-03-15 which was one of the milestones for 2024 (the new one is now 150k$).

Also March was very good to me with dividend payouts exceeding 600$ for the month, which made me revise my initial goal of 400$/month (avg.) by the end of 2024 up to >500$/month. 💲💲💲

Since this account is very new (Dec. 2023), I am very happy with sticking to the plan (so far) in hopes for #fire (Financial Independence Retire Early).🔥🔥🔥

Key take-aways so far are as follows:

1. Select your ETFs and stick with them

- Core:

$SPLG (alternatives are $SPY (+1,17 %) and $VOO (+1,16 %) ), chosen because of slightly lower expense ratio and lower prices (hope for more inflow), trading volume is not a concern as this was bought for looooong

- Dividend 💸:

$SCHD (alternatives are $VIG (+1,42 %) and $VYM (+1,3 %) ), chosen because seemed undervalued at the time of purchase, great dividend

- Growth 📈:

Not yet chosen, open to suggestions

Will probably be $QQQM (alternatives are $VGT (+0,71 %) , $SCHG , $SPGP , $DGRW , $VUG (+1,06 %) )

- REITs 🏠:

Not yet chosen, open to suggestions

Will probably be $SCHH (alternatives are $XLRE and $VNQ (+2,3 %) )

- Misc 🗠:

$O (+2,65 %) The Monthly Dividend Stock

$JEPI / $JEPQ for monthly dividends in the covered call space

$VICI (+1,98 %) / $MAIN (+0,69 %) for additional monthly dividends in the REIT space

2. Learn 🎓

Educate yourself and don't simply "trust" Youtubers. Read investment books, listen to many different voices in the investment arena. Be curious, but cautious... If it says: "100% win rate guaranteed!", it's probably best to stay away from it.

3. Don't try to time the market

As one youtuber says: "Time in the market beats timing the market." I am sure we are all guilty of trying to buy at the best price on a particular day/week... If you are in for the long haul, it doesn't matter.

4. ETF over stock picking

Of course you can have huge winners if you pick individual stocks and if you have some insights that allow you to buy before the hype, great, I am very happy for you. But that doesn't happen very often. If you invest in solid ETFs covering a wide array of markets, you will do just fine.

5. Tailored investing

We are all different and our your time horizon, risk appetite, age, income and other factors most likely vary massively. My life, 47yo, being single without kids, being in a somewhat safe and well-paid job, having paid off properties that generate a decent income stream, wanting to retire in 3-5 years and not needing much is very different to someone who just starts their investment career and/or have a family or are already retired or or or.

Make a plan of what you want the investment to do for you and work towards it. In my case, I want to achieve #fire (Financial Independence Retire Early) as soon as possible, being able to live off dividends entirely. I recon I will need about 50k/ year (lots of safety built in). So building a strong dividend portfolio is my main goal. Sprinkle in some growth opportunities and we have a party. 🥳

Let me know what your goals are and how you plan to achieve those. Also if you have some input on which other ETFs and/or stocks to pick, I am all ears.

When you mentioned your age of 47, my first thought was: is that still considered early retirement? 😅

I take it you are on a very good path, considering you also got real estate.

I think the most important thing for you is to decide what to do with your free time soon! That might be your biggest concern soon.

Someone asked me the other day if I’ve ever considered selling out of all my individual stocks and just going all in on something like $SCHD.

This is a fantastic question, really. Investing in ETFs definitely makes things simple, and there are some really great ones out there.

While I have been making more of an effort to consolidate some of my individual stock positions, having sold 4 of them in the last few months, I don't personally have much of an interest in going all in on ETFs — at least not right now.

While I am a big fan of ETFs, and while I do invest in $SCHD and $VOO (+1,16 %) every week, investing in individual companies is kind of a hobby for me.

Over time, I've really come to enjoy researching and selecting the companies I believe to be good long-term investments. Plus, investing in individual companies helps me practice what I've learned about investing.

With that said, I don't know if I’ll ever sell all my individual stocks, but I do plan to keep consolidating my portfolio over time. I've narrowed my individual positions down from 23 to 19, and may keep lowering it even more.

I'm not going to rush it though. I'm pretty content with where things are at right now.

What’s your take on the matter? Do you only invest in ETFs, or do you hold individual stocks as well? 🤔

Basically, I'm a big fan of keeping things simple, so yes, I considered holding just one ETF. One of the reasons I decided to diversify across positions is issuer risk. I don't think one of the big companies is likely to go bankrupt, but they could change the index or discontinue the product.

hello,

I need an opinion on my etfs. I have $VOO (+1,16 %) but i’m also looking to invest in $VEU (-0,9 %) . should I invest in both or jus put it all in one? i’m looking for long term growth in it.

hello getquin,

which etf would be the best to buy and hold for a really long time? open to all suggestions! I live in the USA

I already own $VOO (+1,16 %)

Valores en tendencia

Principales creadores de la semana