06.09.2024

TESLA at the top of the NASDAQ-100 + C3.ai has to cut spending + Further acquisition in the precious metals sector + Major orders from the USA for headlight specialist Hella

TESLA $TSLA (+9,97 %) at the top of the NASDAQ-100 - Climbing well above the 50-day line

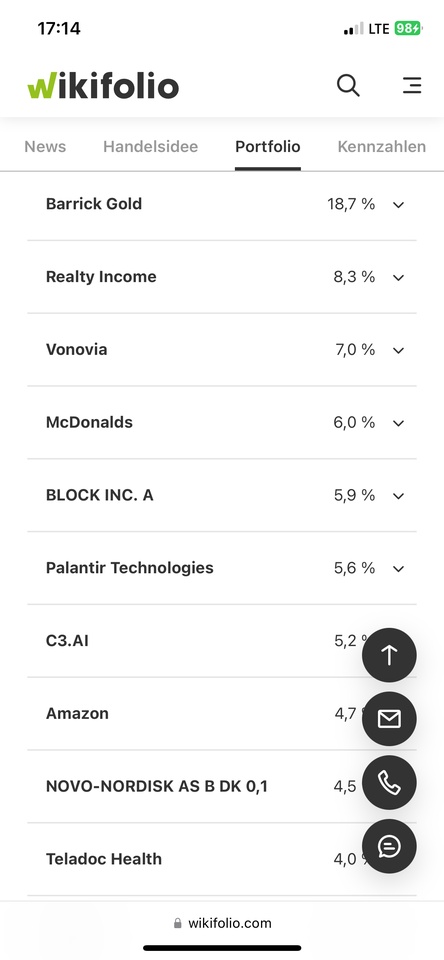

C3.ai $AI (+0,87 %) fell 19% after the AI software company missed estimates for quarterly subscription revenue as companies cut back on spending amid economic uncertainties.

First Majestic $FR (-3,37 %) are pleased to announce that they have entered into a definitive merger agreement pursuant to which First Majestic will acquire all of the issued and outstanding common shares of Gatos. Gatos is a leading silver producer with a 70% interest in the Los Gatos joint venture, which owns the producing Cerro Los Gatos underground silver mine in Chihuahua, Mexico.

The headlamp specialist Hella $HLE (+0,11 %) has received orders for electronics and lighting projects in the USA worth more than two billion euros. The company, which has been part of the French automotive supplier Forvia since the beginning of 2022, announced that series production for the unspecified US car manufacturer will start in Mexico within two to four years. For comparison: Hella is targeting currency and portfolio-adjusted Group sales of between around 8.1 and 8.6 billion euros in 2024.

Friday: Stock market dates, economic data, quarterly figures

ex-dividend of individual stocks

Bank of America USD 0.26

PepsiCo 1.36 USD

Booking Holdings USD 8.75

Quarterly figures / company dates USA / Asia

/

Quarterly figures / Company dates Europe

10:20 PSI Software Half-year figures

Economic data

- 08:00 DE: Trade balance July Trade balance calendar and seasonally adjusted FORECAST: +20.6 billion euros previously: +20.4 billion euros Exports FORECAST: +0.8% yoy previously: -3.4% yoy Imports FORECAST: +1.1% yoy previously: +0.3% yoy

- 08:00 DE: Production in the manufacturing sector July seasonally adjusted OUTLOOK: -0.2% yoy previous: +1.4% yoy

- 08:45 FR: Industrial production July OUTLOOK: -0.3% yoy previous: +0.8% yoy

- 11:00 EU: GDP (3rd release) 2Q Eurozone FORECAST: +0.3% yoy/+0.6% yoy 2nd release: +0.3% yoy/+0.6% yoy 1st quarter: +0.3% yoy/+0.5% yoy

- 14:30 US: Labor market data August employment ex agriculture PROGNOSE: +161,000 yoy previous: +114,000 yoy Unemployment rate PROGNOSE: 4.2% previous: 4.3% average hourly earnings PROGNOSE: +0.3% yoy/+3.7% yoy previous: +0.2% yoy/+3.6% yoy