Following the rebalancing of the S&P Quality Aristocrats last Friday, the following stocks were removed from or added to my two ETF indices (50% weighting):

New additions:

$QDEV (-0,52 %): $NOVN (-1,4 %) , $REL (+1,35 %) , $ITX (-4,07 %) , $LSEG (-5,07 %) , $DB1 (+3,43 %) and more

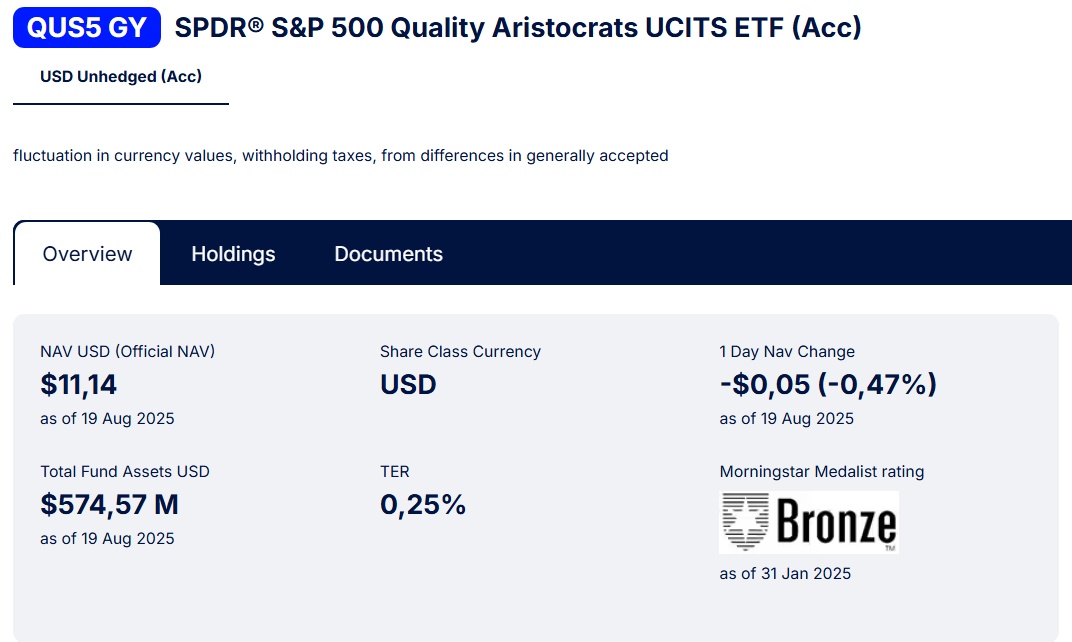

$QUS5 (-0,17 %): $BKNG (+0,07 %) , $MRK (-0,38 %) , $CRM (+2,85 %) , $UNP (+0,11 %) , $COR (+0,66 %) , $CAH (-0,56 %) and more

Kicked out of both indices and therefore according to S&P no longer Quality Aristocrats are among others: $BATS (-2,17 %) , $7974 (-2,8 %) , $HD (-0,47 %) , $LOW (+0,54 %) , $HLT (+1,07 %)

In addition, the allocation of all individual stocks in the indices was reduced again to max. 5 % was limited.

Thanks to the recent rally of $$HY9H (-13,65 %) my current top 10 weighting (ETFs+shares) is as follows:

3.48% Alphabet

3.04% SK Hynix

3.04% Broadcom

2.93% Meta

2.75% Microsoft

2.71% Apple

2.71% NVIDIA

2.55% Taiwan Semiconductor

2.13% Mastercard

2.08% Visa

New portfolio key figures:

P/E: 27.1 (<30) 🟢

Forward P/E: 21.1 (<25) 🟢

P/Β: 11.5 (<5) 🔴

EV/FCF: 28.7 (<25) 🟡

ROE: 42% (>15%) 🟢

ROIC: 19% (>15%) 🟡

EPS growth for the next 5 years: 15% (>7%) 🟢

Sales growth for the next 5 years: 9% (>5%) 🟡

My internal rate of return is currently 20.19%