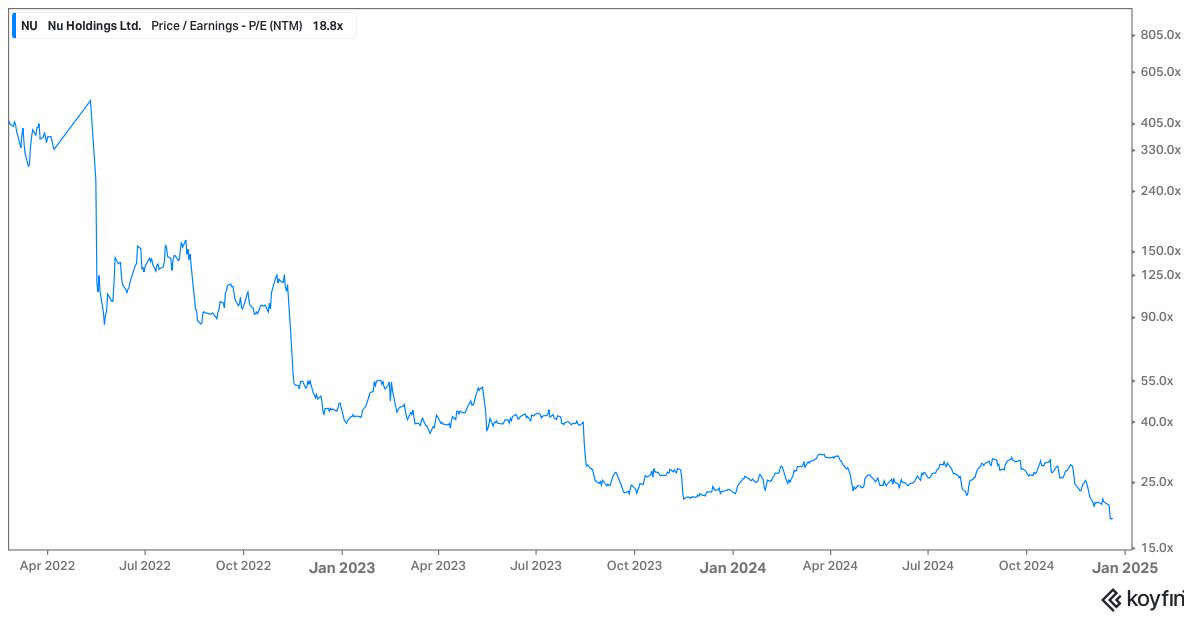

$NU (-0,2 %) - is trading at 18 times expected earnings, the lowest P/E ratio to date

Also sitting at support level with oversold RSI of 24.72 (as of 21.12.)

Believe we will soon see a recovery or at least a bounce, provided there is no negative news.

An appreciation of the Brazilian real or suitable measures to this end would be desirable:

Brazilian Real/USD vs Stock:

Stock vs EPS:

Brazil's central bank raises interest rates to support the currency. Inflation has risen slightly. Could raise concerns about pressure on consumers.

However $NU (-0,2 %) performed well in the past despite this environment, surprising and recording strong customer growth.

💪🚀