Hims & Hers Health is an American company that specializes in telemedicine, health products and nutritional supplements. They offer both prescription and over-the-counter medications as well as personal care products and nutritional supplements via their web platform.

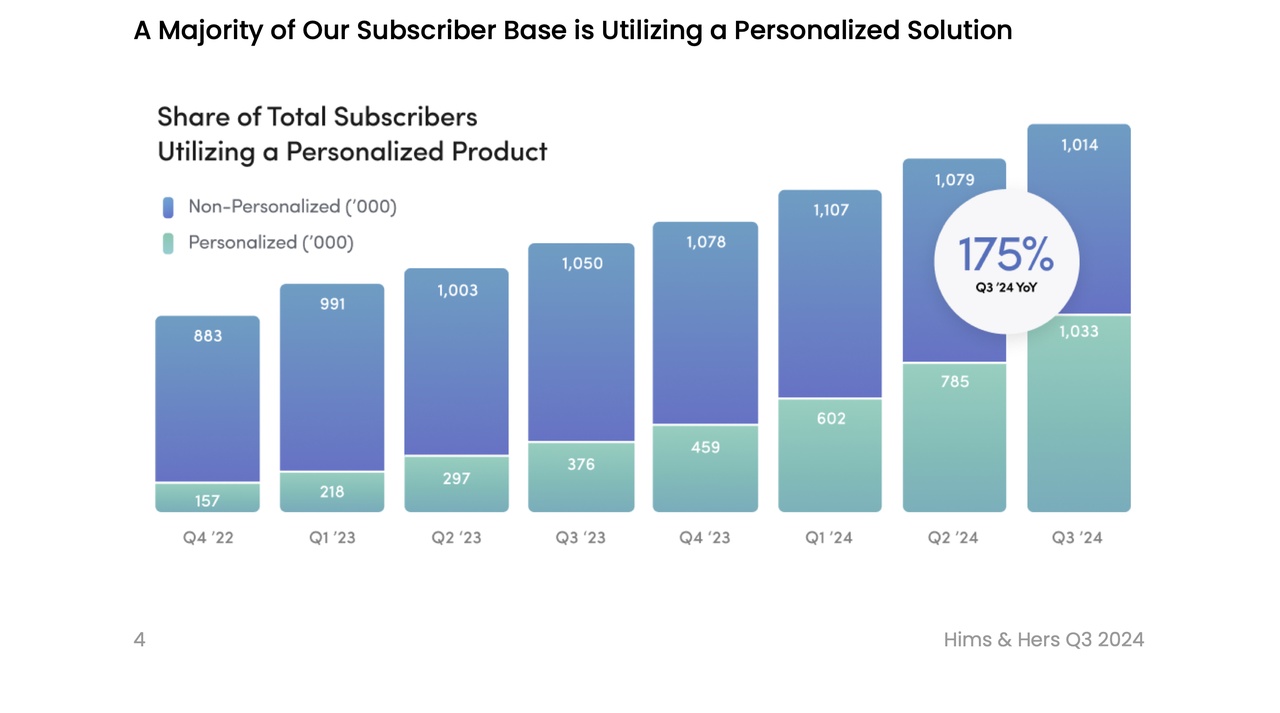

There are also personalized solutions for customers and a subscription model

I see great potential in telemedicine due to demographic change but also because you lower the barriers for consumers for certain products and prescription drugs. Hims has a customer-centric approach and has built a strong brand in recent years.

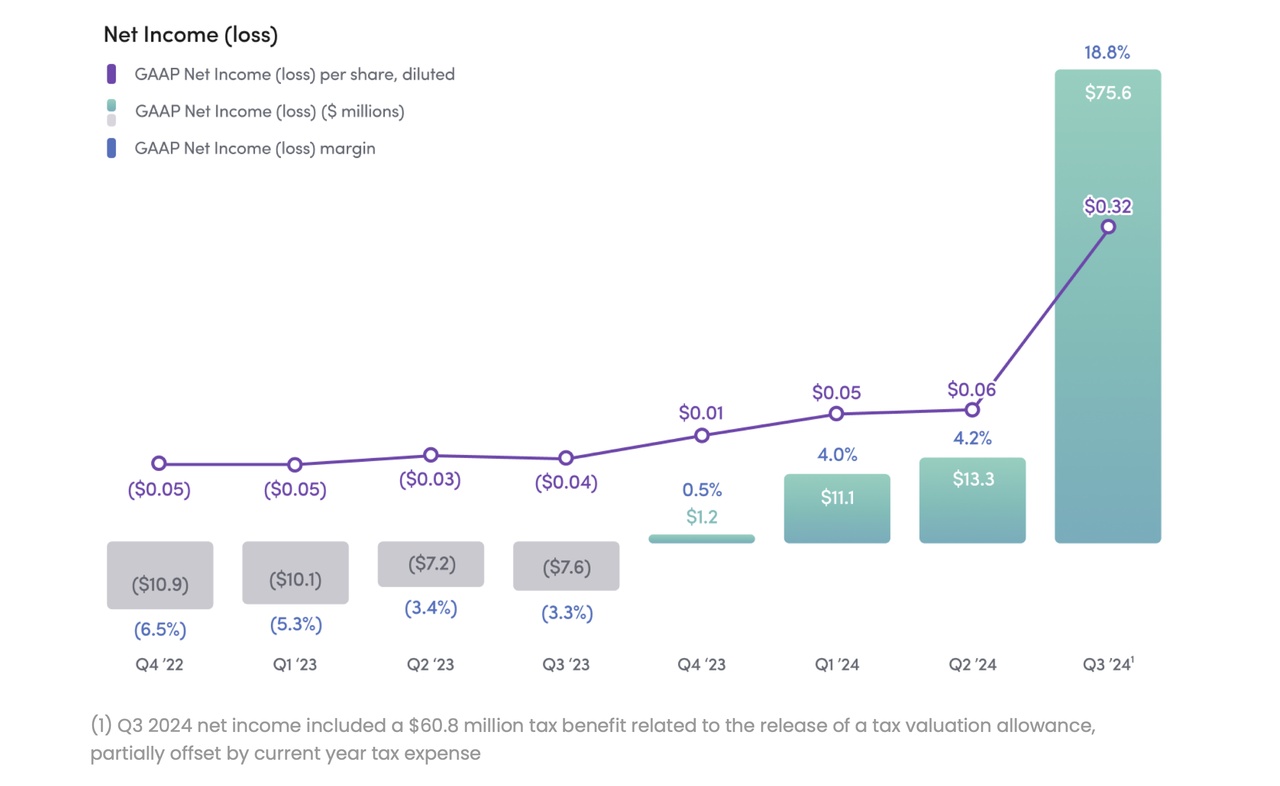

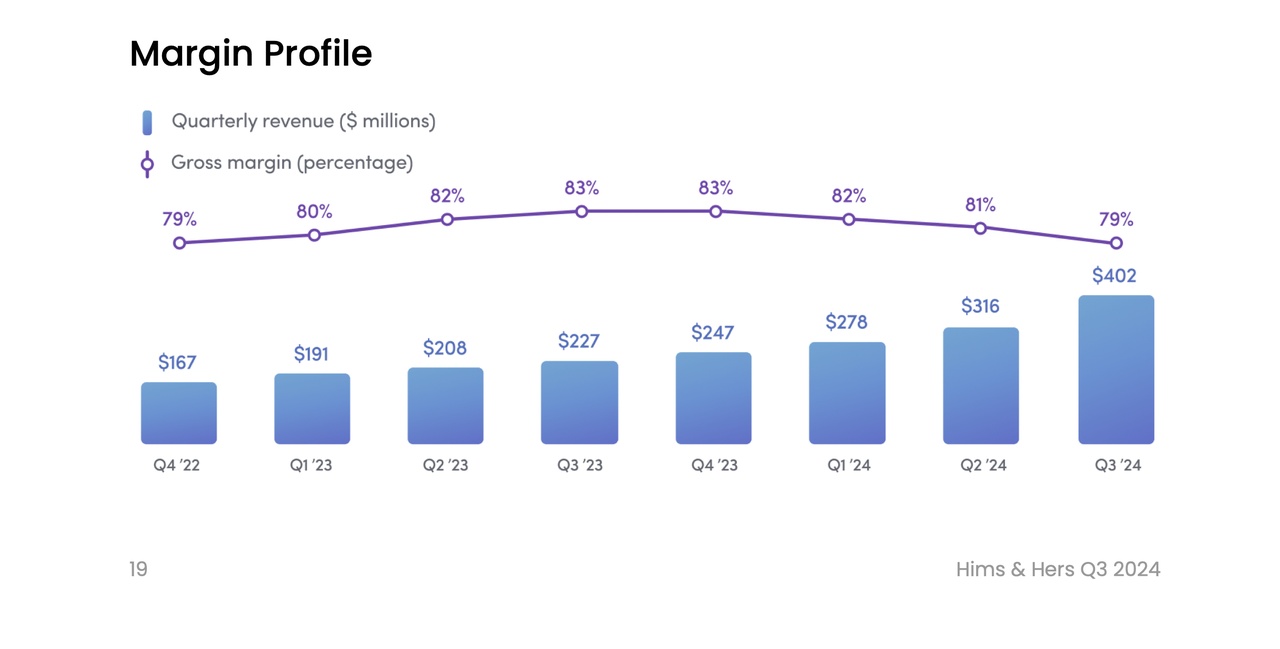

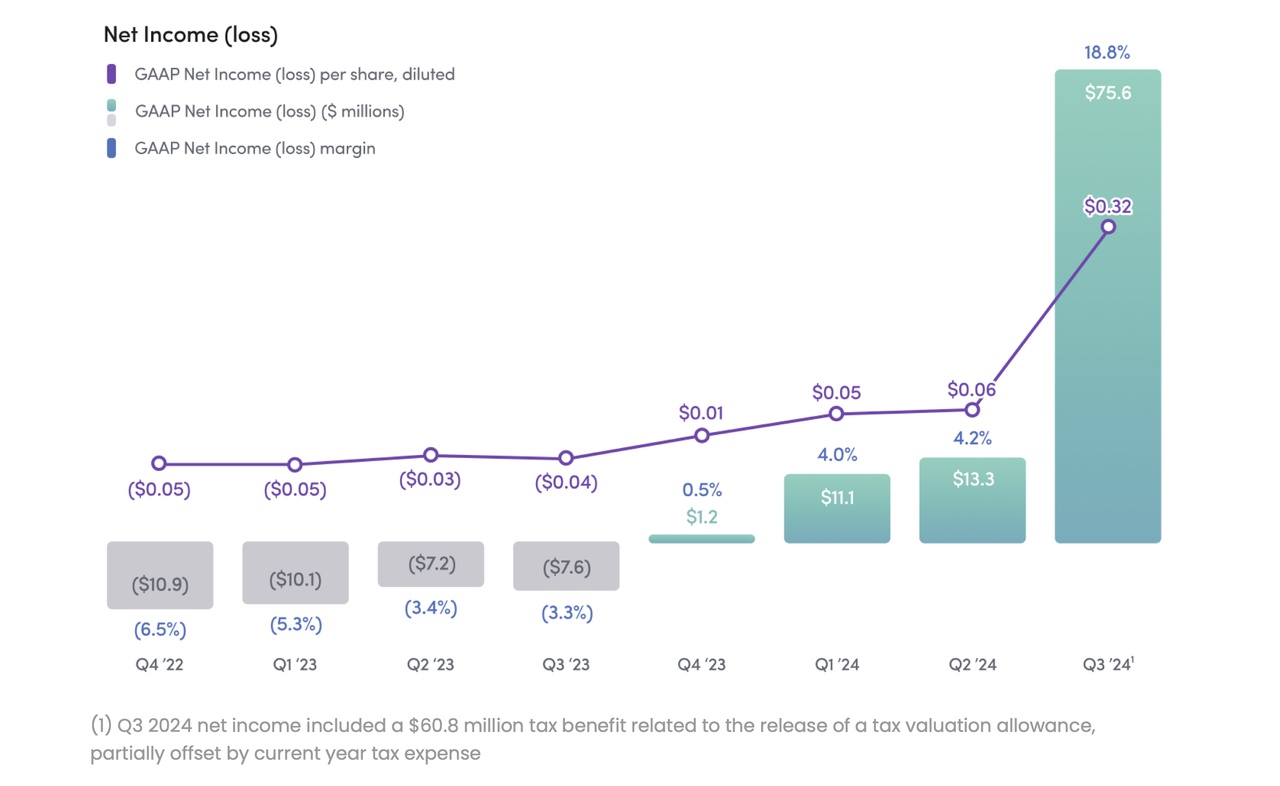

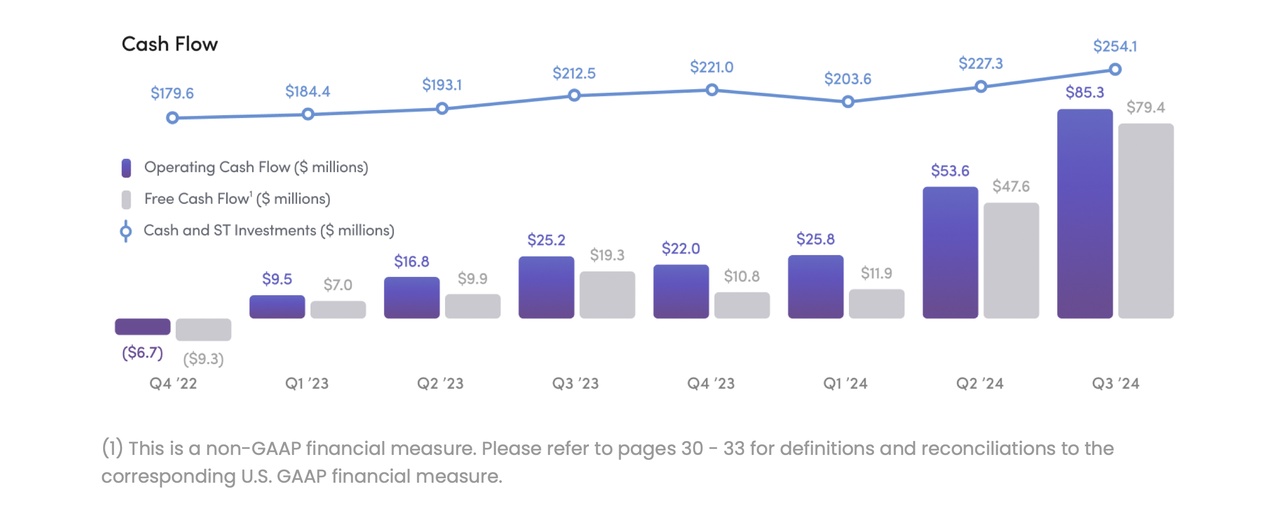

Growth is very strong, with Hims & Hers reporting year-on-year sales growth of 77% in the third quarter of 2024 and 2024 could be the first year in which Hims becomes profitable.

Forecasted profit growth 17.71% per year!

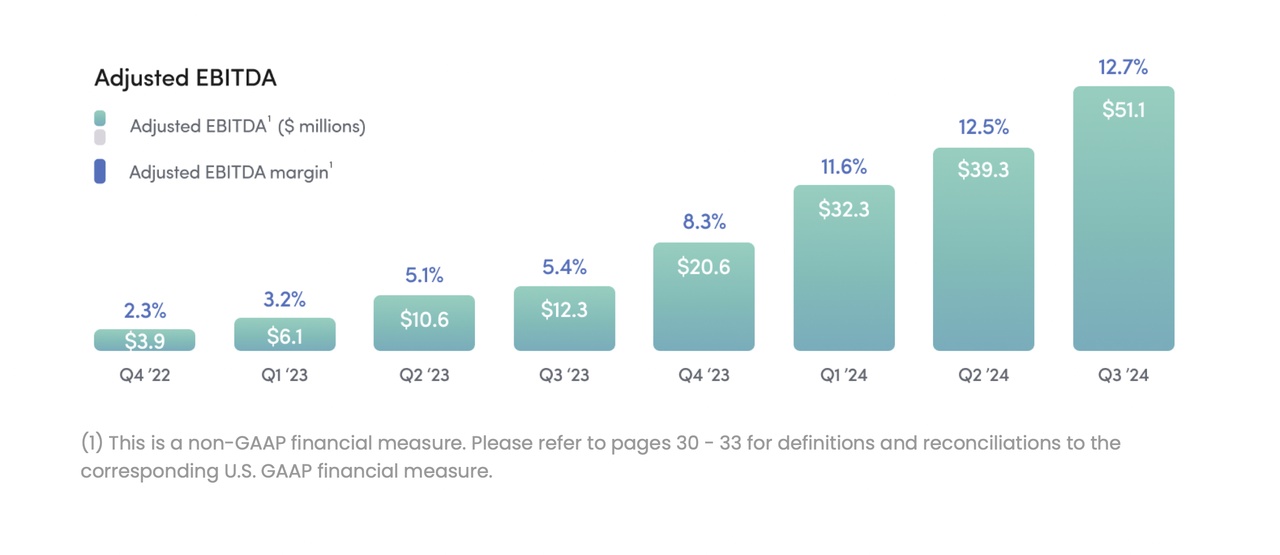

In addition, the company is expected to achieve an EBITDA margin of over 12% in 2024, indicating an improvement in profitability.

Overall, the combination of a growing telemedicine market, strong brand building and positive financial developments could make Hims & Hers an interesting investment opportunity.

I am sticking to my investment as I believe that nothing has changed from my original investment thesis. On the contrary, Hims is showing very strong growth, is fundamentally sound and is now becoming profitable.