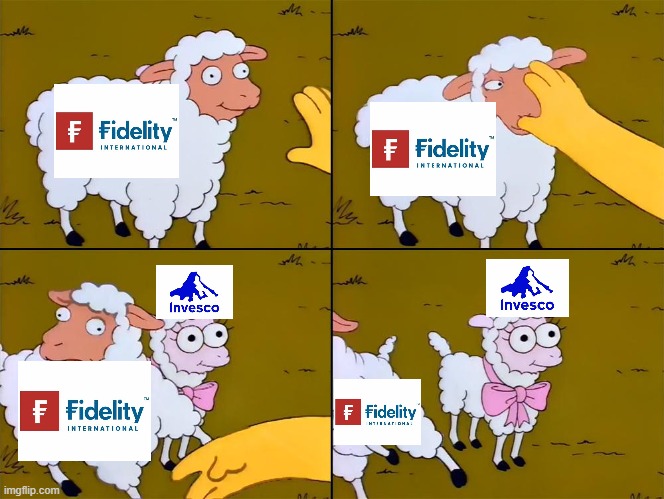

The Fidelity Emerging Markets Quality Income UCITS ETF $FYEM (+0,09 %) unfortunately has to go.

The Invesco FTSE RAFI Emerging Market $PEH (+0,98 %) better reflects the quality factor in the emerging markets in my opinion.

I just never had it on my radar because it has such a meaningless name.

No bullshit @InvescoDACH What am I supposed to do with "RAFI"?

Rarely attractive financial instrument?

However, it has another shortcoming: with a fund size of ~ 35 million, it's really small... you can laugh at me if it's liquidated soon. 😘