Since I have buried myself again in Rabbit hole stock picking and am looking for a Tenbagger, here times for the round, which of the listed here could possibly be with the most potential. These are mirco/small caps, which are a pure bet, total loss calculated possible! SOS ahoy.

Plan: horizon 5-6 years ; follow companies then of course.

Buzzword bingo like pricing power, P/E ratio KUV, sun moon and stars may be used with pleasure.

Source: Martin Lochner video on this (he used to be at Mission Money). His sales stuff on his website no idea not looked at closely.

His source:

Of interest to Generation Faulies:

F.18 and F.19 High Level Take aways.

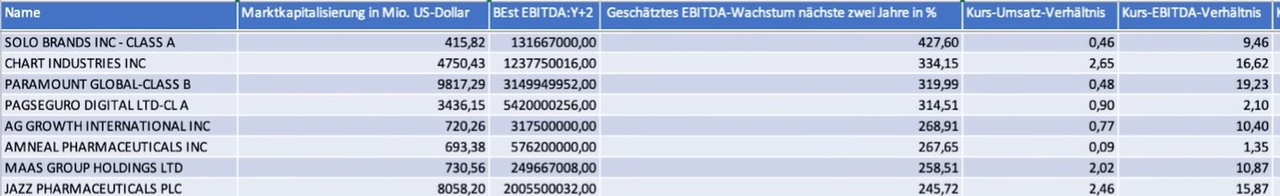

The companies from the video are, behind them my gut commentary. No analysis. I make for really m.M.n. interesting then again dedicated.

1st Chart Industries: Industrial stuff $GTLS (+1,62 %)

https://www.chartindustries.com/

2. Paramount Global (Viacom): Broadcasting/Streaming: knowing the industry, I still see a lot of consolidation and clearly rather no. $PARA (+0 %)

3. PagSeguro Digital: $PAGS PSP Payment Service Provider like an Adyen, Stripe and for the German ones something like concardis. Fiercely competitive field, technical hurdles are relatively medium (PCI & Sox available = high data security, banking license, etc.). Winners are local heros, as soon as the critical mass of merchants is reached. Are there some LATAM homies here who could say something about the store? https://international.pagseguro.com/

4th AG Growth: $AFN (-0,29 %) Agricultural machinery. Canadian shares - no thanks. https://www.aggrowth.com/

5. Ameal Pharma: $AMRX (-0,33 %) Do generic drugs -.

https://amneal.com/products/our-portfolio/

6. Maas Group: $MGH Heavy construction equipment from Australia is something I've always wanted to have https://maasgroup.com.au/

7. jazz pharmaceuticals: $JAZZ (-0,51 %) Medicines for people with serious illnesses. Homebias have an office in Munich. 😊 https://www.jazzpharma.com/

8. okeanis: $OKE (+1,44 %) Tankers with special filters with less exhaust. See YT video. https://www.okeanisecotankers.com/