GROWTH VALUE PERFORMANCE.

RADNET USES ARTIFICIAL INTELLIGENCE FOR THE EARLY DETECTION OF CANCER: IN THE USA ALONE, A USD 100 BILLION MARKET IS BEING ADDRESSED! USD MARKET IS BEING ADDRESSED!

Dear Tenbagger investors Artificial intelligence (AI) has enormous potential to transform healthcare. Particularly in medical imaging, it can help to cope with the growing volumes of data.

Hello my dears,

Today I would like to introduce you to RadNet and ask for your opinion.

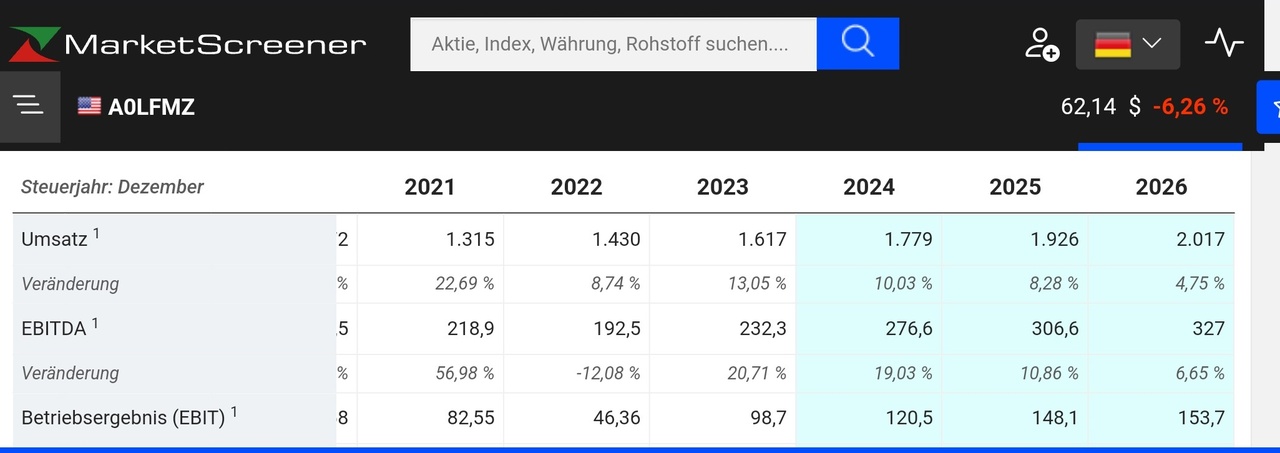

EbitT margin: 2024: 6.77 %

2025: 7,69 %

2026: 7,62 %

Earnings per share: 2024: 0.315

2025: 0,78

2026: 0,915

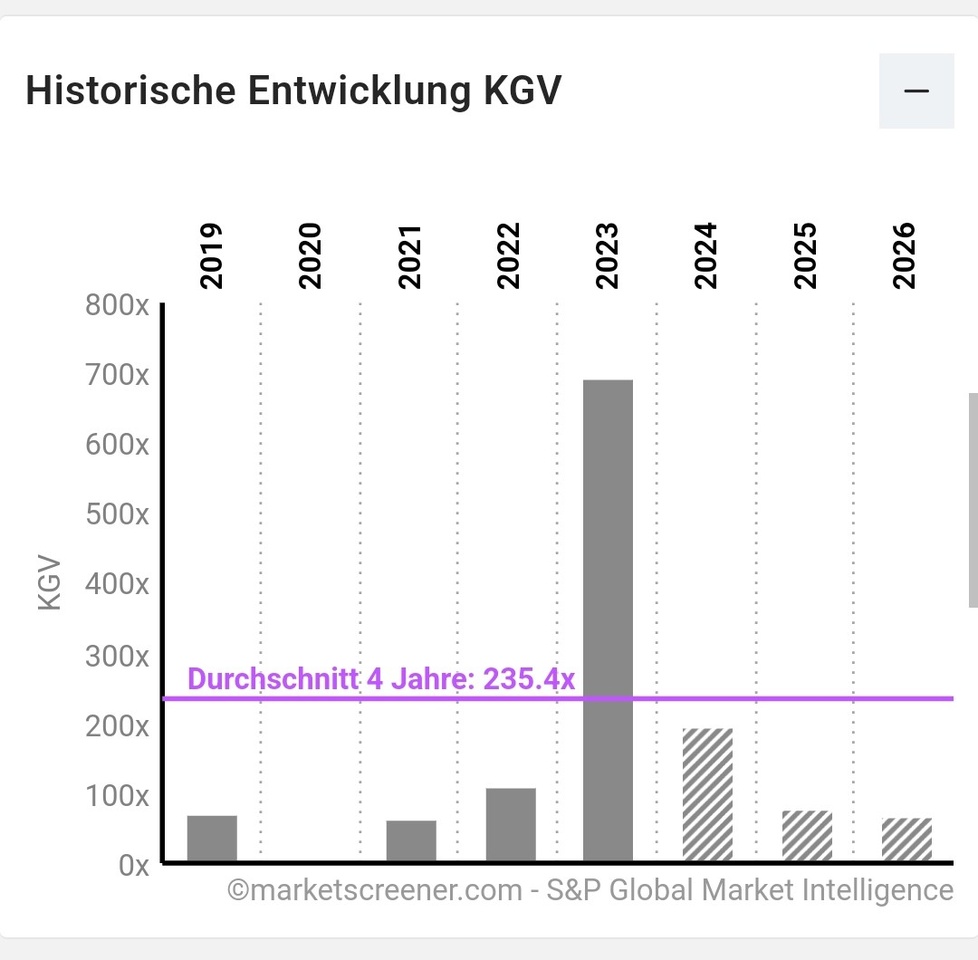

P/E RATIO: 2024: 197

2025: 79,7

(P/E RATIO 1.15)

Profit growth: 2024: 480%

2025: 128%

2026: 39%

Net result: 2024: 23.17 million

2025: 58.06 million

RadNet -

Pioneer of diagnostic imaging services with a focus on AI

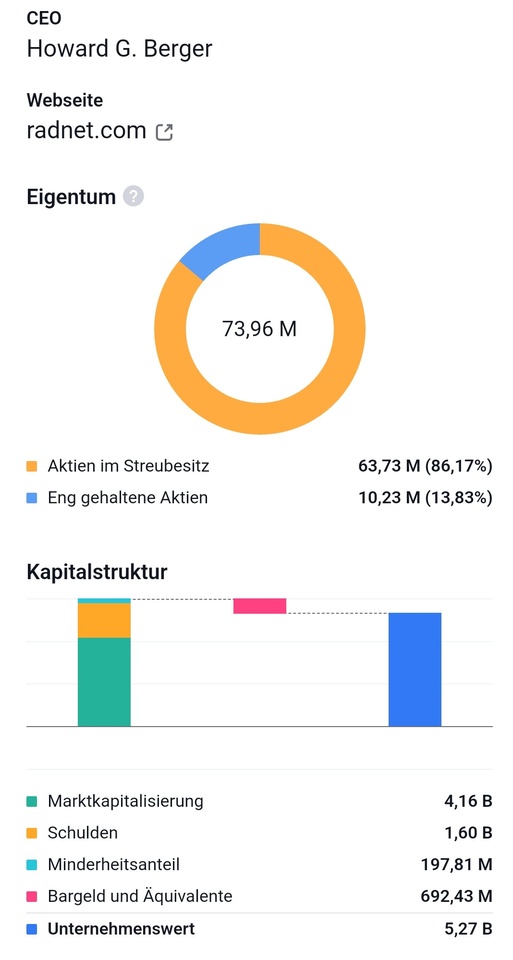

With a market capitalization of USD 4.5 billion . RadNet is one of the most important providers of diagnostic imaging services in the United States.

The company was founded in 1981 by Dr. Howard G. Berger, who still serves as the company's President and CEO. Originally started as a small company providing diagnostic imaging services in California, RadNet grew rapidly through a series of strategic acquisitions and mergers. This expansion allowed the company to broaden its geographic reach and diversify its service portfolio.

In the decades that followed, RadNet has continued to evolve and expand its network of imaging centers. The company went public in 2006, which led to an additional growth spurt. Today, RadNet operates over 340 imaging centers in several US states.

The company offers a wide range of diagnostic imaging services that serve both outpatients and inpatient facilities. The company's primary services include:

Magnetic Resonance Imaging (MRI): RadNet offers a variety of MRI scans that are used to examine soft tissue, joints, the brain and other areas of the body. This technology provides high-resolution images that help diagnose diseases and injuries.

Computed tomography (CT): CT scans are another key service offered by RadNet. They provide detailed images of bones, organs and tissue and are often used to diagnose cancer, heart disease and other serious illnesses.

X-ray: RadNet offers conventional X-ray examinations that allow for quick and efficient diagnosis of bone fractures, pneumonia and other common medical problems.

Ultrasound: Using ultrasound technology, RadNet provides imaging exams for a variety of applications, including pregnancy monitoring, soft tissue examination and vascular disease diagnosis.

Mammography: RadNet's mammography services are designed to detect breast cancer early. RadNet offers both traditional 2D mammograms and more advanced 3D mammograms that provide more accurate results.

Nuclear medicine: RadNet also performs nuclear medicine examinations, which use radioactive substances to diagnose and treat diseases.

The market for diagnostic imaging is highly competitive. RadNet competes with major players in the industry. These include, in particular, HCA Healthcare (one of the largest healthcare providers with a large number of imaging centers), SimonMed Imaging and Envision Healthcare.

RadNet is committed to continuously investing in new technologies and services to improve the quality of patient care and meet the demands of the market. The company has focused on the introduction of Artificial Intelligence (AI) in imaging to increase the accuracy of diagnoses and improve the efficiency of imaging processes. The market seems to be enthusiastic about this AI strategy. Under the leadership of DeepHealth (the digital health division), RadNet has expanded its portfolio of AI software solutions to enable more accurate screening for the three most common cancers: breast, lung and prostate. RadNet is also using AI technologies in neuroradiology, which is crucial for new drugs and treatment therapies for diseases such as Alzheimer's. Also important is RadNet's use of AI in operational processes such as patient outreach and engagement, which have a major impact on costs and efficiency. The company's AI strategy is the story that is currently being played out on the market

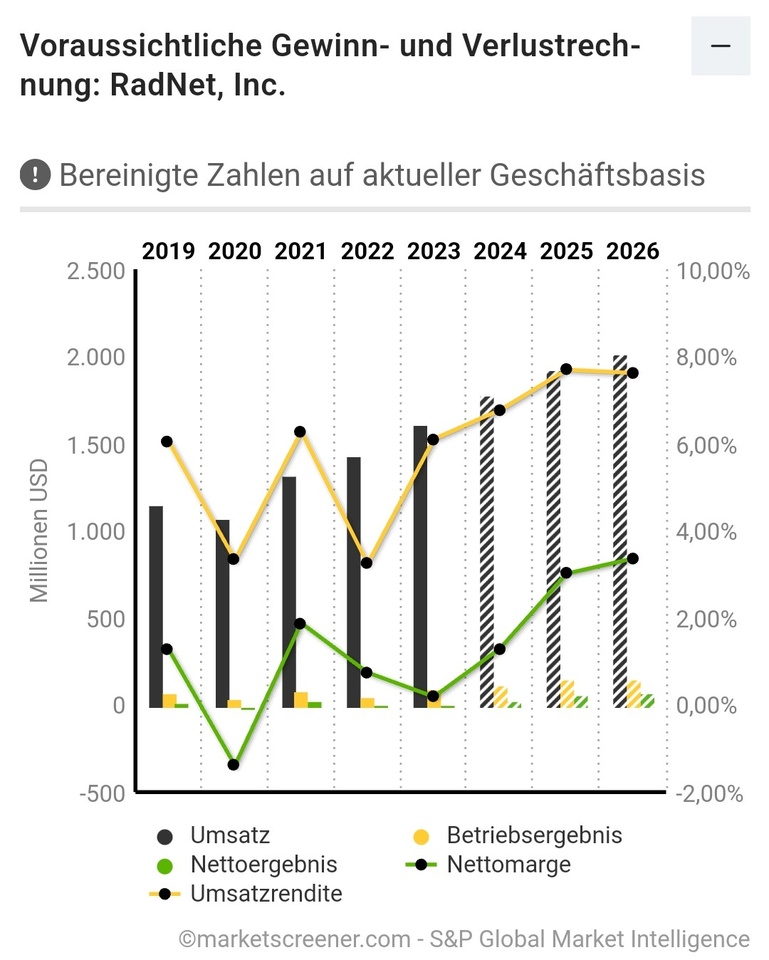

The last quarterly figures were presented on 07.08.2024 after the close of trading. The share closed the following day up over 8 %. Among other things, record turnover was achieved. Despite the strong revenue growth, RadNet reported a net loss of USD 3.0 million for the second quarter of 2024 compared to a net profit of USD 8.4 million in the same period of the previous year. This loss was primarily due to several exceptional and non-recurring items, including $8.8 million in debt restructuring and repayment costs and $3.3 million in research and development costs related to the DeepHealth Cloud OS and generative AI.

On a positive note, the Digital Health segment, which includes AI applications, recorded a 36% increase in revenue to USD 15.8 million, driven by a 137% increase in AI revenue to USD 5.6 million. This growth underlines the successful launch of the AI-supported mammography screening program DeepHealth for improved breast cancer detection.

As part of the quarterly figures, management has raised its annual forecast for sales and adjusted EBITDA for the second time in a row in 2024.

(Aktien Magazin 03,09,2024)