Stock analysis StoneCo

$STNE (+1,94 %)

StoneCo Ltd. is a provider of financial services (84%) and software (15%). StoneCo is active in an exciting emerging market: Brazil.

But first, the key figures:

Price: $13.25 (YTD +40%) (-85% from ATH) (-58% IPO 2018).

KUV: 2

P/E RATIO: 4730

forward P/E ratio: ~18

Revenue growth yoy: +31% (Q1 2023)

5y avg. Revenue growth: +74.44%

EBIT growth yoy: 240.56%

5y avg. EBIT growth: 40.90%

I became aware of the company mainly due to the catastrophic development of the share price, which resulted in a (supposedly) favorable valuation of a fast growing company.

What happened?

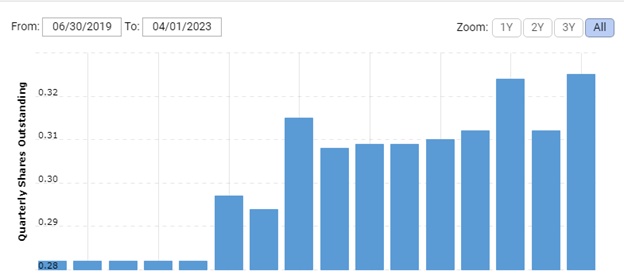

In May 2021, StoneCO acquired a stake in Banco Inter for the equivalent of $471 million dollars. At the time, StoneCo had a valuation of approximately $20 billion (~$4.15 billion today). However, this stake rapidly depreciated, resulting in a -90% loss (StoneCo fully liquidated its stake in Banco in February 2023). Accordingly, the losses had a negative impact on the results of the last quarters and triggered a crash in the share price. StoneCo had not only bought a completely overpriced stake, but at the same time had borrowed in a foreign currency (dollars) with rising interest rates. The falling exchange rate of the Brazilian real to the U.S. dollar also played an important role here. To finance the deal, some new shares had to be issued (see picture no. 1).

Why should the company or the share be interesting at all?

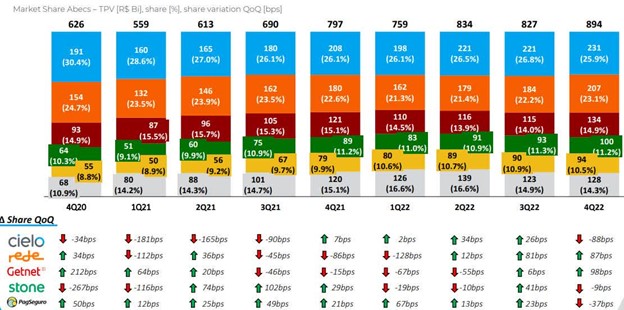

The management was gradually replaced after the gross blunder. A new CFO and a new CEO were hired. With Pedro Zinner, the company is now headed by an experienced CEO who had already achieved a successful turnaround at Envea.Although the Banco deal eroded StoneCo's fundamentals, the operating business continued to perform very well. StoneCo continues to record strong growth and is even gaining market share (see picture no.2). Profits are being written again and a large cash position is being built. The negative one-off effects that affected the results are now a thing of the past and nothing seems to stand in the way of strongly increasing profits. Measured against the growth rates, a forward P/E ratio of 18 is very favorable, even if growth is slowing down somewhat. Debt is now covered by assets again and the company is in a much better position than 2 years ago.Macro environment: The Brazilian Central Bank currently has an interest rate of 13.75% after strong interest rate hikes. Currently, inflation there is around 4%, close to the central bank's target of 3.25%. So a rate cut in the near future is definitely in the realm of possibility - which could provide further upside for the stock price.

Conclusion:

In my opinion, with StoneCo you get a fast-growing, yet profitable company in a fast-growing sector of an exciting emerging market. The downside is limited due to the crashed share price, currently the company is undervalued (by my personal valuation standards), but it also needs to win back investor confidence first. Nevertheless we are dealing here with a ailing company in a difficult market environmentwhich is also exposed to political risks in Brazil. So please inform yourself again intensively before you click here on buy :D

No investment advice and information to the best of my knowledge based on the sources.

Sources:

https://investors.stone.co/news-releases/news-release-details/completion-ceo-transition

https://investors.stone.co/static-files/c62e910c-9608-425f-9ff7-c56c335f0087

Also: MSN Finance, Yahoo Finance, MarketScreener