📈 BDC Depot Update January '23 📈

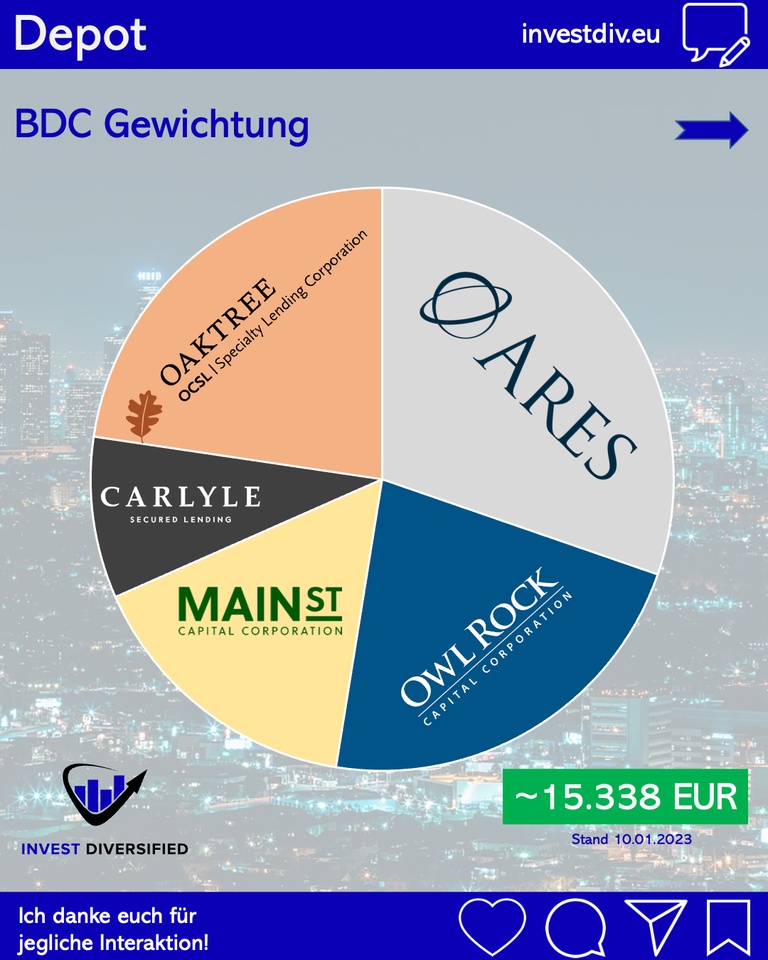

Hello everyone 🙋♂️. Today we have an update on the Business Development Companies in the depot ($ARCC, (+0,13 %)

$OCSL,

$ORCC, (+0,9 %)

$MAIN, (-0,15 %)

$CGBD (-0,36 %)) and some info about how they performed in 2022.

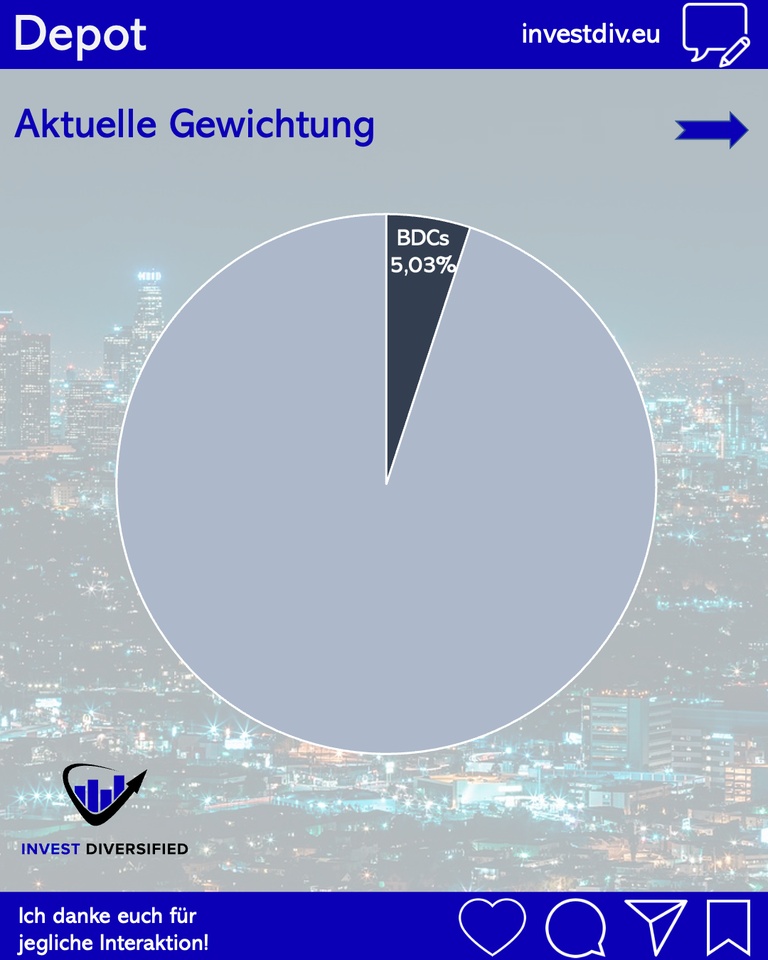

➡️ In total the five BDCs have a market value of ~15,338 EUR and therefore a weighting of 5.03% in the overall portfolio 👍.

➡️ In terms of share price, not much has happened with the BDCs since the last time, but there have been plenty of dividends. 2022 I have a total of 1,174.35 EUR cash flow through BDCs.

➡️ Last year I had to leave the depot with $FSK (+0 %) one BDC had to leave the depot, but this was replaced by various additional purchases.

➡️ With +2,7% the S&P 500 and the NASDAQ100 were clearly outperformed.

➡️ For 2023, I will certainly make strategic additional purchases, I also have 1-2 more BDCs on the watchlist. Overall, however, a weighting should be a maximum of 10%.

Do you have BDCs in your portfolio❓?