11th German Raw Materials Night 💰🥇 $965515 (+1,54 %)

Generally quite interesting, I hadn't dealt with commodities before. In addition to asset managers, mining companies from Canada 🇨🇦 $CXB (+1,64 %) and oil companies from the USA 🇺🇲 $SMK presented themselves.

Conclusion (according to the trade fair, no advice😂)

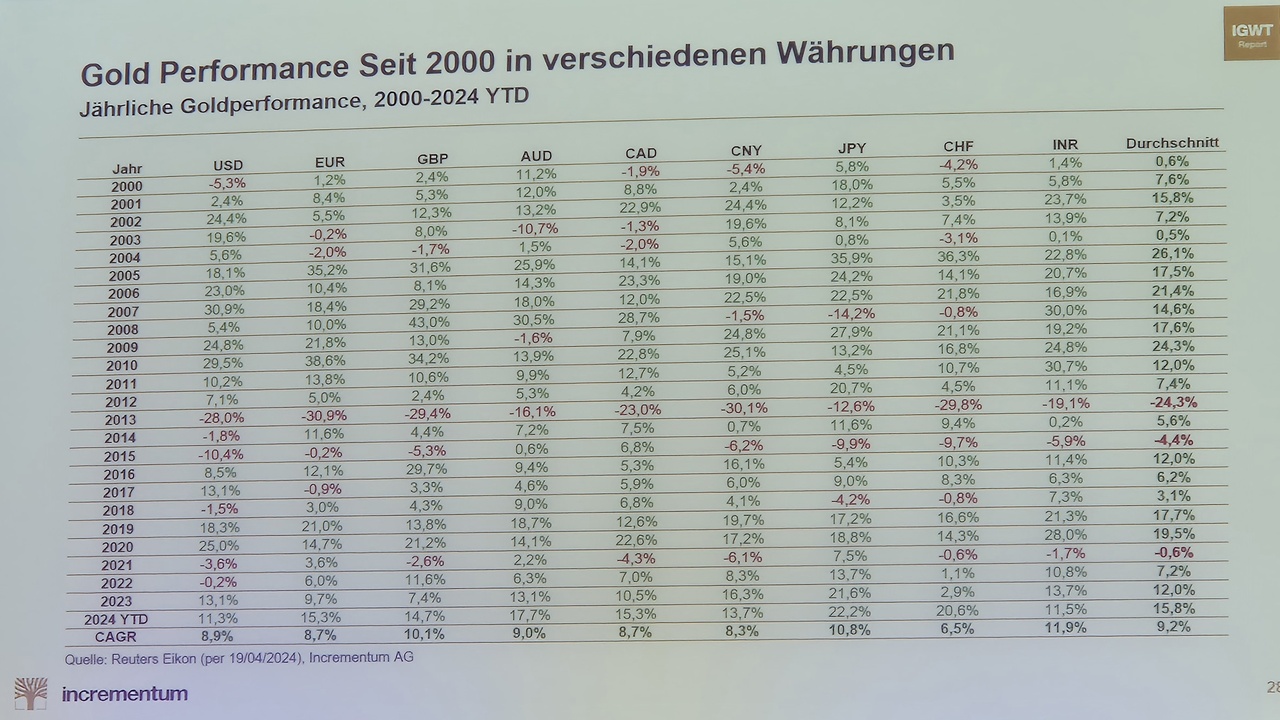

The gold price has broken out of its multi-year consolidation.

Gold mines require an active management approach.

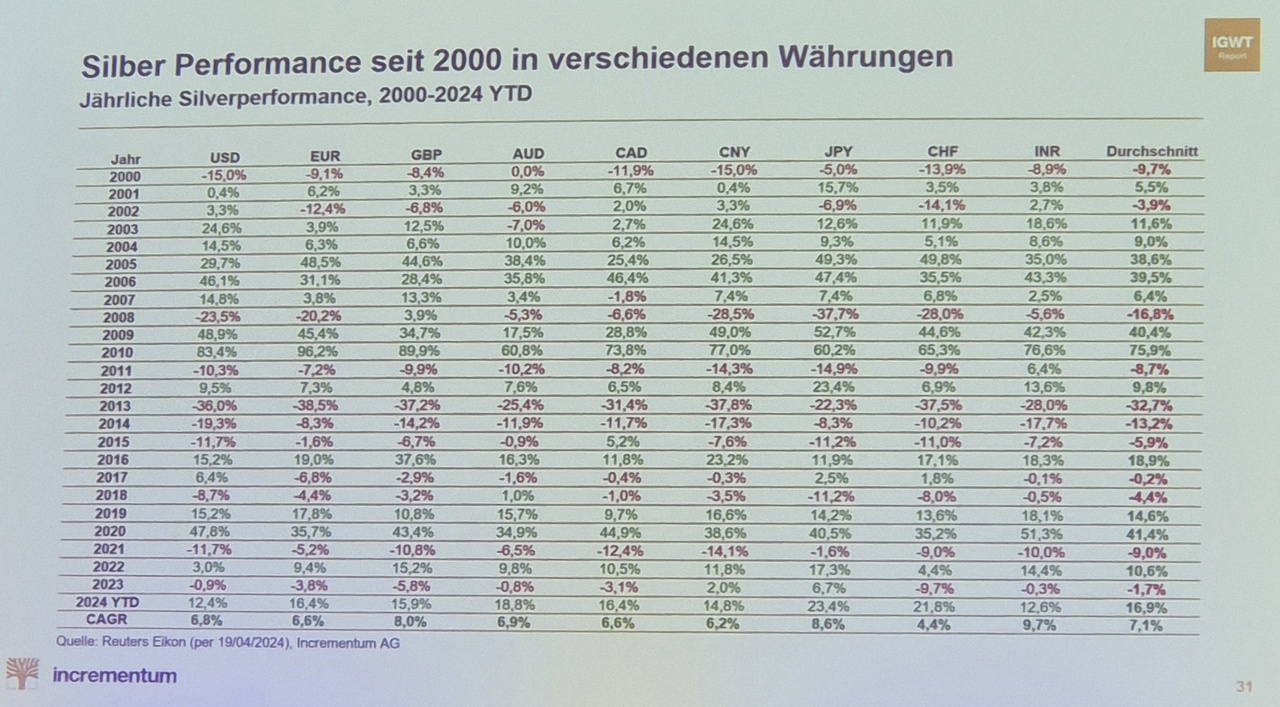

Is silver the new uranium?

12-month gold price at around USD 2700, short-term consolidation possible

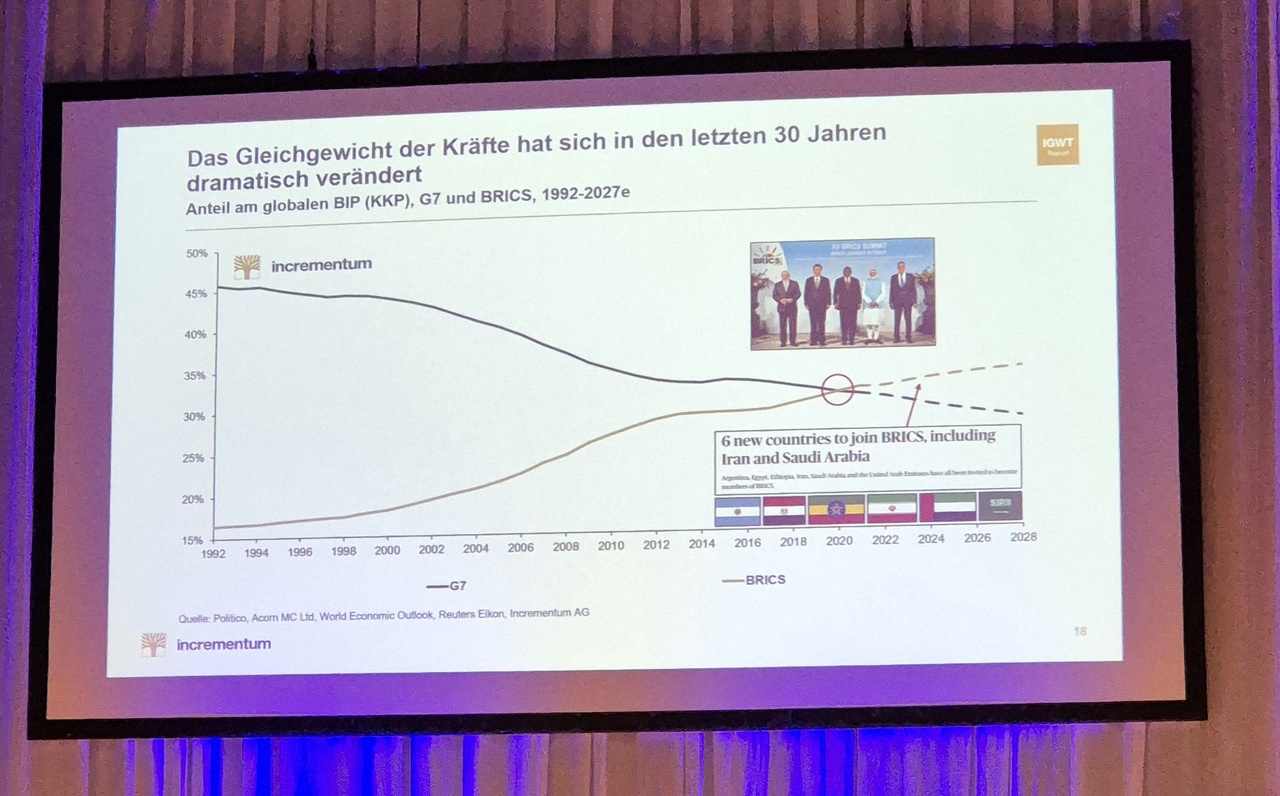

Inflation shock -> interest rate shock -> recession shock -> PIVOT

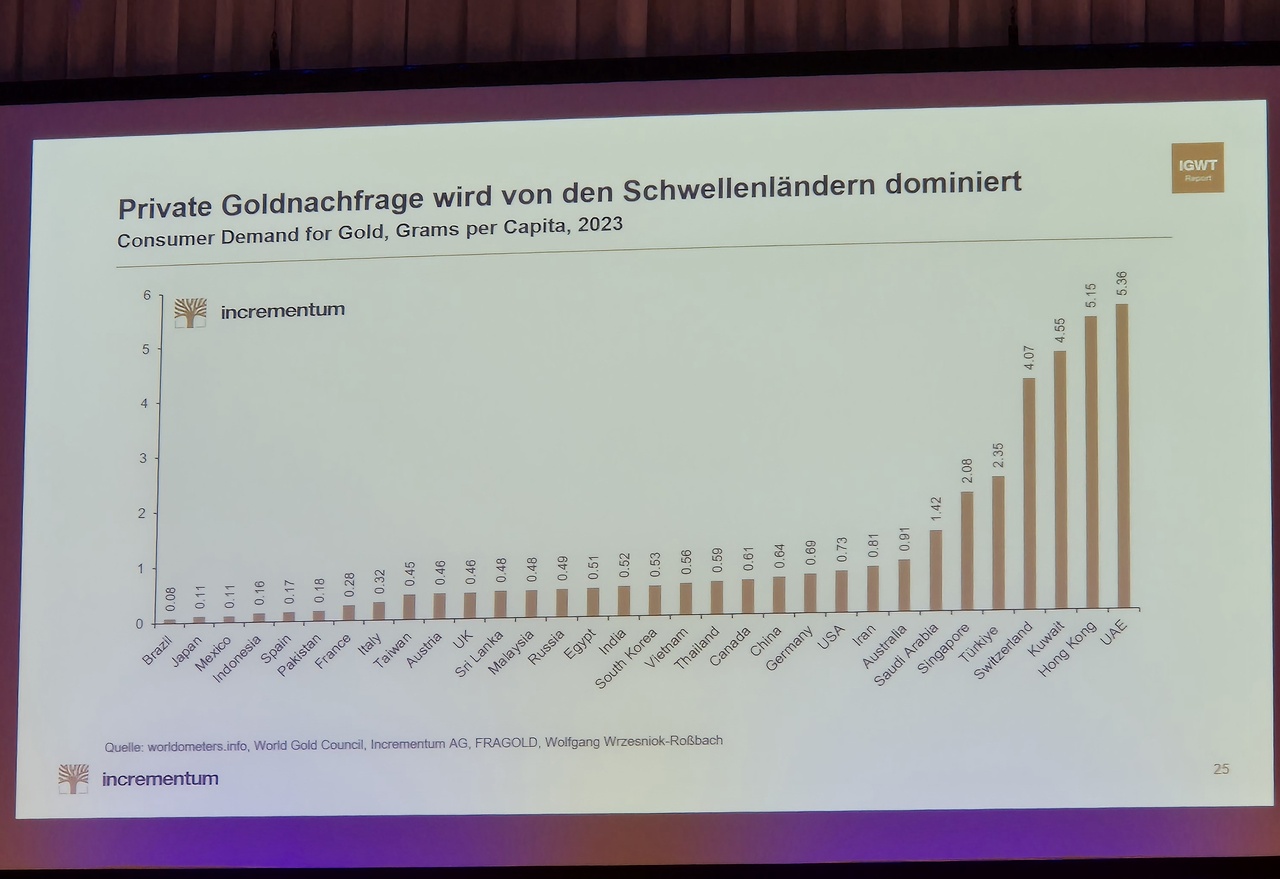

Private gold demand is dominated by the emerging markets.

Investment point that I have taken with me is to take a closer look at $8001 (+0,75 %) Itochu. It's been on my watchlist for a long time, might be added to my portfolio, has a nice commodity component.