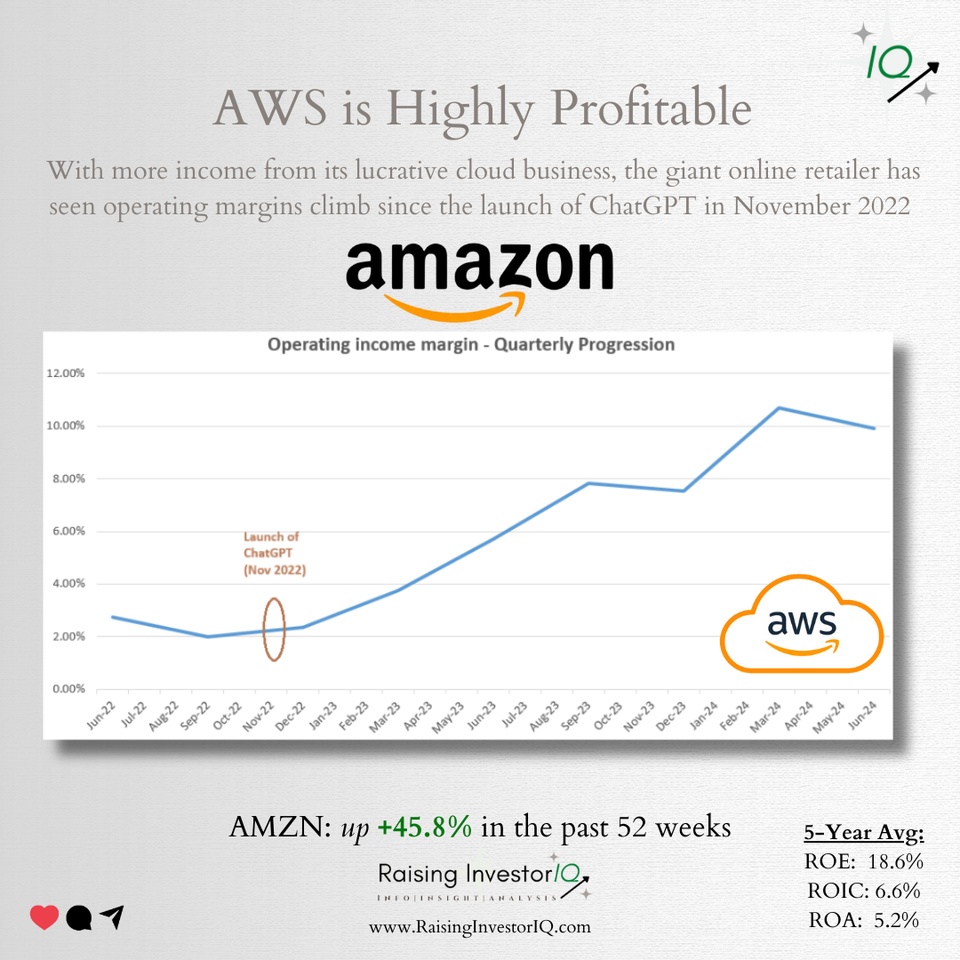

$AMZN (-0,86 %) Amazon has experienced strong demand for cloud services, meaning pricing power.

AWS, its most profitable segment, saw revenues increase to $26.3 billion in Q2, or 19% YoY surge making up only 17.8% of overall sales, but accounting for a sizeable 63.3% of its operating income.

We're bullish on $AMZN (-0,86 %) . They're efforts to reduce operating expenses, while at the same time, investing in AI and garnering more from leasing GPUs and selling products online means more revenues spread over a lower cost base, leading to better profitability.