My new investment. $CORT (+1,19 %)

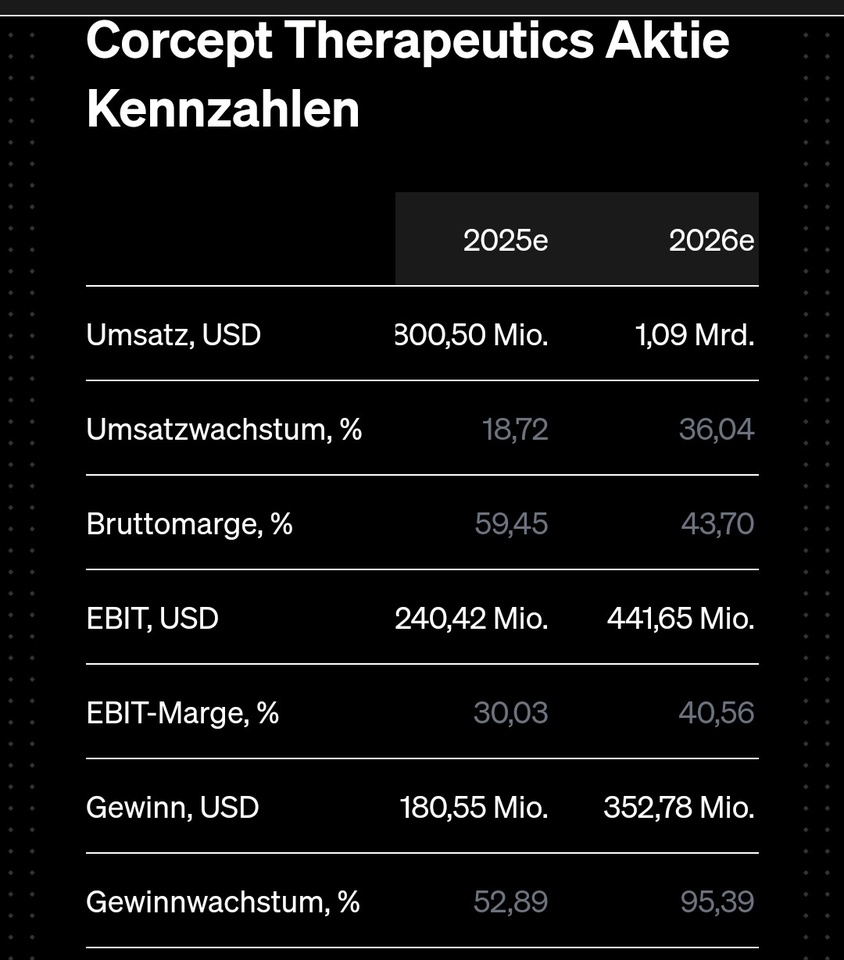

Performance

5years. 227%. 10years 1626%

P/E RATIO

2024: 31,4. 2025: 20,50

Earnings growth

2025: 55,30%. 2026: 50,50%

Earnings per share

2024: 1,12. 2025: 1,84. 2026: 2,75

Free cash flow

2024: 170million. 2025: 258million

EbiT margin

2024: 20%. 2025: 30%. 2026: 40%

Market capitalization: 4.11bn.

Key figures such as margin and free cash flow will increase enormously.

Corcept Therapeutics benefits from higher prevalence of hypercortisolism - Truist sees share price potential of 65%!

The biotech company Corcept Therapeutics (CORT) specializes in cortisol modulation to block the effect of the excess stress hormone cortisol in the body. Excessive production (hypercortisolism) can trigger Cushing's syndrome, which is accompanied by symptoms such as weight gain, high blood pressure or depression. It can also be associated with cancer. Korlym, which has been approved by the FDA since 2012, is a treatment option that once again saw record numbers of new prescriptions from doctors and patients in the last quarter. A marketing authorization application for the more effective Relacorilant is to be submitted in the fourth quarter. CEO Joseph Belanoff emphasized: "Physicians are increasingly aware that hypercortisolism is much more common than previously thought, so they are screening more patients for this disorder."

For example, the CATALYST study recently showed that the prevalence is much higher than previously thought, with around 24% of patients with difficult-to-control type 2 diabetes being diagnosed with hypercortisolism instead of the expected 2.5%. The in-house research team has developed a library of more than 1,000 selective cortisol modulators with different pharmacodynamic properties. Mechanisms of action of Relacorilant for the treatment of prostate cancer and adrenal cancer are also being tested. According to studies, the survival rate of platinum-resistant ovarian cancer, a type of ovarian cancer, has already been doubled from 14% to 29%.

The 2nd quarter recently impressed with an increase in sales of over 39%. The Truist analysts raised the price target from USD 65 to USD 76 (Buy) on September 30 and still see upside potential of around 65%. The experts emphasize that the continued momentum in Korlym's uptake over a decade after its market launch is "impressive and hard to ignore". In the current fiscal year, Corcept aims to grow again by 33 to 39 %. The P/E ratio will fall from 41.6 to 14.2 by 2027. The momentum stock is now generating new buy signals.