I am slowly questioning my investment decision of SMA Solar very much.

I entered on 16.10.2020. I wanted to get a solar stock in the MVzK portfolio. Shares like:

$SEDG (+0,96 %) - SolarEdge

$13X - Xinyi Solar

$HRPK (-0,16 %) - 7cSolarparking

$JKS (+5,91 %) - Jinko Solar

were too volatile for me at the time and had already reacted too much in the sector.

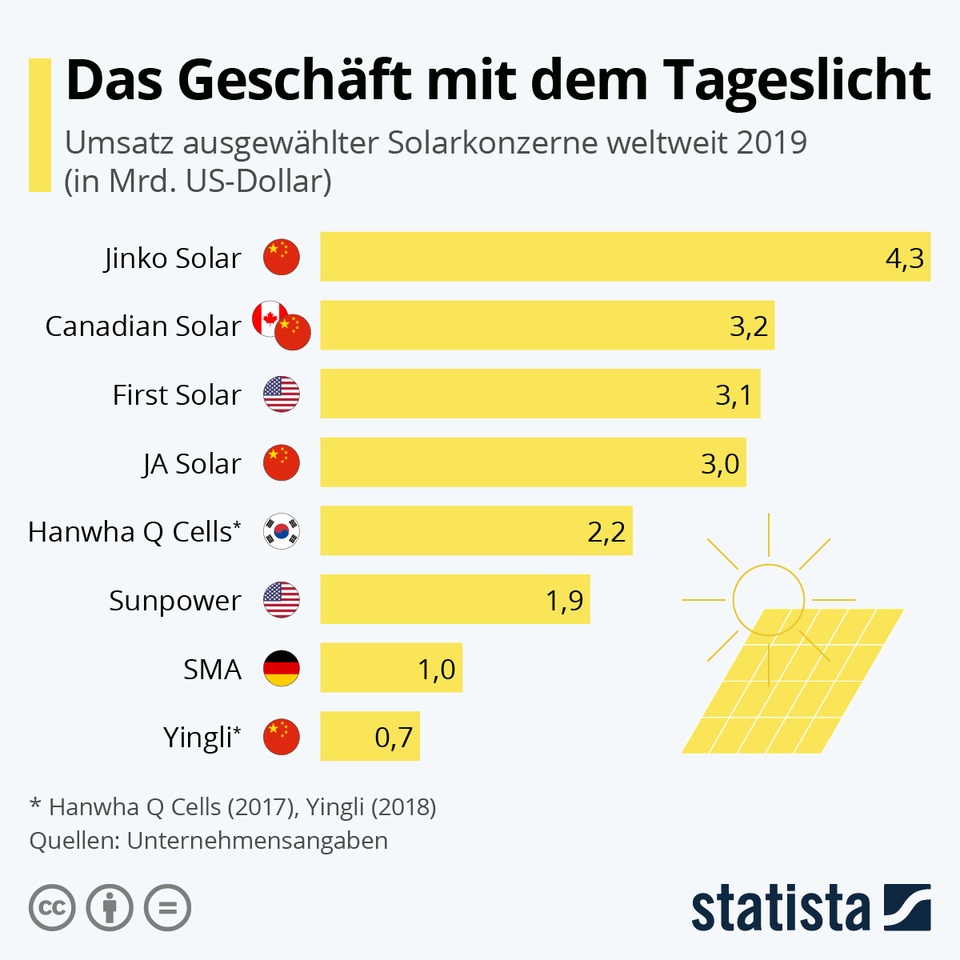

$S92 (+3,51 %) In terms of sales, SMA Solar is rather at the bottom:

Sales were in 2019 (the other years can be difficult to pull for valuation):

JinkoSolar (China) - USD 4,257 million

Canadian:> Solar (Canada/China) - USD 3,201 million

First:> Solar (USA) - 3,063 million USD

JA Solar (China) - 3,037 million USD

Hanwha:> Q Cells (South Korea) - 2,189 million USD

Sunpower:> (USA) - 1,864 million USD

SolarEdge:> (USA) - 1,426 million USD

SMA:> Solar (Germany) - 1,026 million USD

Yingli:> Solar (China) - 650 million USD

In general:> I saw more potential here, as SMA Solar has been getting better and better positioned. However, if you look at the latest forecast for 2021 and 2022, this was once again missed by more than 70%. Of course, under the given circumstances, the entire sector is not doing so well.

The chip sector is hurting this industry the most. There are virtually too few available. Since China and the U.S. have large productions, however, these still come off best. SMA Solar has been falling for ages and is in a complete bear market.

In general, there are now 2 variants for me. I assume very much that this industry is forward-looking and much is still to be expected here. But what role will SMA play here. I do not need like SolarEdge and Jinko a rise in the 2 digit range daily, but would rather a solid rising company than too high vola.

I am beginning to question this with SMA Solar.

So either I buy now times in the low again and think here further long-term, or I just let the run... maybe create a savings plan on it and take the long term or I slowly part with the company and in the medium term maybe from the sector.

Are you invested in the sector and if so in which company? How do you proceed here? Do you currently buy or do you continue to wait?

Chip shortage and the abundance of crises (Ukraine, Corona, inflation and interest rate turnaround) make it of course maximally difficult especially in the sector. The turnaround in interest rates will also have an impact here.

It remains exciting and I will take a close look at the next week. I'm curious how you view this sector.