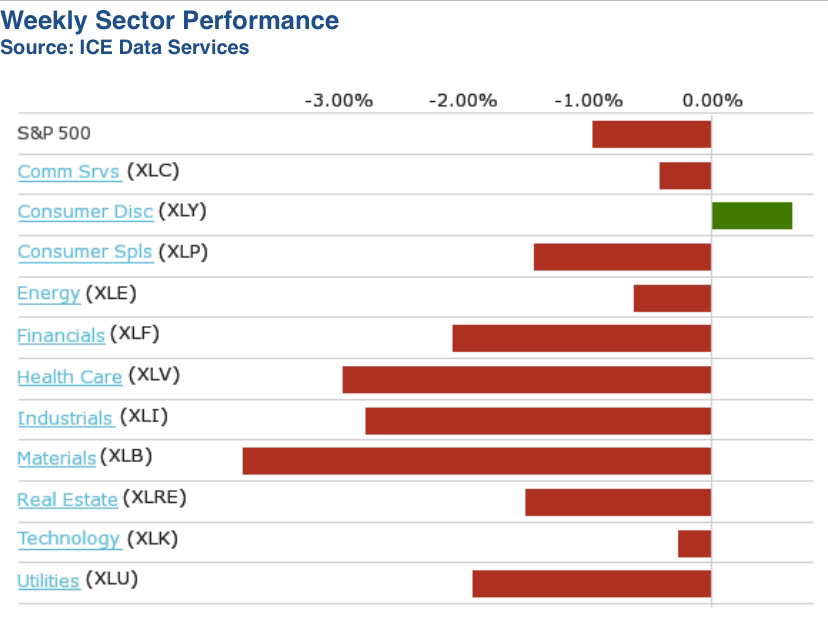

Last week's S&P500 sector performance | $SPY (-0,23 %)

S&P 500 posts first weekly decline since early September as materials and healthcare weigh

The S&P 500 Index fell 1%, posting its first weekly decline since early September, as investors analyzed corporate quarterly results. The market index closed the week at 5,808.12 points, its first weekly decline since the seven days ending September 6. However, it is still up 0.8% for the month and 22% for 2024.

Several companies have beaten analysts' average earnings estimates this reporting season. Megacaps like Coca-Cola (KO) and Tesla (TSLA) released better-than-expected quarterly results this week, while Union Pacific (UNP) missed expectations on both earnings and revenue.

By sector, materials and health care saw the largest percentage declines this week, down 4% and 3%, respectively. Industrials lost 2.8% and financials 2.1%. Utilities, real estate and consumer staples were also down.

In the materials sector, shares of Newmont (NEM) fell 16% for the week as the mining company's third quarter earnings per share and revenue came in slightly below average analyst estimates.

In healthcare, HCA Healthcare's (HCA) Q3 results missed Wall Street estimates as Hurricane Helene negatively impacted some of its facilities. The hospital company also warned of another hurricane-related loss in the current three-month period. Shares fell 13%.

In the industrial sector, shares of Carrier Global (CARR) saw the biggest percentage drop this week, falling 9.6%, as the company's Q3 results missed analysts' expectations and it lowered its 2024 guidance.

Nevertheless, two sectors posted weekly gains: Consumer Discretionary rose 0.9% and the Technology sector gained 0.2%.

Tesla shares gave the consumer discretionary sector a strong boost, rising 22%. The electric vehicle maker's quarterly results unexpectedly rose year-on-year and beat the average analyst estimate, despite weaker-than-expected sales. Tesla also said it expects "modest growth" in vehicle deliveries this year, an improvement from its previous forecast that vehicle volume could potentially be "significantly lower".

In the technology sector, shares of Lam Research (LRCX) rose 6.6% as the company's adjusted earnings per share and revenue for the first quarter of the fiscal year were ahead of both the previous year and analysts' estimates.

Next week's earnings calendar includes reports from Google parent Alphabet (GOOG, GOOGL), Visa (V), Advanced Micro Devices (AMD), McDonald's (MCD), Pfizer (PFE), Microsoft (MSFT), Facebook parent Meta Platforms (META), Eli Lilly (LLY), AbbVie (ABBV), Caterpillar (CAT), Apple (AAPL), Amazon.com (AMZN), Mastercard (MA), Merck (MRK), Berkshire Hathaway (BRK.A, BRK.B), Exxon Mobil (XOM) and Chevron (CVX).

In economic data, the focus will be on October employment figures, with the ADP private sector report due on Wednesday and monthly nonfarm payrolls data and the Labor Department's unemployment rate due on Friday. Other highlights include the release of third quarter gross domestic product on Tuesday and personal consumption expenditures for October on Thursday.