BB Biotech: my investment case

The biotech market

Biotechnology is playing an increasingly important role in today's world. This science, which deals with the application of biological systems and organisms including their components for the development and research of products and technologies, has created a global market that was valued at USD 1 trillion in 2022 and is expected to grow at an average rate of 14% p.a. to USD 3.67 trillion by 2032.

Investment opportunities

However, it is very difficult for private investors to participate in this market, as the topic is very complex and diverse and the shares are often very volatile. The success of a company in this sector often depends on a few products or technologies that have been researched for a very long time, which is why individual studies can sometimes lead to extreme price swings.

In addition to a biotech ETF, investment companies are also a good way to participate in this market with the advantage that specialists are at work here who manage a portfolio and actively pick stocks with expertise that private investors rarely have in this area.

Presentation of BB Biotech AG

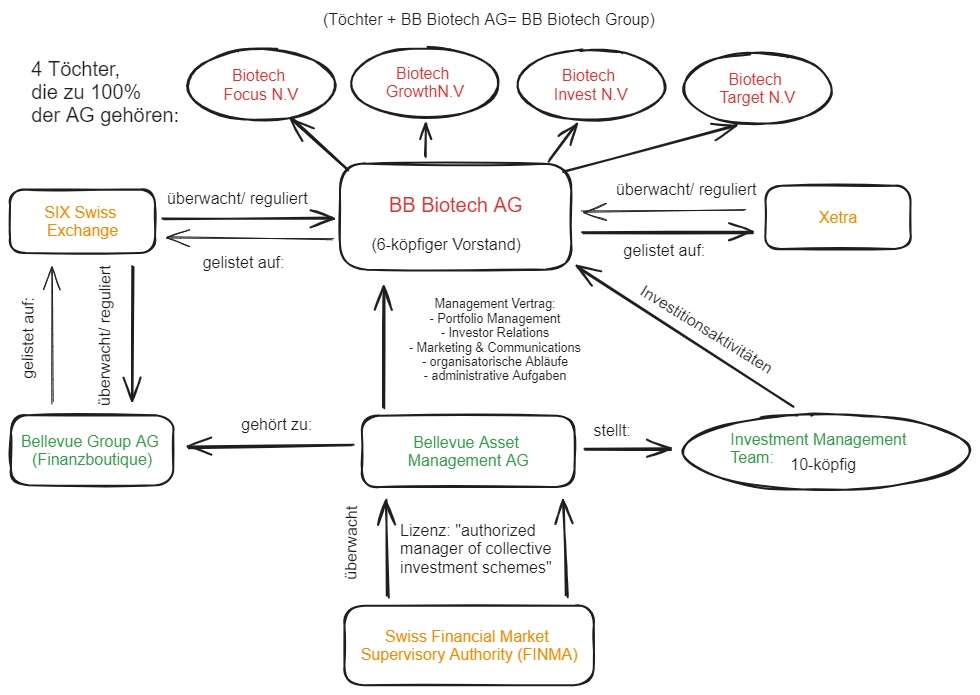

With a market capitalization of CHF 2.65 billion, BB Biotech AG is definitely no longer a small cap and also has an interesting business model. It is a Swiss investment company that focuses on the growth market of pharmaceuticals in biotechnology and invests in companies in this sector. I have summarized the group structure in a simplified chart and will not go into it in detail:

It is important to add that Bellevenue Asset Management AG receives payment for its services in the form of 1.1% of market capitalization p.a., which is paid monthly. The contract is for an indefinite period and stipulates a notice period of 12 months to the end of the following year.

The four subsidiaries of BB Biotech AG are based in Curaçao, an autonomous state within the Kingdom of the Netherlands, from which the company benefits in certain respects.

Investment strategy

BB Biotech AG manages a portfolio of Ø20-35 companies (as of March 13, 2024: 29 positions) with a focus on mid and small caps, but occasionally also holds a smaller proportion of large caps and unlisted companies in the portfolio. The companies are predominantly from North America. The portfolio and changes can be viewed at any time on the website and are documented transparently. The investment process consists of several stages in which a team of analysts and the investment team work together with the Board of Directors. The target is a return of around 15% p.a. and the company emphasizes that the investment is of a long-term nature, which investors should also bear in mind.

Risks

As the portfolio is focused on biotechnology, the performance of the portfolio and therefore of the company and its shares depends on the global biotech market. This is also reflected in the company's sales and profit, which amounted to CHF 500 million (CHF 200 million loss) in the 2023 financial year, but also fluctuated between CHF 700 million and CHF 1500 million (CHF 600-1500 million profit) at times.

The biotech market peaked in 2021 and has slumped sharply since then, as many macroeconomic factors had a negative impact on it, first and foremost of course the high interest rates. Many are hoping for a turnaround soon and are counting on the interest rate cuts by the Fed and ECB, which are eagerly awaited this year, as a catalyst. Increased M&A activity, which goes hand in hand with falling interest rates and a stable market environment, is also cited as a possible catalyst for the turnaround. Nevertheless, investors should be aware that with this share they are betting on a very volatile growth market and a team of external investment managers. German investors should also be aware of the exchange rate risk between the euro and the Swiss franc, as this is a Swiss company that operates in Swiss francs.

My advantages/decision:

Although I am aware of the risks, I have now invested in the share anyway and this is due to the following factors:

Firstly, I am deliberately betting on the turnaround in the biotech market, which in my opinion should give the market a tailwind this year due to falling interest rates and increased M&A volume. In my opinion, the biotech market is an important future growth market that still has a lot of untapped potential.

I am convinced by BB Biotech AG's investment strategy, which can be very profitable due to its focus on mid and small caps. In addition to the small number of economists in the investment team, the majority of the managers have a background in medicine, biotechnology or pharmacy, which is why I have a clear conscience about placing the investment activities in the hands of these experts by buying the shares, as I have absolutely no expertise in this area. The diversified portfolio, in which no single position accounts for more than 14%, means that the risk associated with individual stocks in this sector is manageable.

The company also pursues a strict dividend policy and has paid a dividend once a year for 10 years. The dividend has risen consistently, apart from a few cuts, and the company says that it aims to pay an average dividend yield of around 5% in the long term. Due to fluctuating sales, this should not be the reason to buy and those looking for a sustainable dividend are better served elsewhere. In the past, however, the company has repeatedly carried out extensive share buyback programs, which is more appealing to me.

The shares are all in free float and no investor holds more than 3% of all shares. There is only one class of shares, with one voting right per share, and no options or convertible bonds. The shareholder structure is very diverse and there are no institutional investors who hold a significant proportion of voting rights.

To summarize, I am convinced of the biotechnology sector, the business model of BB Biotech AG and the share and am happy to add it to my portfolio as a small diversification. I am still young and the investment is long-term for me. I am curious to see how it develops.

What is your opinion on the share and the article? This is one of my first analyses and I welcome feedback and suggestions.

No investment advice and no guarantee of accuracy. If you are interested in the share, you should inform yourself.

Sources: https://www.bbbiotech.ch/other-de/private, https://market.us/report/biotechnology-market/

#stock

#aktien

#biotech

#schweiz

#holdings

#stockanalysis

#dividends

#tech