Moin,

Today there is again an update, to a portfolio, which I keep extra for content.

The sense of this portfolio is quite easy. Again and again you hear the excuses: "I have no money to invest" or "I have no time to invest".

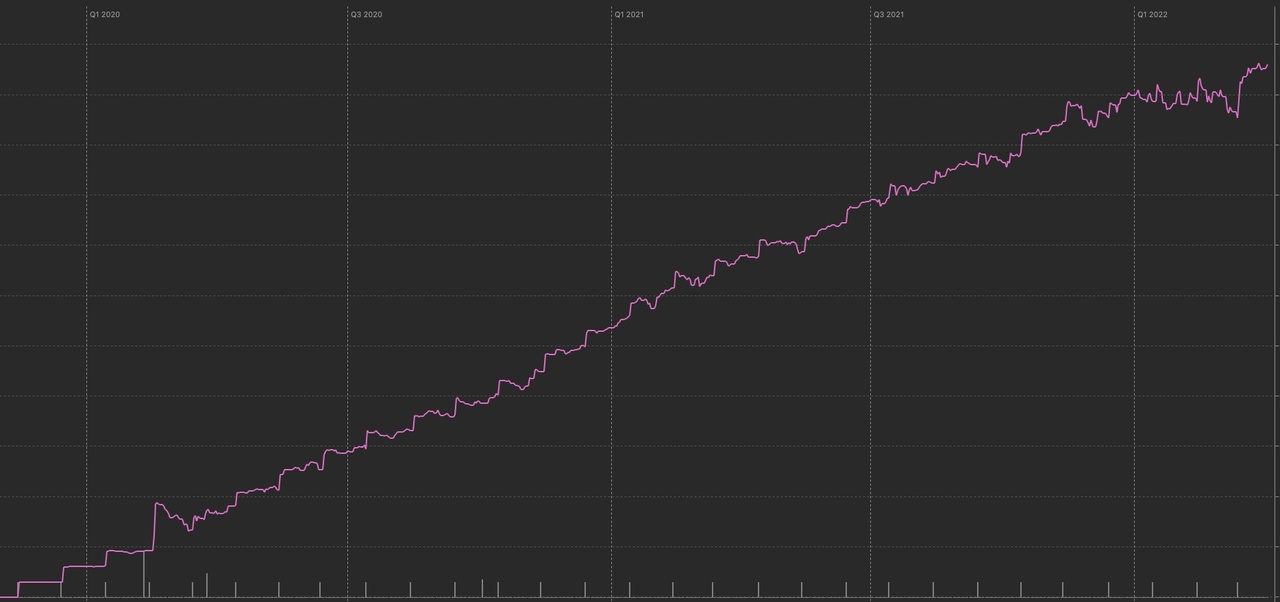

Then in November 2019, I opened this portfolio with Comdirect and received an additional €100 bonus, of which I then included a $DIS (-5,3 %) Walt Disney share at that time with in the portfolio have bought.

Otherwise, only 60€ per month go into the portfolio. In addition, I have once set a standing order on the clearing account of the deposit and 2 savings plans:

35€ in the $IQQW (+0,24 %) IShares MSCI World

25€ in the $EUNM (+0,42 %) IShares MSCI Em

This execution has now been 29 times and I didn't have to spend any time on it.

So this portfolio is not about a lot of money, but to show how you can also with little money and little effort, participate in the profits of large companies. It is now only 2.5 years, but I am very curious how this portfolio looks after 10 and 20 years. I'm definitely going to let it run. And whenever I hear or read this "excuse", I have something tangible to show.

If you can invest very little, let's say like in this example, the 60€ a month. Would you do it that way (or put it all in an All World) or would you rather leave it and not invest at all?