Depot review April 2024 - Red at last?

After 5 months of partly clearly positive performance, the first month of losses since October 2023 now follows.

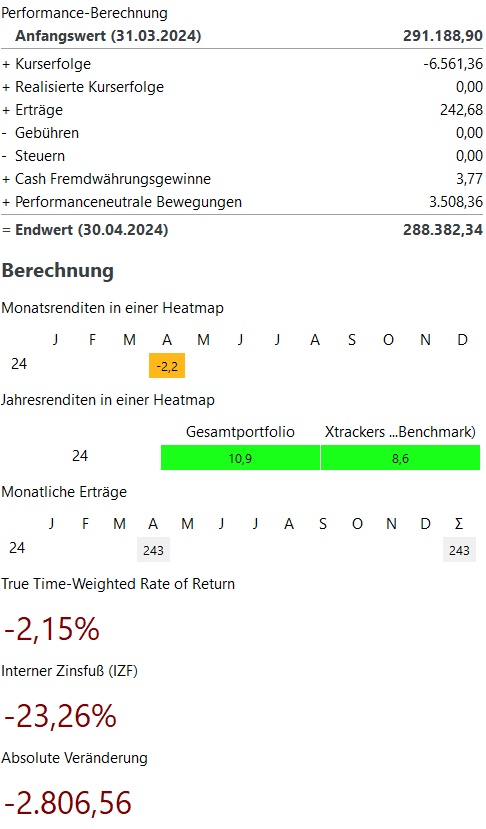

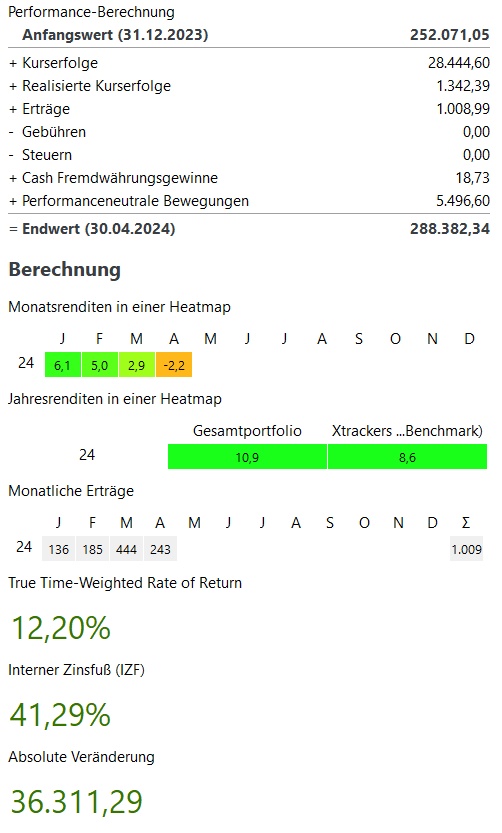

Overall, April was -2,2%. In total, this corresponds to price losses of ~6.500€.

Monthly view:

On the winning side there was actually only one really positive share and that was Alphabet $GOOG (+2,36 %) which will now also join the ranks of the Big Tech dividend payers.

On the losers' side it is a colorful mixture of Sartorius, Meta, Microsoft and Bitcoin.

The performance-neutral movements in April were €3,500. I bought in April for ~€1,500.

Annual view:

In the current year, my performance is +10,9% and thus well above my benchmark, the MSCI World with 8.9%, despite the weak April.

In total, my portfolio currently stands at ~288.000€. This corresponds to an absolute growth of ~€33,000 in the current year 2023. ~28.000€ of this comes from price gains, ~1.000€ from dividends / interest and ~5.500€ from additional investments.

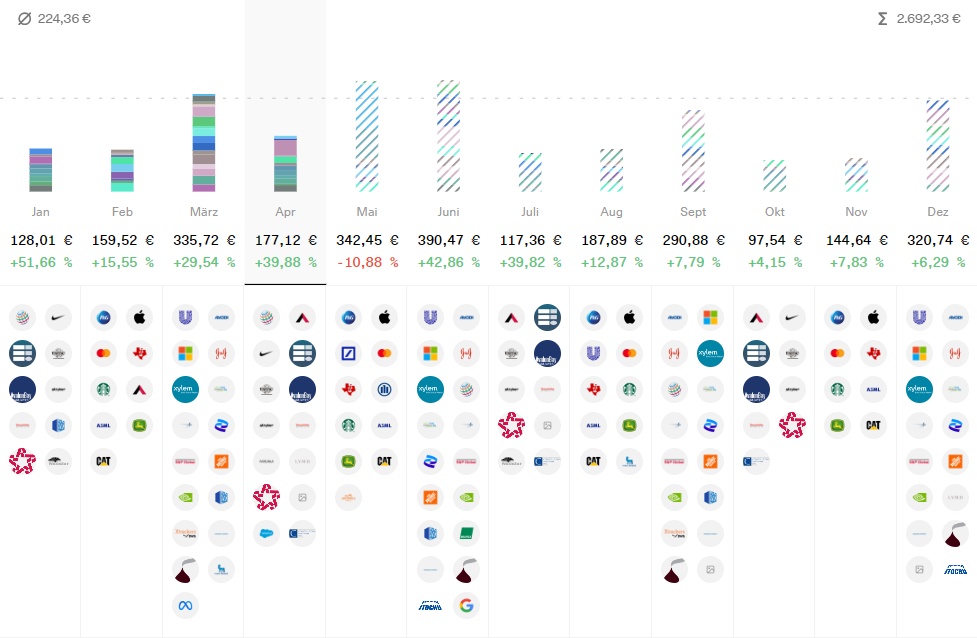

Dividend:

- The dividends in April were +26% above the previous year at ~€160

- In the current year, dividends after 4 months are also +30% over the first three months of 2023 at ~790€.

- In April, there was also a dividend for the first time from Salesforce $CRM (-1,39 %)

Buys & sells:

- I bought in April for approx. 1.500€

- As always, my savings plans were executed:

- Blue chipsNovo Nordisk $NOVO B (+2,75 %) Stryker $SYK (+0,14 %) Apple $AAPL (+0,7 %) Microsoft $MSFT (-0,07 %) Home Depot $HD (-1,52 %) LVMH $MC (+0,44 %) Texas Instruments $TXN (+1,83 %) Nike $NKE (-0,96 %) Starbucks $SBUX (+0,68 %)

GrowthMercadoLibre $MELI (-1,34 %) Crowdstrike $n/a

ETFsMSCI World $XDWD Nikkei 225 $XDJP and the WisdomTree Global Quality Dividend Growth $GGRP- CryptoBitcoin $BTC and Ethereum $ETH

- Sales there were none in April

Target 2024:

My goal for this year is still to break the €300,000 barrier in my portfolio. Despite the weak April and the rather weak start to May, I am optimistic that I will reach my target by buying more in the second half of the year.

#dividends

#dividende

#rückblick

#depotupdate

#aktie

#stocks

#etfs

#crypto

#personalstrategy