Economy on 20.10.2023...

Small expiration day, more rate hikes?, AMEX numbers today... ⤵️

And once again, a stock market week comes to an end, where one is not really sad about it now. Sure there was like Netflix yesterday, one or the other star in the sky, but after the good start on Monday and Tuesday, it went then from Wednesday only downward.

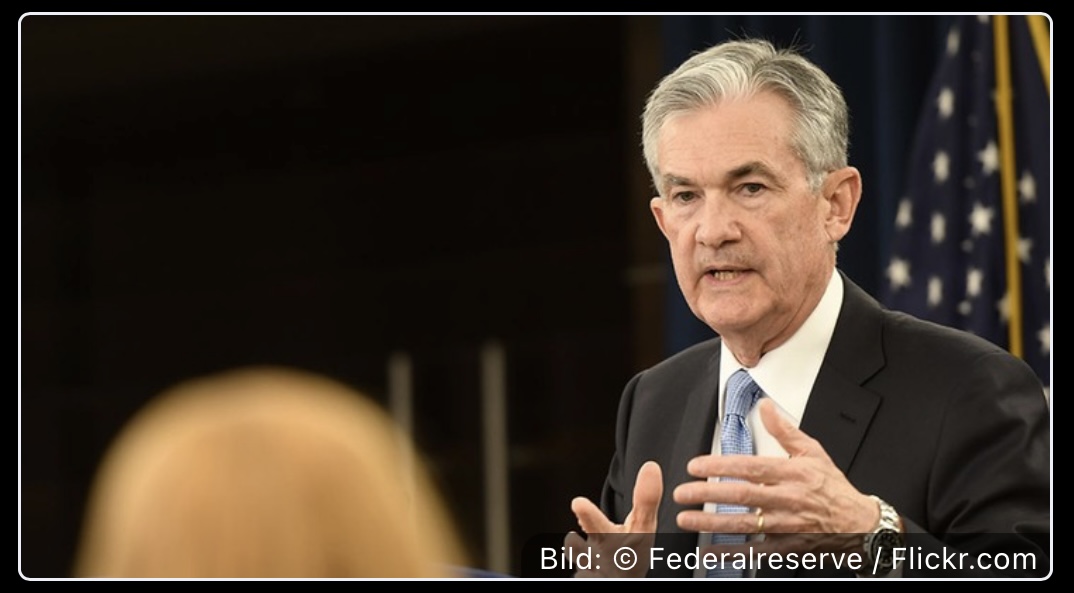

Also the latest statement of the FED, in the press conference of Powell yesterday evening:

"Powell does not rule out further interest rate increases".

will not really help the market. Probably rather fuel the fire further. November 1 is the next decision.

In his speech, Powell emphasized that the Fed will proceed "cautiously" in its monetary policy decisions. He said there is a lot of evidence of a gradual cooling in the labor market, which could help get inflation under control. Significant progress has been made, he said, and data have recently shown further cooling in inflation.

At the same time, however, Powell said that a continued strong economy could warrant further rate hikes. While the last forecasts of the members of the Federal Open Market Committee in the so-called "dot plot" expected another rate hike by the end of the year, the market recently rather did not expect it.

Yesterday, there were also a few numbers to look at:

$AAL (+0,56 %)

American Airlines Group Inc. beat analyst estimates of $0.32 in the third quarter with earnings per share of $0.38. Revenue of $13.5 billion below expectations of $13.53 billion.

$SNAP (+0,45 %)

Snap-on Inc. beat analyst estimates of $4.46 in the third quarter with earnings per share of $4.51. Revenue of $1.16 billion exceeded expectations of $1, 15 billion.

$T (-0,14 %)

AT&T Inc. third-quarter earnings per share of $0.64 beat analyst estimates of $0.62. Revenue of $30.35 billion exceeded expectations of $30.2 billion.

More on the last trading day this week in the shortcut:

Eurex: Short expiration day for equity and index options

Economic data

08:00

- EU: Acea, new car registrations, September

- DE: Producer prices September PROGNOSIS: +0.5% yoy/-14.2% yoy previous: +0.3% yoy/-12.6% yoyj

15:00

- US: Fed Philadelphia President Harker (2023 FOMC voting member), speaks at Risk Management Association, Philadelphia Chapter management.

No time stated

- EU: Conclusion of two-day meeting of justice and home affairs ministers

- EU: rating reviews for European Union (Moody's); Hesse (S&P); Saudi Arabia (Moody's); Czech Republic (S&P); France (Moody's); Greece (S&P); U.K. (Moody's); U.K. (S&P);

ex-dividend individual stocks

RMR GROUP INC a 0.378 EUR

Quarterly figures / Company dates USA / Asia

13:00 American Express | Schlumberger Quarterly Figures

Quarterly figures / Company dates Europe

07:30 Faurecia Sales 3Q | Forvia Group Quarterly Figures

08:00 Villeroy & Boch quarterly figures

No time stated: AMS Osram Extraordinary General Meeting | Schindler Technology Day

#quartalszahlen

#boerse

#börse

#aktien

#news

#newsroom

#community

#communityfeedback

#nachrichten

#täglich

#investieren

#wirtschaft

#politik

#inflation

#fed

#rezession

#mitverstandzumkapital

#krypto

#kryptowährung

#bitcoin

#ethereum

#solana

#zinsen

#ezb

#dax

#inflation

#dividende

#netflix

#tesla

#krieg

#china

#amex