December2023 and annual financial statements2023

December performance:+2.89%

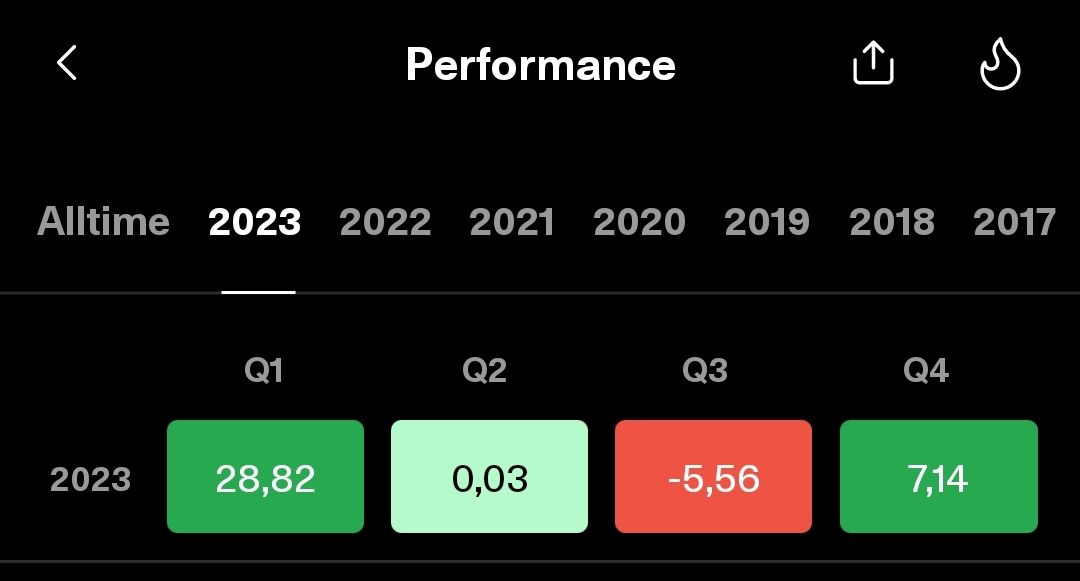

TTWROR 2023: +30,41

Total return currently at:+141%

Portfolio size due to cash balance +389%

🚀 In principle, the portfolio has moved sideways since Q1. Of course, the crypto sector is the main driver with YTD +327%

Target for 2024 as every year TTWROR of 15%

🔥Hot factor: my hot factor list is a watch list in which I record positive and negative signals to strengthen my buying decision for individual stocks.

This has currently grown to 945 stocks, of which 624 have generated at least one positive signal this year. Microsoft was in first place in 2023 with 96 signals. I created a model portfolio for 2023 that looked like this: https://getqu.in/RWhPK0/

I created a new sample portfolio for 2024 today. Interestingly, many placements have changed, but only BP has dropped out and Telekom has come in instead. https://getqu.in/OZFMLV/

Disclaimer: This list only refers to tracked signals, for a definitive purchase they would run through two more checks for me. Therefore no investment advice, just an insight into my strategy

🚀KingMidasFactor: There are currently 1832 stocks on my second watchlist that did not make it onto list 1.

Stock market magic formula: no value calculated

🤖Roboadvisor overall performance currently at +11.99%

1 franc currently 1.07 euros

Investment and strategy changes in May:

Roboadvisor: Savings rate is reduced to 1/10.

Crypto: Reduction of the savings rate by 50% from January. I am currently playing Tetro Tiles for a few sats in between

Nerdminer/Lotterieminer is running but without success

NFTI won't be buying any more stamps. And just keep all the ones I've already bought.

I've been playing Zeedz, known from the Lion's Den, for a few weeks now. I want to test how far you can get without spending a single euro, as the roadmap is still in its infancy, not much can be expected at the moment

🎼Music rights via GlobalrockstarsI currently invested €318 there and got €160 out of it. Soon it should be possible to trade the titles, maybe then it will be a bit more exciting.

Current individual stocks:

$KO (+0 %) Cola and $IBU (-0,15 %) I bought this week.

Other new individual stocks will have to wait, as my emergency situation has not yet reached the target range.

Podcast:

@DonkeyInvestor and I started our little podcast, which was to serve as a stage for the stories of various investors. In between, Bass-T joined us and we took a little break. In December, I continued with the @DividendenWaschbaer and we practiced a small format change. We currently have 2 seasons with 2 trailers and 16 episodes, 152 subscribers on Spotify alone. And almost 3000 plays. Our trademark: poor quality, a bunch of Ehms and a strong Baden dialect.

If you want to listen, you can find us here: https://podcasters.spotify.com/pod/show/waschbaerundkoenig

If you fancy a chat or would like to bring us a topic, let us know.

Professionally: After I successfully passed my certification as a lean expert in May, nothing else came up despite several negotiations. After applying for a job in another department, I was accepted, but without a definite date due to budget cuts.

Real estate: After we suffered our third water damage in February, I hope to finally be able to spend my birthday in my own apartment in 2024.

🔭Outlook 2024: What's next for Getquin?

I'm getting married in April and then my portfolio will be restructured.

What I want for 2024 is definitely more time at a time when I need it and when it's not imposed on me.

I'm planning to have a balcony power station installed, but there are some conditions imposed by the owners' association that make this a bit more difficult.

Feel free to use the block function and if you like my investments or ideas, follow me.

To the Getquin team, thank you for this community, I look forward to further developments! Many thanks also to the many contributions of the individual users. Many thanks also to my followers and fans who encourage me to get a little better every day.....

Thank you for reading!!! And a good start to the new year.