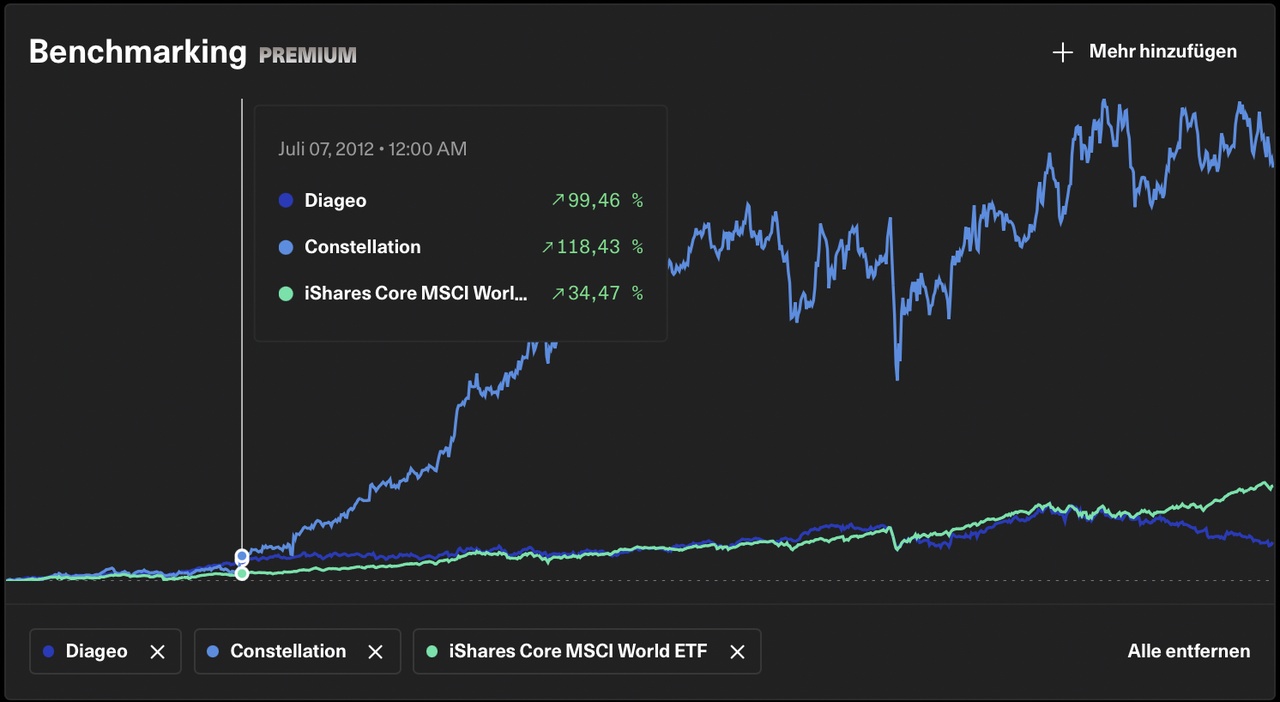

Diageo $DGE (+1,9 %) vs. Constellation Brands $STZ (-1,59 %) - Which "drink" belongs in the depot? 🍸📈

Hello everyone,

I'm just about to give my portfolio a little "sip" and am faced with a difficult decision: Diageo or Constellation Brands? Both stocks look very interesting to me.

Here are a few "hard" facts to get me thinking:

Diageo

- P/E RATIO: 18.6

- Dividend yield: 3.3%

- Sales growth: Stable growth of around 5% p.a. in recent years

- Geographical diversification: Sales are generated worldwide, with strong positions in Europe, North America and Asia

- Product portfolio: Premium spirits such as Johnnie Walker, Guinness, Smirnoff, Tanqueray, to name but a few

Constellation Brands

- P/E RATIO: 18.1

- Dividend yield: 1.5%

- Sales growth: Strong performance, driven by the US beer market

- Geographic diversification: Mainly US and Mexico, but with expansion plans

- Product portfolio: Beer brands such as Corona, Modelo and wine and spirits brands; plus an exciting stake in the cannabis market

Diageo brings impressive stability and global presence. Its brands are iconic and the company has a proven track record. The dividend is solid and the company has proven that it can deliver consistently, even in uncertain times.

But then there's Constellation Brands, with a strong position in the profitable US beer market and an interesting foray into the cannabis sector. They are innovative and have the potential to enter new, growing markets. The numbers look good, and their P/E ratio is in a similar range to Diageo - but with a bit more risk, I'd say.

So now I'm faced with a choice: do I play it safe with Diageo and their global influence, or do I take the extra risk with Constellation Brands and hope for a repeat/continuation of past performance?

What do you think? Which of these two stocks would you add to your portfolio, and why? 🍷🍻

I look forward to your well-founded opinions - and perhaps a few personal "tasting experiences"! 😉