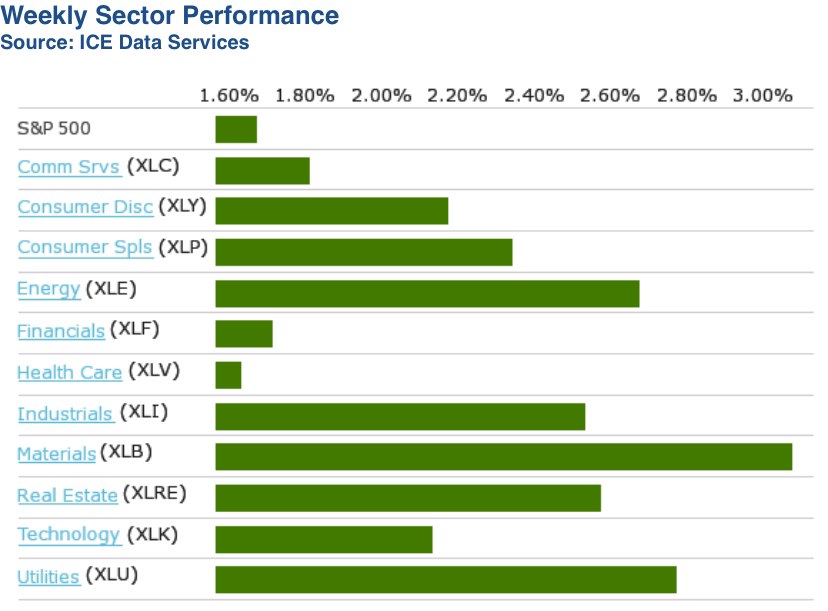

Last week's S&P500 sector performance | $SPY (+0,62 %)

S&P 500 posts broad weekly gain, communication services slow down the rise

The S&P 500 index rose 1.7% this week, with gains in all sectors except communications services. The market index ended Friday's session at 5,969.34 points, up 4.6% for November and 25% for the year to date.

Existing home sales in the US rose more than expected in October, posting their first annual gain in more than three years, data from the National Association of Realtors showed.

US private sector output reached its highest level since April 2022, according to S&P Global's preliminary Purchasing Managers' Index, despite a continued contraction in manufacturing. The outlook for the coming year rose to a 2.5-year high.

Other economic data was mixed. The manufacturing index for the US Mid-Atlantic region turned negative in November, while the contraction in the Midwest improved unexpectedly, according to separate surveys by the Federal Reserve Banks of Philadelphia and Kansas City.

Consumer goods had the highest percentage gain of the week with a 3.1% increase, followed by a 3% gain in the materials sector and gains of 2.6% each in real estate and utilities.

Among the gainers in the consumer discretionary sector were shares of Walmart (WMT), which jumped 7.4% after the retailer raised its full-year guidance and reported better-than-expected results for the fiscal third quarter - helped by gains across all segments.

In the materials sector, shares of Corteva (CTVA) rose 11% after the company unveiled a new financial framework through 2027 at an investor day. This includes USD 1 billion in additional net sales from growth platforms, around USD 1 billion in cost reductions and productivity gains and around USD 4.5 billion in returns for shareholders. Corteva also announced a share buyback program of USD 3 billion.

Communication services, the only sector with losses this week, fell by 0.3%, although only three of its components fell - two of them from the same company: Alphabet, the parent company of Google (GOOGL, GOOG). Alphabet's Class A shares fell 4.4% and Class C shares fell 4.2% after the US Department of Justice and a group of states demanded in a report that Google sell its Chrome browser and take other drastic measures to end its monopoly on internet searches.

Important economic data is due next week, including consumer confidence for November and new home sales in October on Tuesday. Numerous reports follow on Wednesday, including October consumer spending, pending home sales and the first revision of third quarter gross domestic product. The market will be closed on Thursday for the Thanksgiving holiday.