As announced my deposit value.

Although wanted to make all positions open but when I saw how much alone options in account statement I thought nä that's too much so I make times ne very fast written round without profits only with final result.

Good or winners

- Microsoft (Iron Condor)

- Visa Spread (Put)

- Deutsche Bank (Put)

- Telecom (Put)

- ETF MSCI EAFE (Put)

- 5x Main (Call)

- Omega Health. (Put)

- PPB (Put)

- PFLT (Call)

- NASDAQ ETF QQQ (Broken Butterfly)

- 3x S&P500 ETF Spy (Spread Put)

- 5x on the future S&P500 Mini (mostly spreads)

Bad/Loser

- Nvidia (Spread Put, closed early)

- LTC Propertis (call then rolled in overtired state and more crap)

Short explanation to the $LTC (+1,14 %) I thought that it would not break the 40$ mark, but the term was too long and we see it dancing at 44$ and is my strongest stock in the portfolio. When I then saw that I had to act I was not mentally condition and that is one of the reasons why I also advise against options. I converted the call into a put when I was tired and I was just lucky that the price developed so well. So I could close the option with a small profit and that brought back calm. Only briefly it was really luck more not it could have changed so that I would have to buy 100stk for 50$ what is available but.

$NVDA (-2,33 %) The loss was achieved by a stoploss because I wanted to try this order times with options. Would otherwise have been a winner

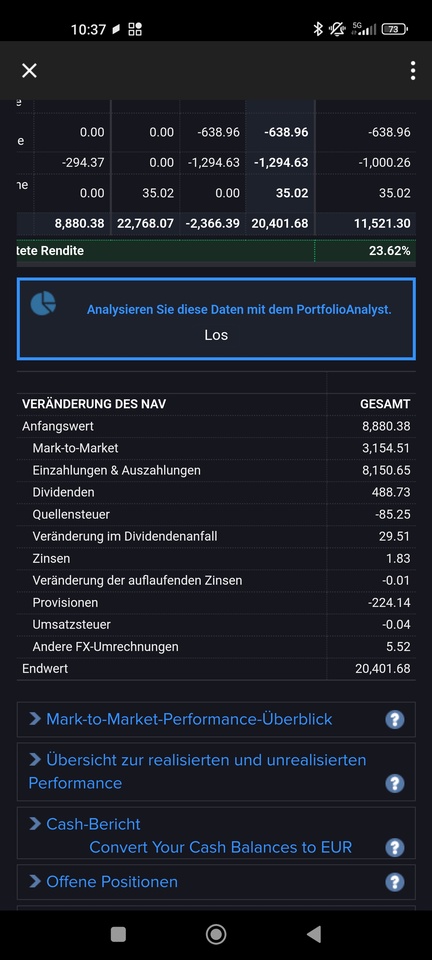

Now we finally come to my depot^^

As you can see I have only crossed out my account numbers and put in 3 All worlds as benchmarks. You can see that I am currently outperforming them. I would like to say here that it is not my intention. I want to have actually only ne class yield and wen this +20% then I am happy, who does not. But you can also see that I have daily fluctuations also strong see you -5% in June. But since I continue to make that will also in the largest also caught up again.

Important is always the term when an option is closed shortly before the end you have more profit. But if it has a long duration and is highly volatile you can claim more premium and thus increases its own profit or loss to mention it briefly (if I ever write more detailed about options then let me know I look when I do what like).

Finally, I also show times my net figures. You can see them in the last two pictures. And as I said if you want I can write more about options, just let me know.

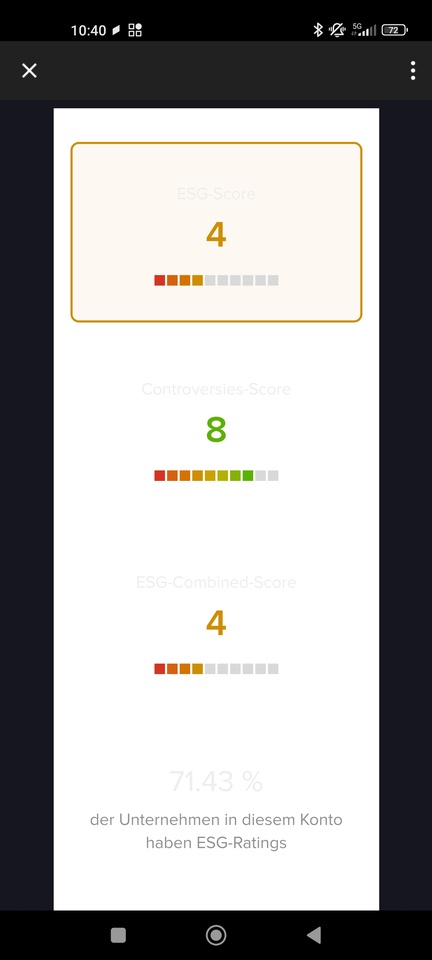

PS. Enclosed my ESG if who cares 😅

#koksundnutten

#ziele

#finanzen

#finanziellefreiheit