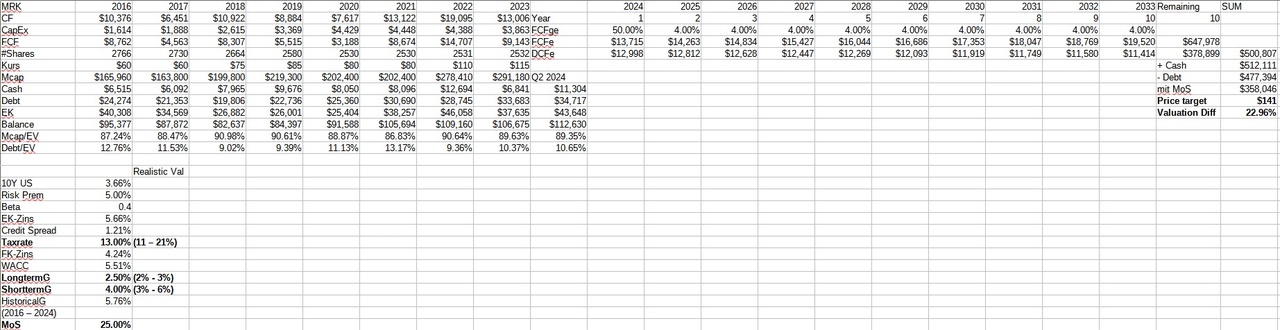

$MRK (+1,18 %) I took the trouble to write a DCF analysis of Merck:

A few notes and assumptions:

- FCF for 2024 is estimated at approx. USD 14 bn, which is my starting point

- No dilution of the shares is expected

- No products and strategies of the company are included (e.g. Keydruda patent expires in 2028)

- A constant market cap to enterprise value ratio of approx. 9:10 is assumed (has historically always been in this range)

- Risk premiums are stated at today's level (5% equities to fixed income, 3.66% 10y USD and credit spread of 1.21% for A-)

- this also assumes that $MRK (+1,18 %) the A- or A3 rating is retained

- The historical FCF growth was 5.8% (2016-2024). I rather conservatively expect 4%

- Long-term economic growth in the USA is around 3%. I also calculate rather conservatively with 2.5% for $MRK (+1,18 %)

- A margin of safety (MoS) of 25% is also built in

- Although the growth was calculated rather conservatively, it was still $MRK (+1,18 %) was not exactly constant in its FCF figures, which means that it will probably not achieve this constant forecast growth

The fair value here is 141USD (with MoS, mind you). That is +23% upside

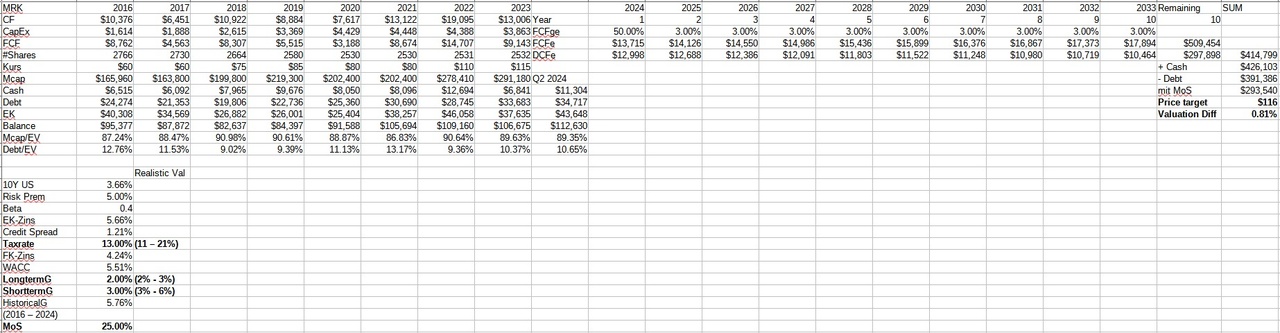

Here again an extremely conservative forecast with 3% growth and 2% long-term growth

Here the share seems to be fairly valued (but again with MoS)

Since I am still missing a healthcare/pharma stock myself, I will probably $MRK (+1,18 %) probably buy it. The dividend, low vola (0.4 beta) and quality factor are also convincing