Good question, the market is definitely hot right now and we are at a point (or close to it) where valuations are less important.

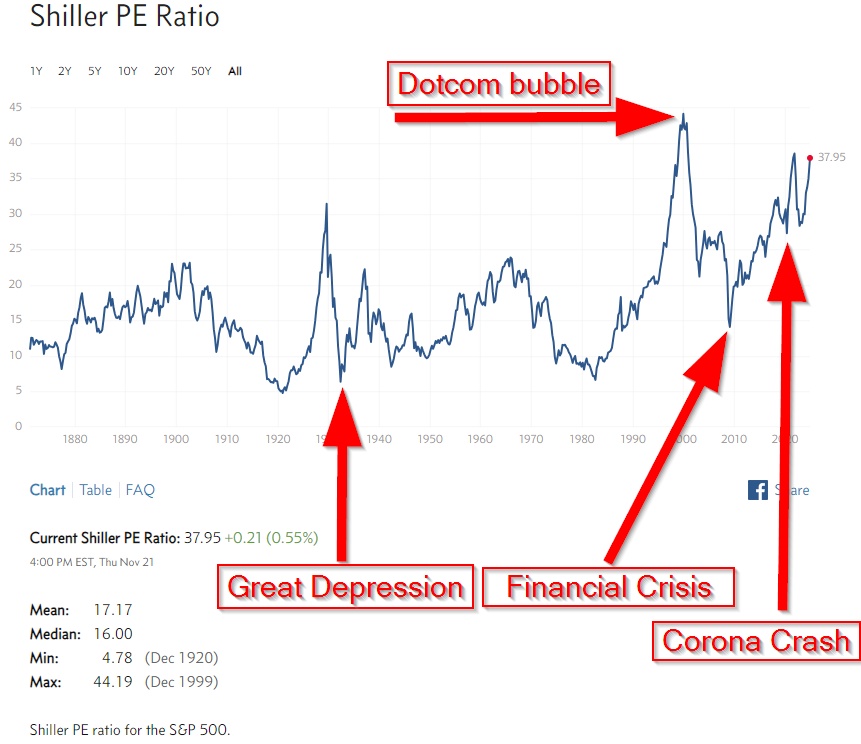

Schiller PE for the S&P500 $SPY (+0,69 %) is 3rd highest in history.

https://www.multpl.com/shiller-pe

There is a broad consensus in the financial world that high valuations speak for lower return in the long term.

But anything is possible in the short term.

However, this only applies to the US market and the technology sector in particular.

The international markets are mostly fairly valued.

And emerging markets (except India) are cheap.

If I had to buy something, I'd buy those instead.

But I'm already so invested that I can sit back and build up some investment reserves.

Just to be clear and not to be misunderstood:

I'm not saying the market is going to crash. I'm just saying that the valuation of the S&P500 has risen faster than earnings have grown.

This is an ongoing trend. Here is a paper from 2021 that describes this valuation expansion:

https://www.aqr.com/Insights/Perspectives/The-Long-Run-Is-Lying-to-You

If you want to sell, these above average valuations are great.

Unfortunately, most people here are at the beginning or middle of their investing careers. And buying at high valuations has historically led to lower returns. 😘