Old Republic International Corporation- The stock for Opis?

Company presentation: Old Republic International Corporation

Old Republic International Corporation is a leading US insurance company specializing in comprehensive insurance and property solutions. The company emphasizes integrity, quality, service excellence and financial strength. With a history of over 90 years, Old Republic International has earned a first-class reputation for outstanding customer service and fair business practices.

Historical Development

Founded over 90 years ago, Old Republic $ORI (+0,52 %) Republic International has developed into one of the leading players in the insurance industry through steady growth and the establishment of long-term partnerships. These years of experience and solid background have made the company a trusted name in the insurance sector.

Business model

Old Republic International's business model is based on providing responsible and sustainable insurance and real estate solutions. The company aims to create equal value for its shareholders, employees and customers while generating stable returns. Old Republic International takes a customer-oriented approach and places particular emphasis on long-term relationships and financial stability.

Core competencies

Old Republic International is characterized by the following core competencies:

- Integrity and Quality: The company is known for its high standards of integrity and quality in all areas of its business.

- Excellent customer service: Old Republic International has earned a reputation for outstanding customer service, resulting in long-lasting customer relationships.

- Financial Strength: The company's solid financial stability is one of its greatest strengths, enabling it to reliably meet its obligations to customers and shareholders.

Future prospects and strategic initiatives

Old Republic International strives to continue to meet high expectations of financial stability and trust. To further strengthen its position in the insurance industry, the company plans to capitalize on new growth opportunities. Strategic initiatives could include entering new markets, introducing innovative products and services and increasing operational efficiency. These measures should help to achieve the strategic goals and strengthen the company's market position in the long term.

Insider shareholdings

- Arnold Levy Steiner: 0.25%

- Craig Richard Smiddy: 0.07%

- Rande Keith Yeager: 0.06%

- Stephen Joseph Oberst: 0.06%

- Spencer LeRoy: 0.04%

- Stephen Robert Walker: 0.03%

- William Todd Gray: 0.03%

- Thomas Andrew Dare: 0.02%

- Francis Joseph Sodaro: 0.02%

- Jeffrey Patrick Lange: 0.02%

- Carolyn Jean Monroe: 0.01%

- Steven James Bateman: 0.01%

- John Maynard Dixon: 0.01%

- Fredricka Taubitz: 0.01%

- Glenn W. Reed: 0.01%

- Charles James Kovaleski: 0.01%

- Lisa Jeffries Caldwell: 0%

- Michael Denard Kennedy: 0%

- Peter Boyd McNitt: 0%

- Barbara Ann Adachi: 0%

This means that the insiders of Old Republic International Corporation only hold a total of around 0.66% of the shares in the company. But this is hardly surprising for an older company. However, this means that nobody has "skin in the game".

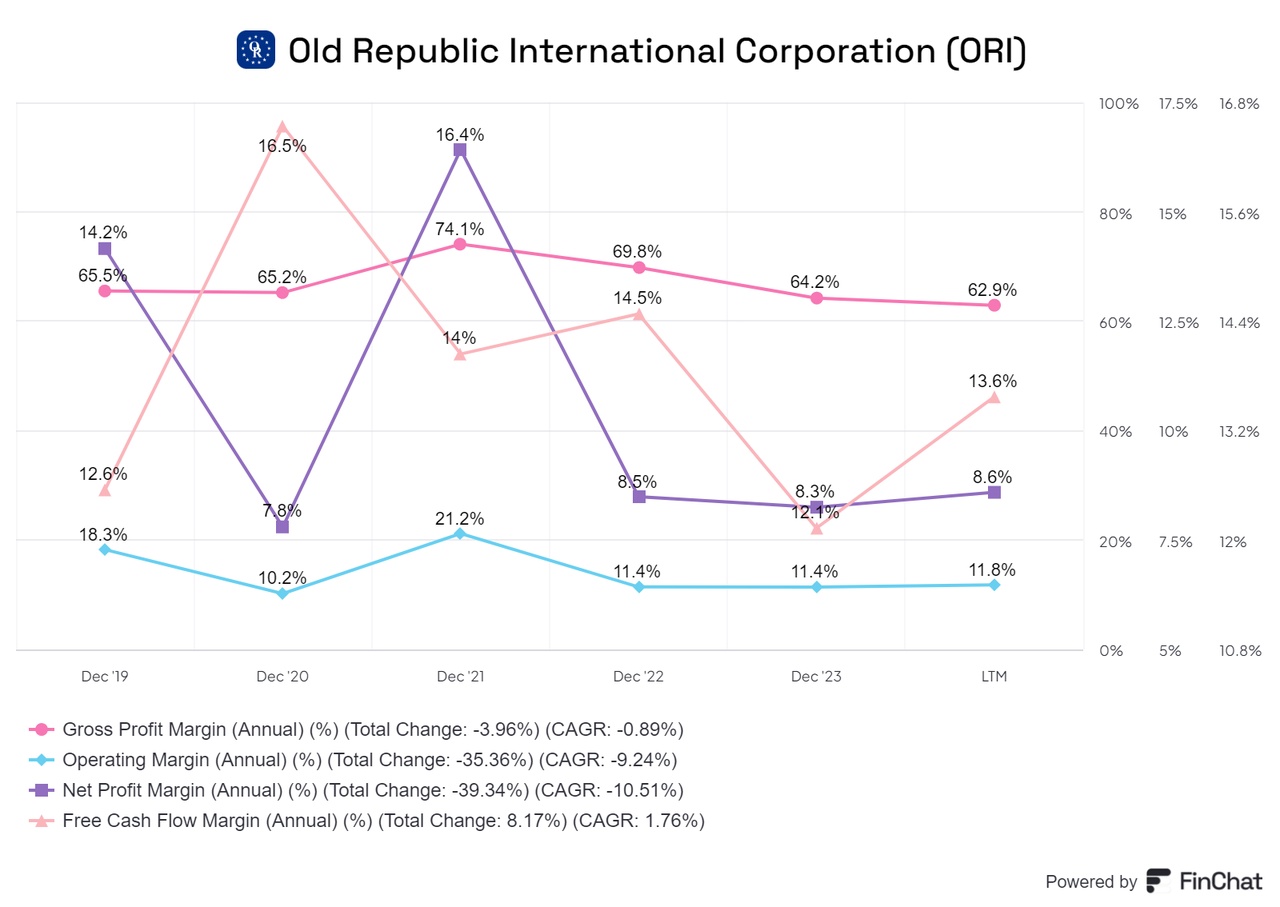

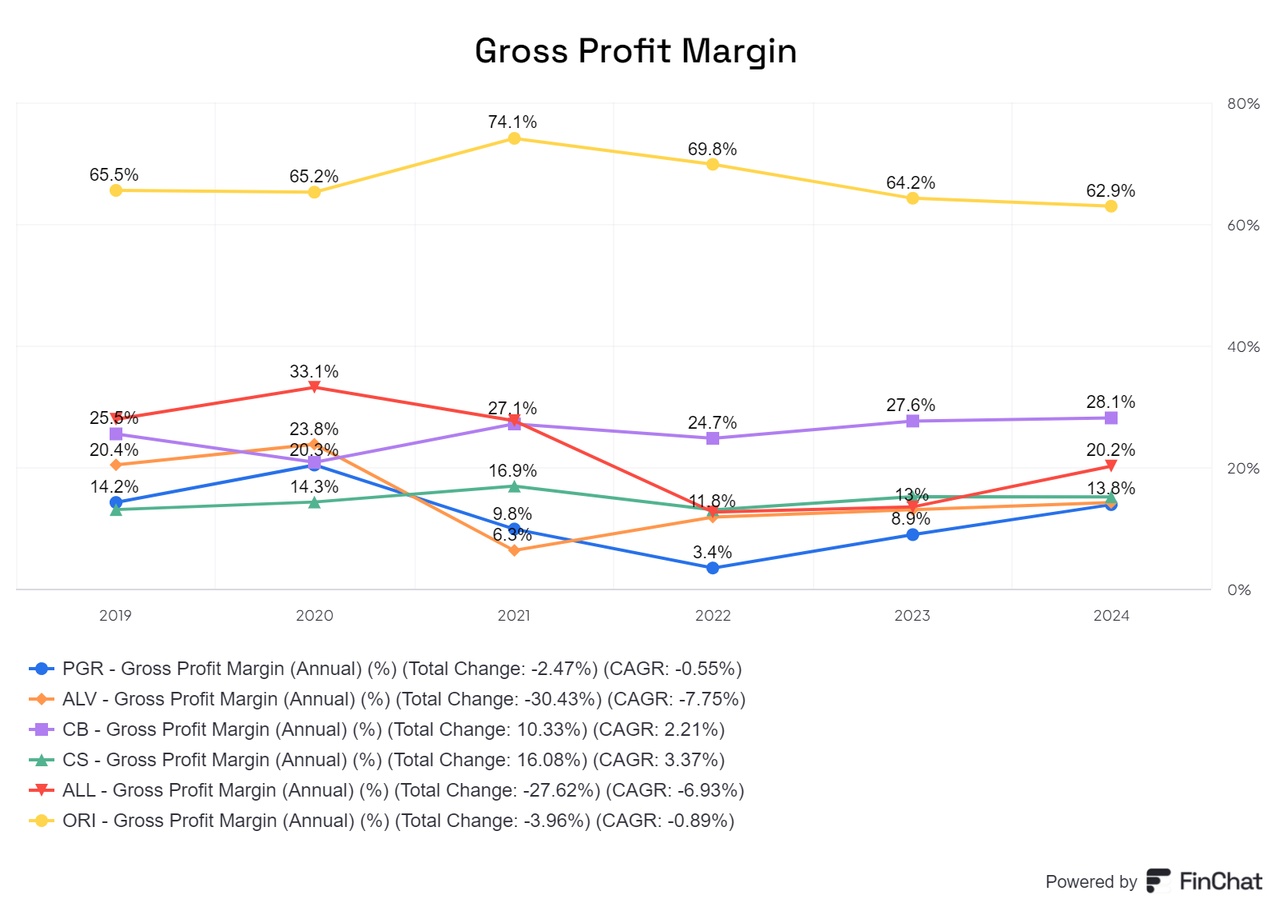

Margins top of the notch

Compared to other insurance companies, Old Republic International Corporation (ORI) has an exceptional gross margin. At 62.95%, this is more than twice as high as the next best competitor and illustrates how efficiently the company is managed and how profitable its customer relationships are.

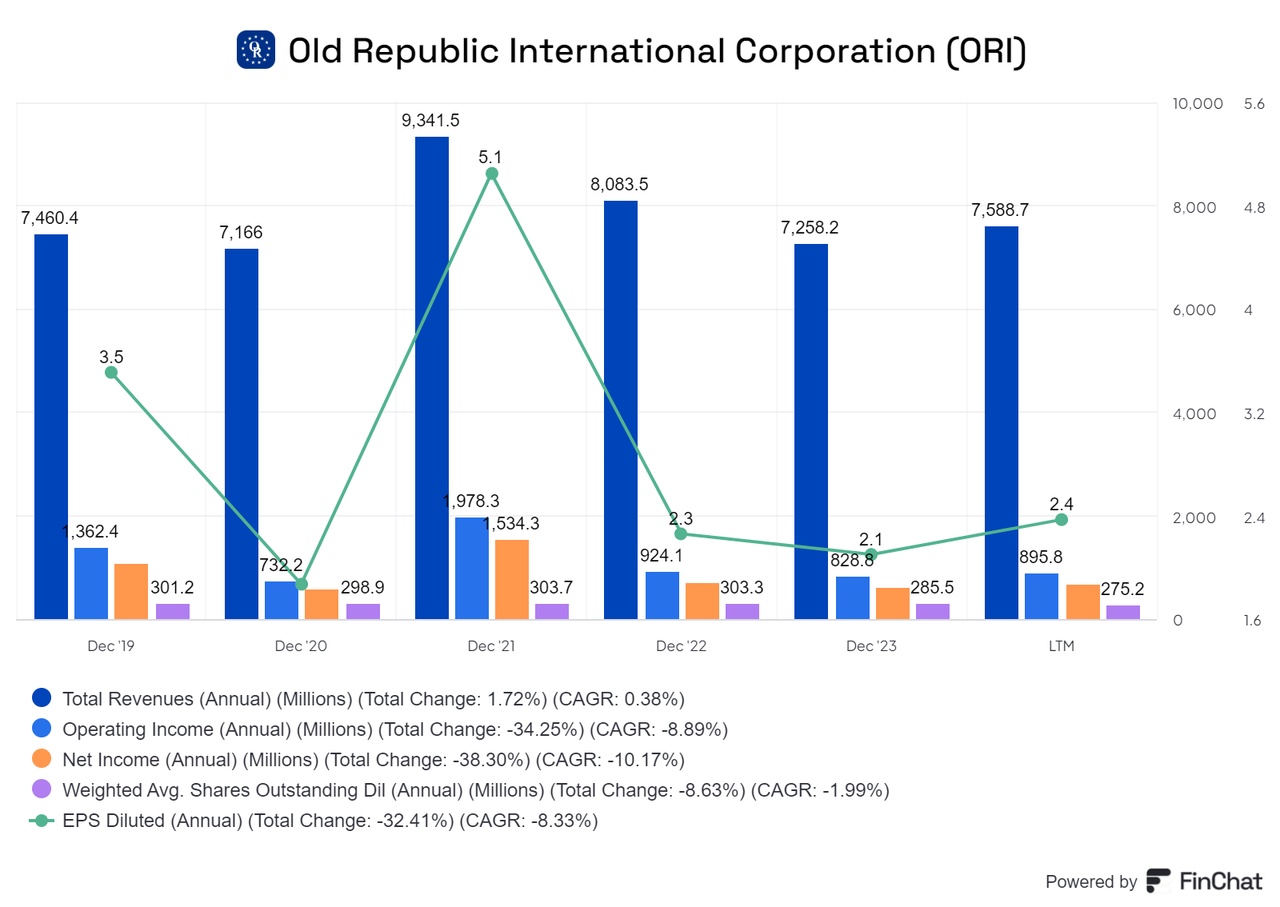

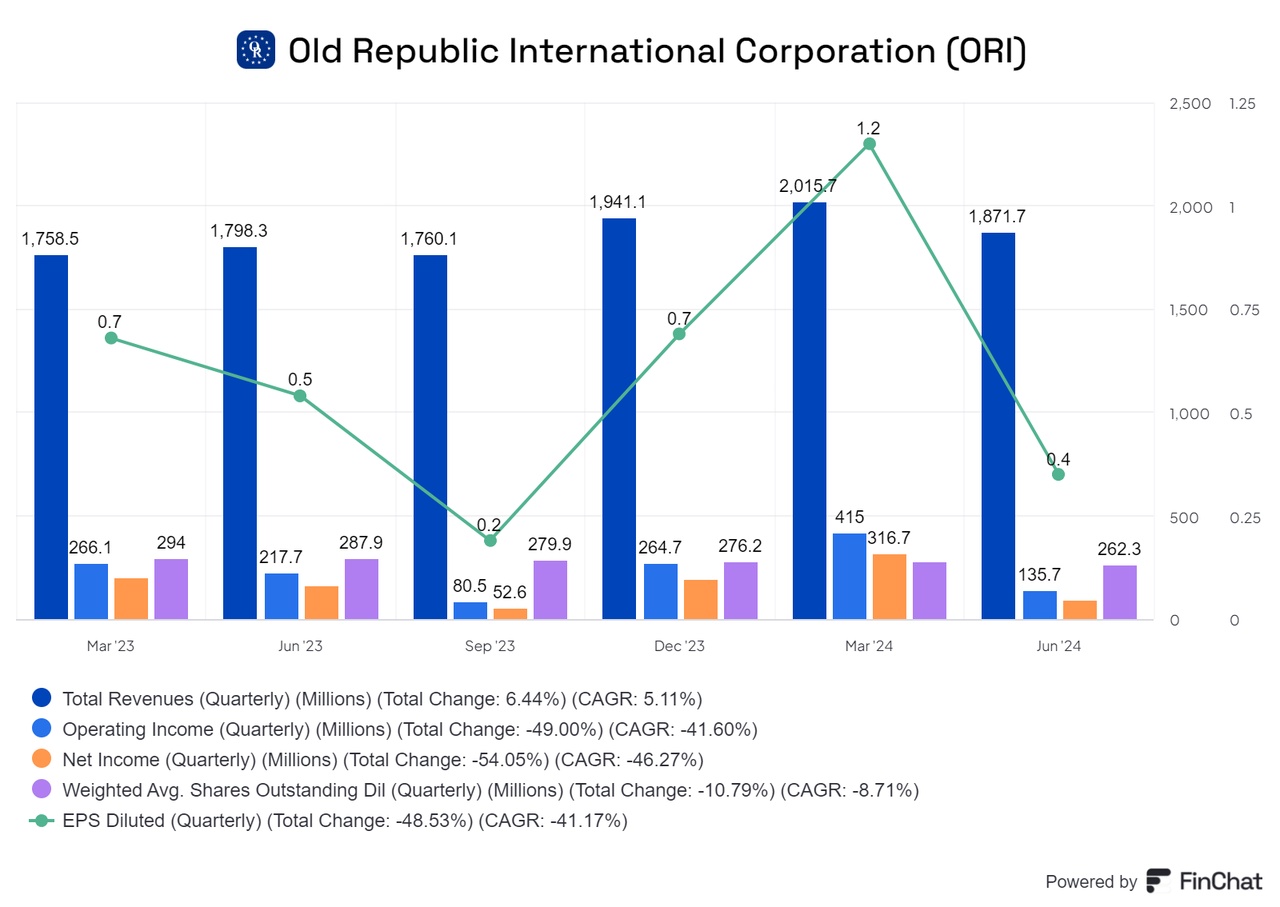

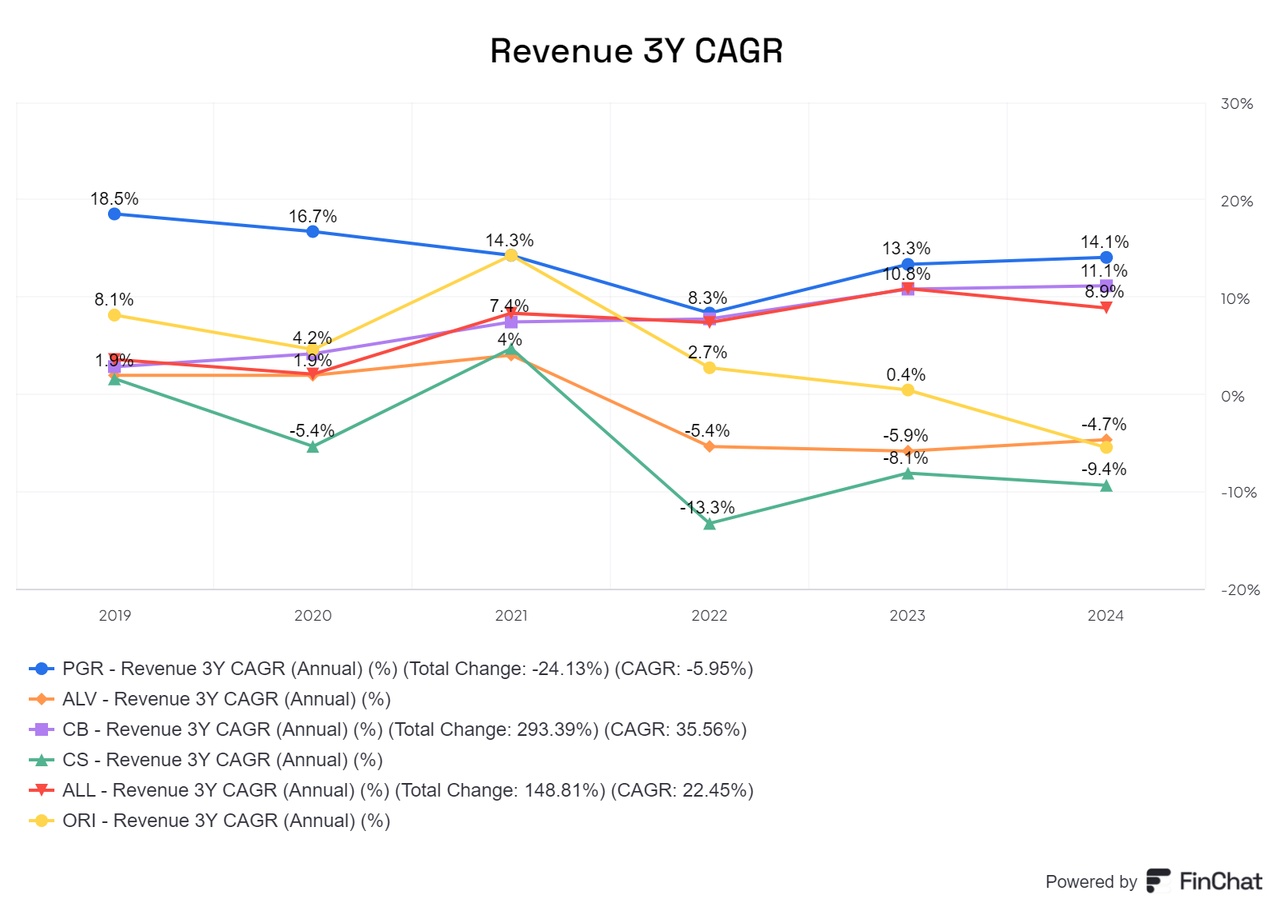

Sales development

Old Republic International Corporation's sales are currently stagnating at around USD 7 billion and are not showing any significant growth. Growth rates are even slightly negative. However, this is not necessarily an alarming sign if the company is simultaneously working more efficiently and retaining high-quality customers. As is usual with insurance companies, the net result also shows a certain stagnation. However, it should be borne in mind that the company would be extremely profitable in years with few claims.

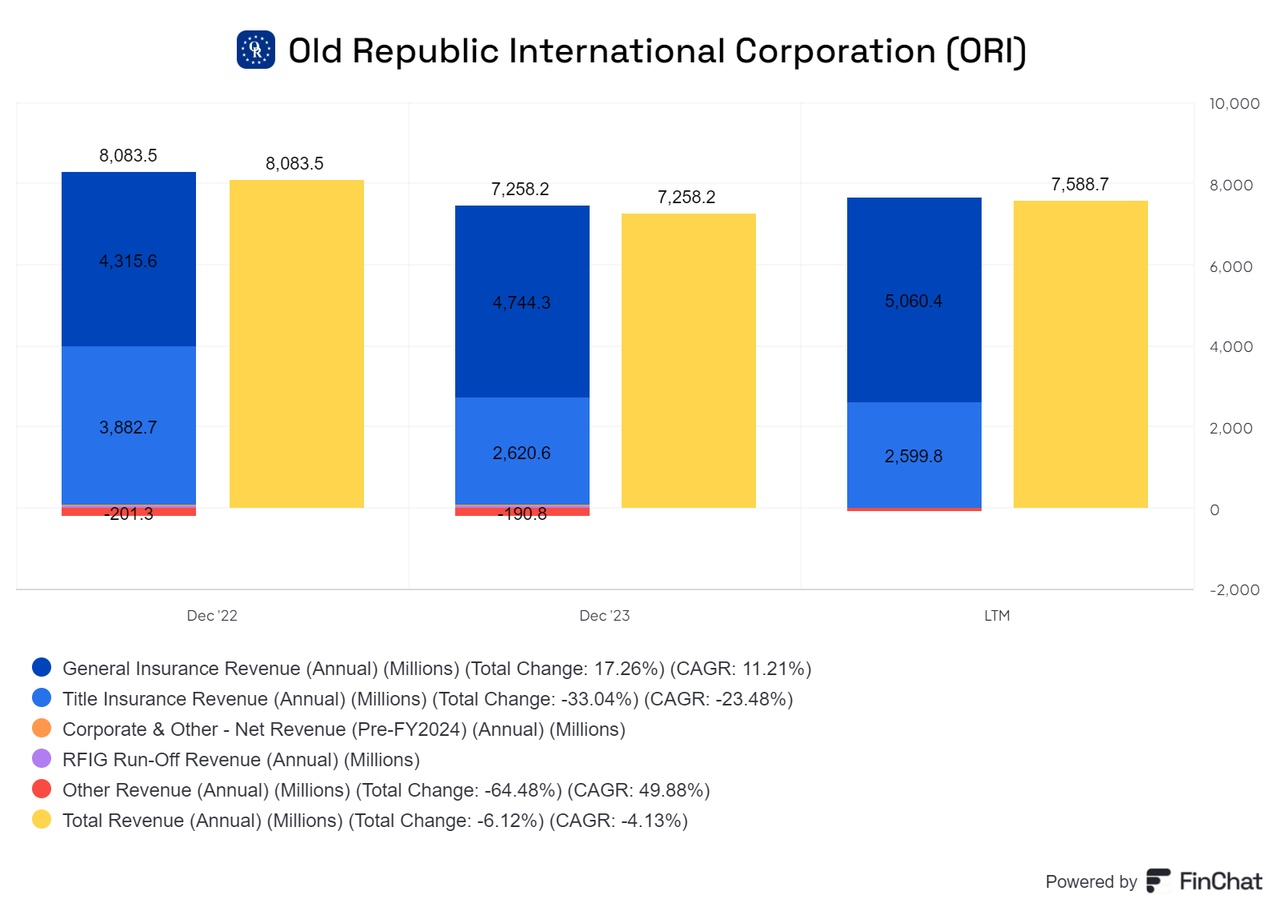

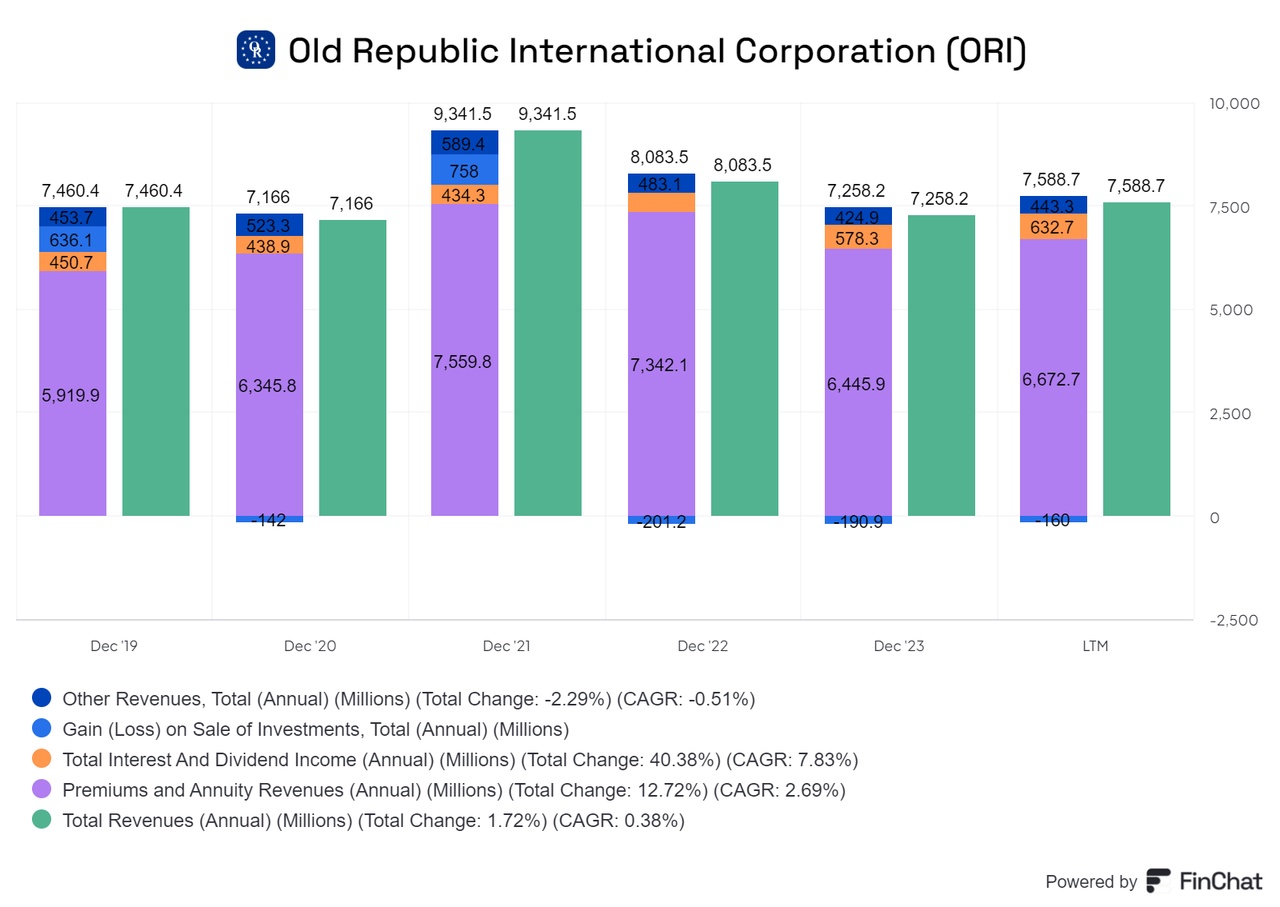

Sales distribution and EBT influence

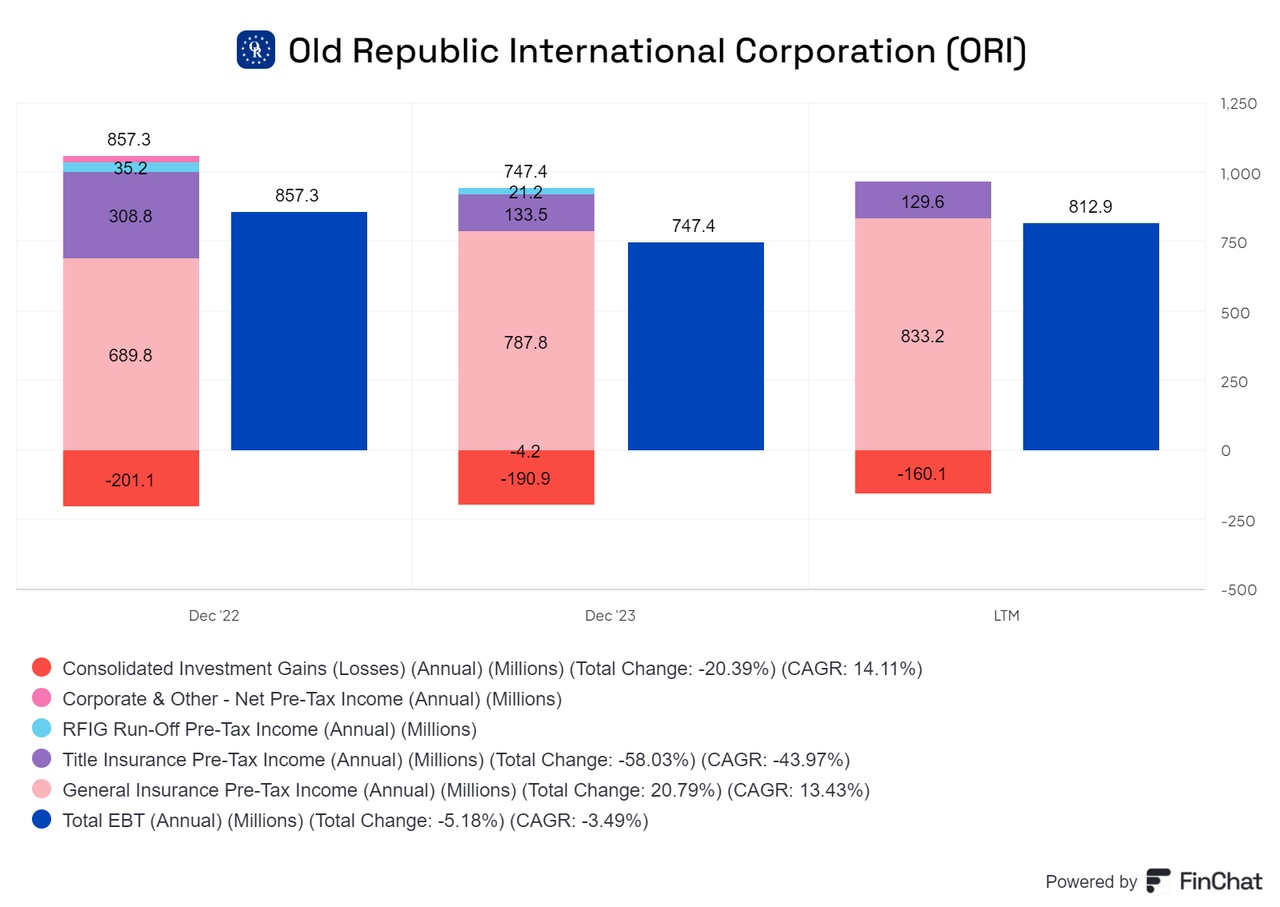

A look at the distribution of turnover shows that the majority of revenue comes from insurance income, which can be seen as positive. This means that Old Republic International (ORI) is less dependent on interest income or investment gains. A closer look at the sources of income makes it clear that investments are not ORI's core strength.

However, it is important to note that ORI's core business - insurance - is directly profitable. The largest share of EBT (earnings before taxes) also comes from the general insurance segment, which also accounts for the largest share of sales. This shows a solid business structure in which the core business generates profits independently and is not dependent on volatile investment profits.

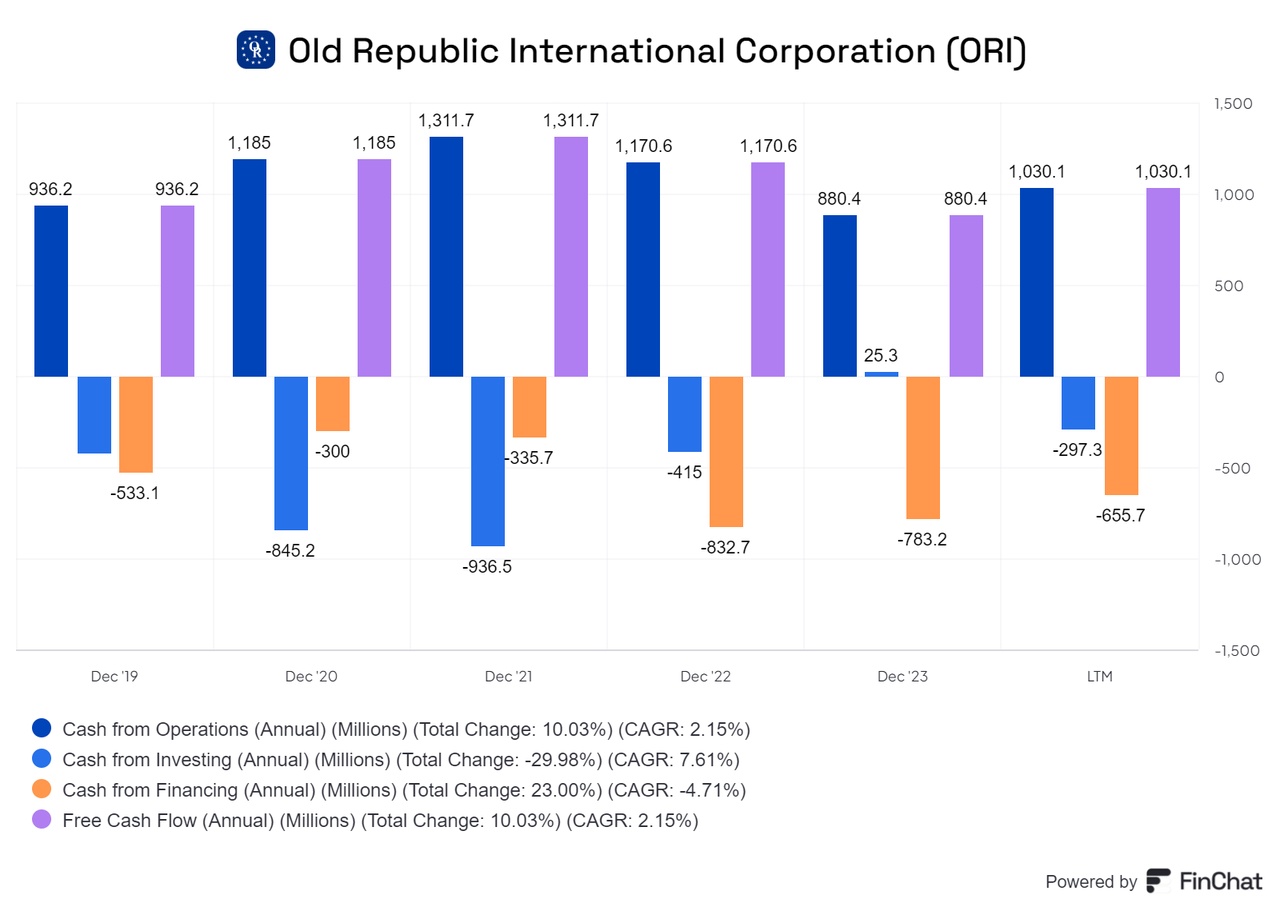

FCF

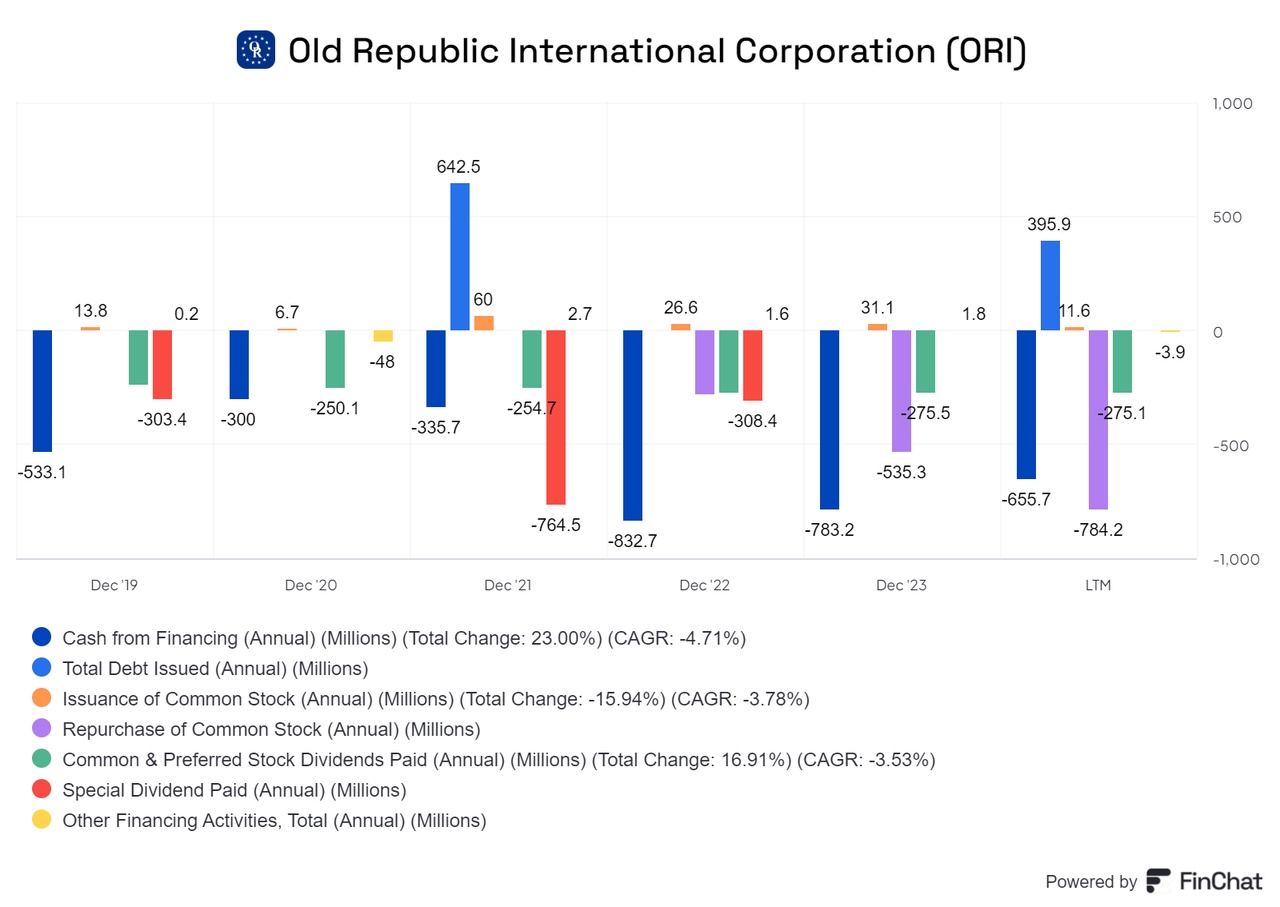

Old Republic International's free cash flow (FCF) is positive, which is typical for an insurance company and indicates solid operating activities. However, the cash flow from financing activities is negative every year. This indicates that the company regularly returns capital to shareholders, be it through dividend payments, share buybacks or the repayment of debt.

A closer look shows that the negative cash flow from financing activities is mainly due to share buybacks and dividend payments. This is not necessarily negative, as such measures are aimed at returning value directly to shareholders. This aspect can therefore be considered largely unproblematic.

This strategy indicates that ORI pursues a conservative financial policy and strives to continuously provide value to its shareholders, even if the company uses external sources of financing.

Part 2:https://getqu.in/i9RpER/

$PGR (-0,36 %)

$ALV (-0,66 %)

$CB (-1,14 %)

$CS (-0,84 %)

$ALL (+1,36 %)