Q3 2024 Investor AB

Positive aspects:

Growth in net asset value (NAV):

The adjusted net asset value (NAV) rose by increased by 2 % in the 3rd quarter of 2024. The company also achieved a total shareholder return of 8 %, which is significantly above the SIXRX Return Index of 4 %.

Performance of the subsidiaries:

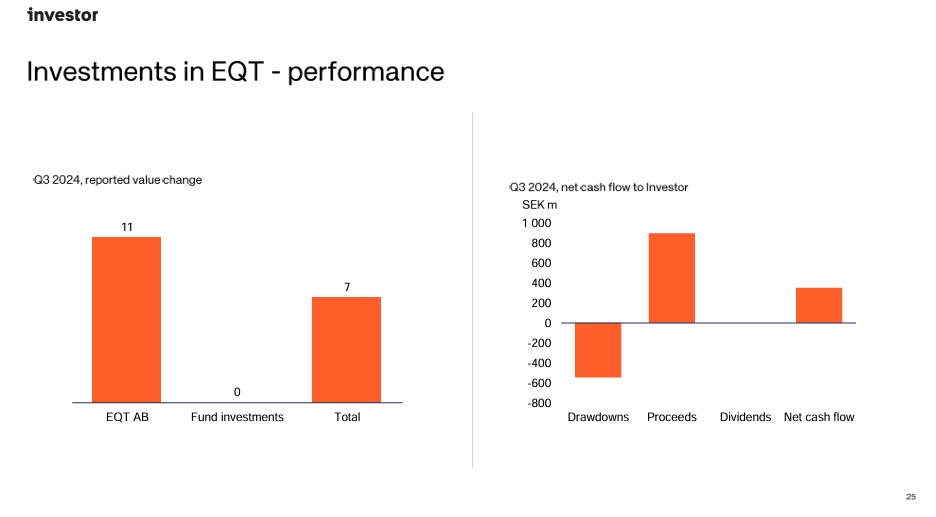

The main subsidiaries showed a strong performance, with organic organic sales growth of 7 % and an adjusted EBITA growth of 8 %. In particular Patricia Industries made a significant contribution and accounted for 21% of the total assets assets, which corresponds to a value of SEK 212 billion.

Returns from investments:

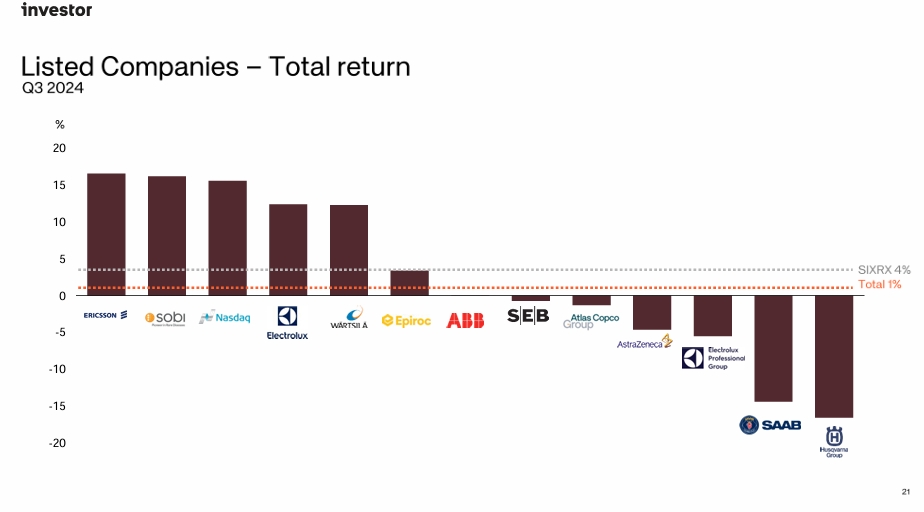

Investments in EQT achieved a total return of 7 %while the portfolio of listed companies recorded a total return of 1 %. Patricia Industries generated a total return of 3 %.

Operating profit:

The operating profit for the year 2024 (YTD) amounted to SEK 149.870 million, which is more than double the previous year's figure of SEK 72.467 million. This shows a significant improvement in operational efficiency and profitability.

Cash flow:

The Cash flows from operating activities increased to SEK 17.850 million, compared to SEK 14.493 million in the previous year, indicating an improved ability to generate cash.

Negative aspects:

Net financial items:

The company recorded a negative net financial items a loss of SEK 4.113 million for the year 2024 (YTD), which is slightly better than the loss of SEK 4.392 million in the previous year, but still indicates challenges in managing financing costs.

Investment activities:

Net expenditure on investments amounted to SEK 7,666 million, which represents a significant decrease compared to a positive cash flow of SEK 612 million in the previous year. This indicates higher capital outflows for investments, which could affect liquidity if not controlled.

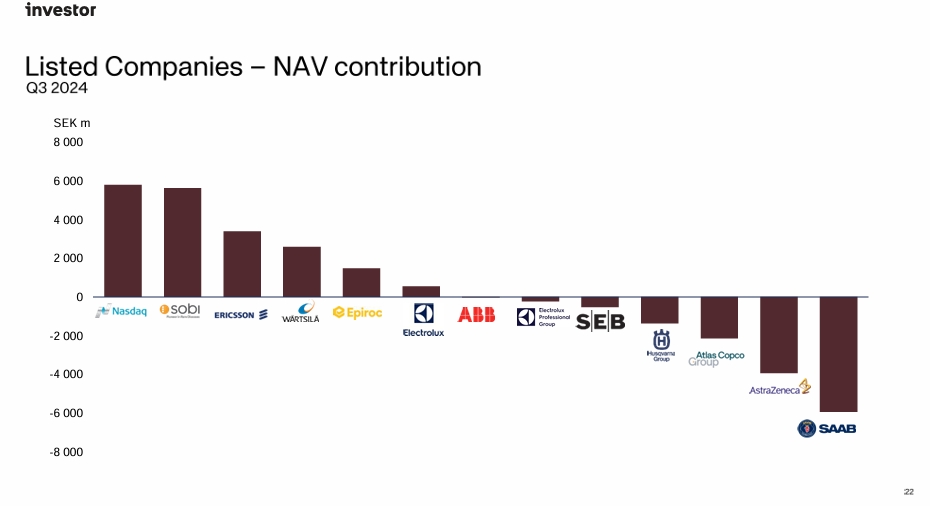

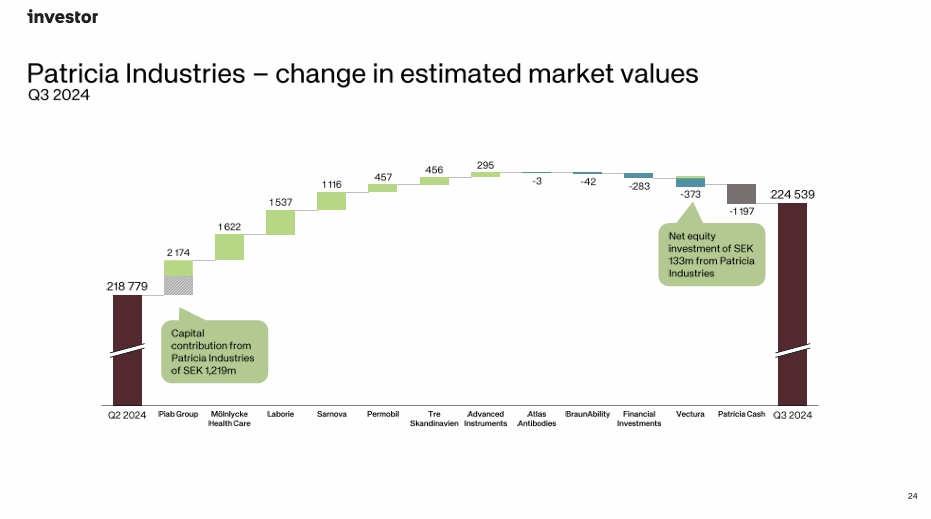

Performance of listed companies:

The total return of listed companies was relatively low at 1 %. Some holdings, such as Electrolux and the Atlas Copco Grouprecorded negative returns, which weighed on the overall performance of the portfolio.

Outlook:

Investor AB is well positioned for future growth, with a continued focus on a diversified portfolio. diversified portfolio portfolio. The company will continue to focus on organic growth and strategic acquisitions to further strengthen its market position. The strong performance of Patricia Industries and the positive returns from the EQT investments will probably continue to contribute to the increase in value, but overall the current returns of the listed companies are rather sobering.

I have now set myself a limit and will wait until it is reached.