The semiconductor industry has recorded an increase of 40-50% since the beginning of the year

Brief overview:

($NVDA (+2,01 %) , $AMD (-0,35 %) , $ASML (-1,59 %) , $KLAC (+0,46 %) , $CDNS (+0,16 %) , $LRCX (+0,38 %) , $TXN (-0,01 %) , $TSM (+0,43 %) , $LRCX , $KLAC (+0,46 %) , $INTC (+1,8 %) , $QCOM (+2,48 %) ....)

The largest contribution to this was made by companies such as $NVDA (+2,01 %) (Nvidia), $TSM (+0,43 %) (Taiwan Semiconductur) and $AVGO (+0,31 %) (Broadcom).

Here are a few companies you should know:

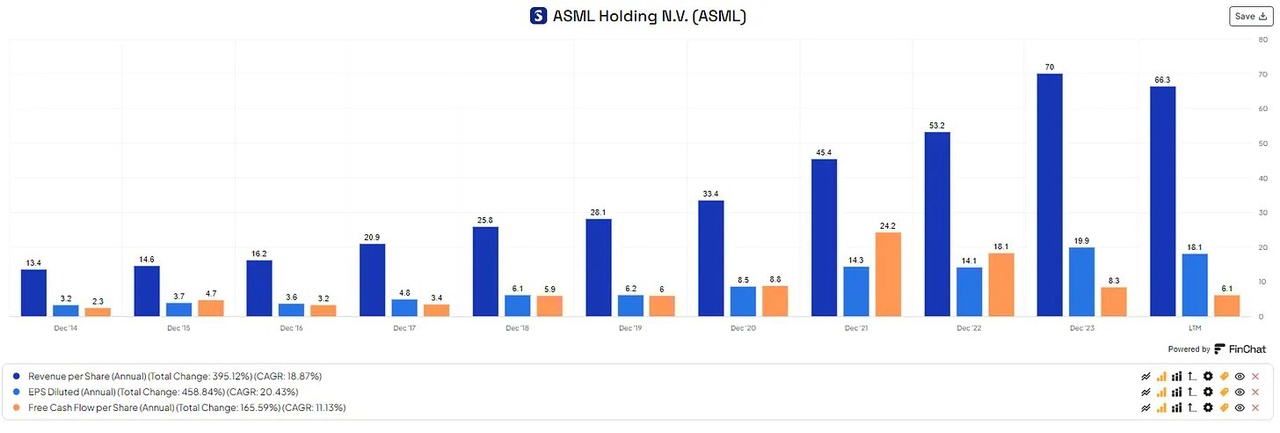

ASML - $ASML (-1,59 %) :

- ASML is a leading manufacturer of photolithography machines for semiconductor manufacturing

- The share has gained approx. 42.2 % in the last 5 years

- The 5-year average ROIC of ASML is 21.23 %.

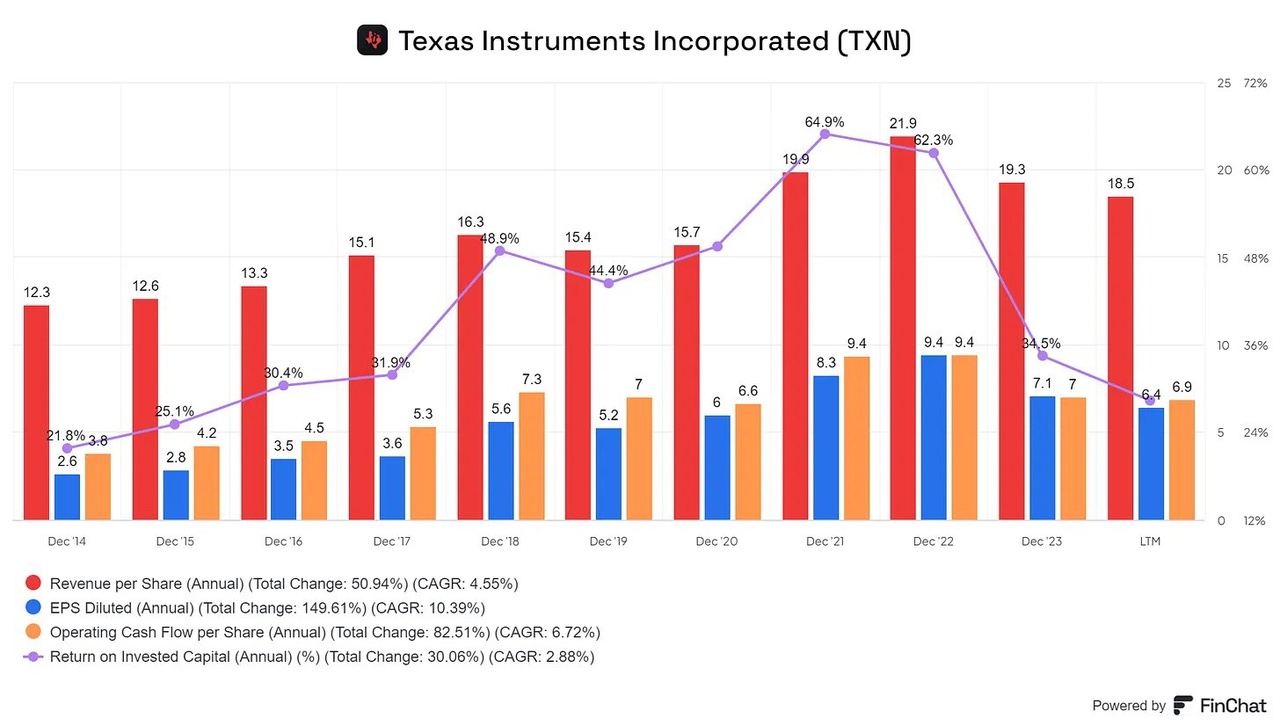

Texas Instruments- $TXN (-0,01 %) :

- Texas Instruments specializes in analog and embedded processing chips that are critical to a wide range of electronic applications

- The share has achieved an average annual growth rate of approx. 14.6 % over the last 5 years.

- Earnings per share have increased by 12.19% over the last 10 years

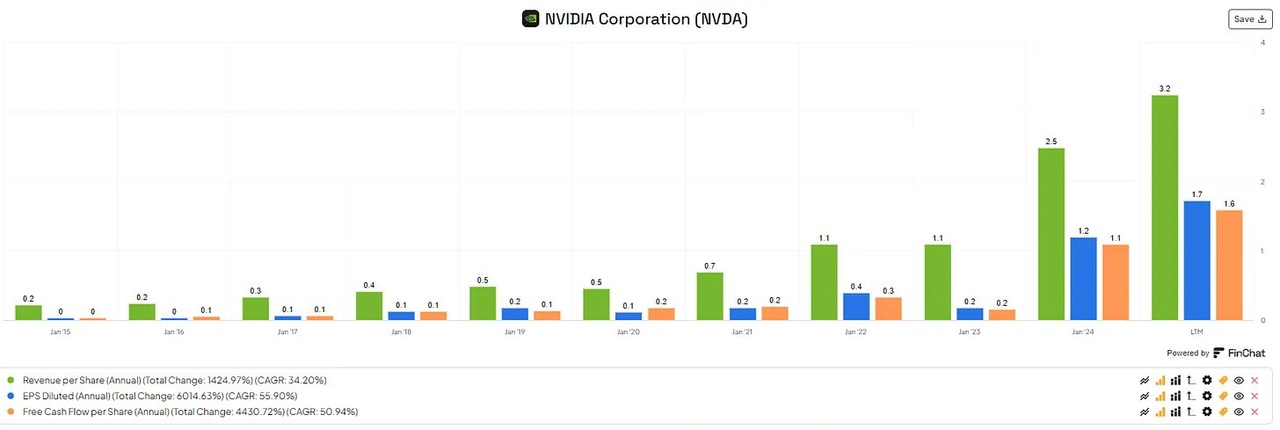

NVIDIA- $NVDA (+2,01 %) :

- Nvidia is a global leader in graphics processing units (GPUs) and artificial intelligence (AI).

- The average annual increase in sales over the last 5 years was 49.37%

- Future EPS growth is estimated at 31.74%

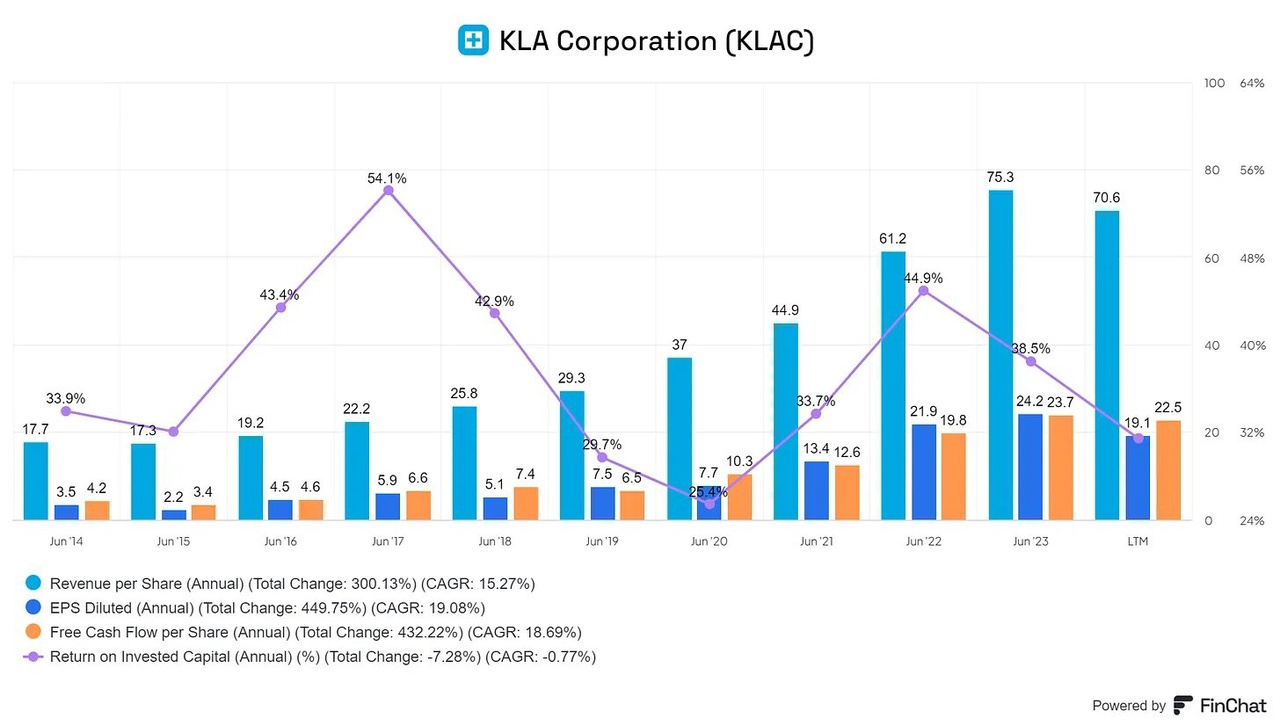

KLA Corporation - $KLAC (+0,46 %) :

- KLA provides advanced inspection, measurement and data analysis solutions that are essential for high-quality semiconductor production

- ROIC 5-year average is 34.66%

- FCF per share has increased by 18.7% over the last 10 years

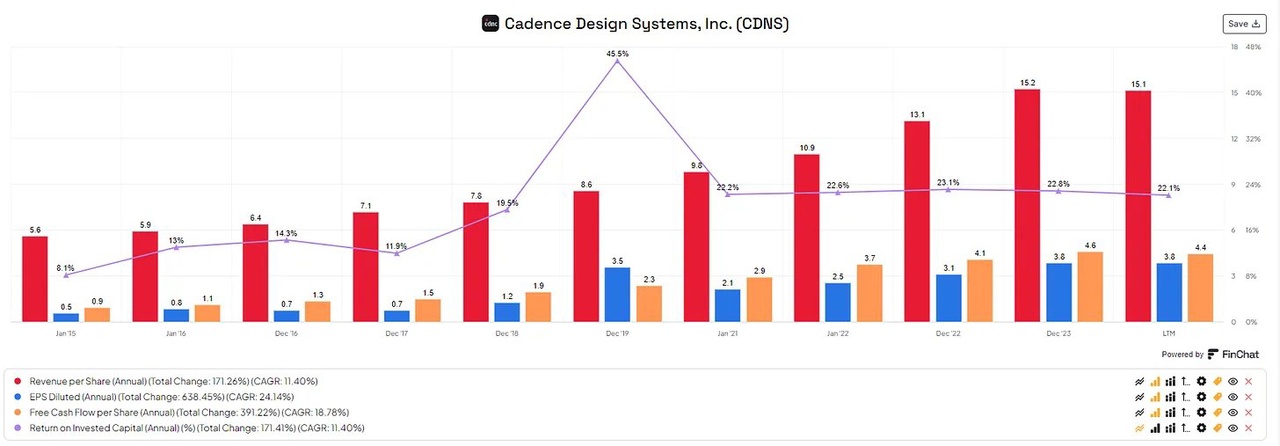

Cadence Design Systems $CDNS (+0,16 %) :

- CDNS provides software and engineering services for electronic design automation (EDA).

- The share price has increased by an average of approx. 34.5 % annually over the last 5 years

- The free cash flow per share has averaged 18.78% per year over the last 5 years.

Data from: https://finchat.io/