$KLAC (-0,99 %) fits perfectly into my prey scheme.

Share behaves unchanged on mega figures. Has been on my watchlist for a long time anyway.

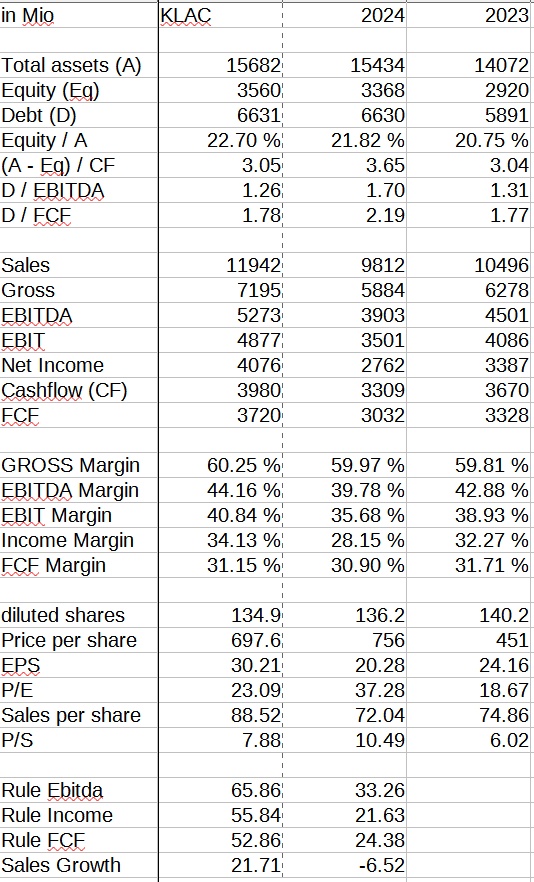

Positive:

- consistently high dream margins for all metrics (Gross 60%, Net >30%, FCF > 30%)

- Hardly any CapEx (just 2% of sales, even falling despite higher sales)

- Service sales are growing constantly (while sales declined in 2024, service sales continued to rise by 10%)

- this leads to a higher service share, which ensures more constant growth

- Dividend + share buybacks result in approx. 20€/share/year for shareholders (approx. 3%)

- constant reduction of outstanding shares

- Q1 figures put KLAC approx. 2 quarters ahead of analysts' estimates

- the guidance for Q2 together with the statement "expectation of sequential quarterly growth in revenue" gives hope for a growth of approx. 20% YoY

Negative:

- KLAC also sees difficulties in the semiconductor market: "While some customers are facing near-term challenges, we are optimistic about continued semiconductor market growth in the fourth calendar quarter of 2024 and into calendar 2025" (they also say they are supported by AI and HPC customers)

- Giving back to shareholders is nice, but you have so much money, some of which should be used to pay down debt (not being done)

What do you think about $KLAC (-0,99 %)

Valuation doesn't look too high for these numbers

The first column contains my expectations for FY 2025

This results in a forward P/E (9 months) of approx. 23