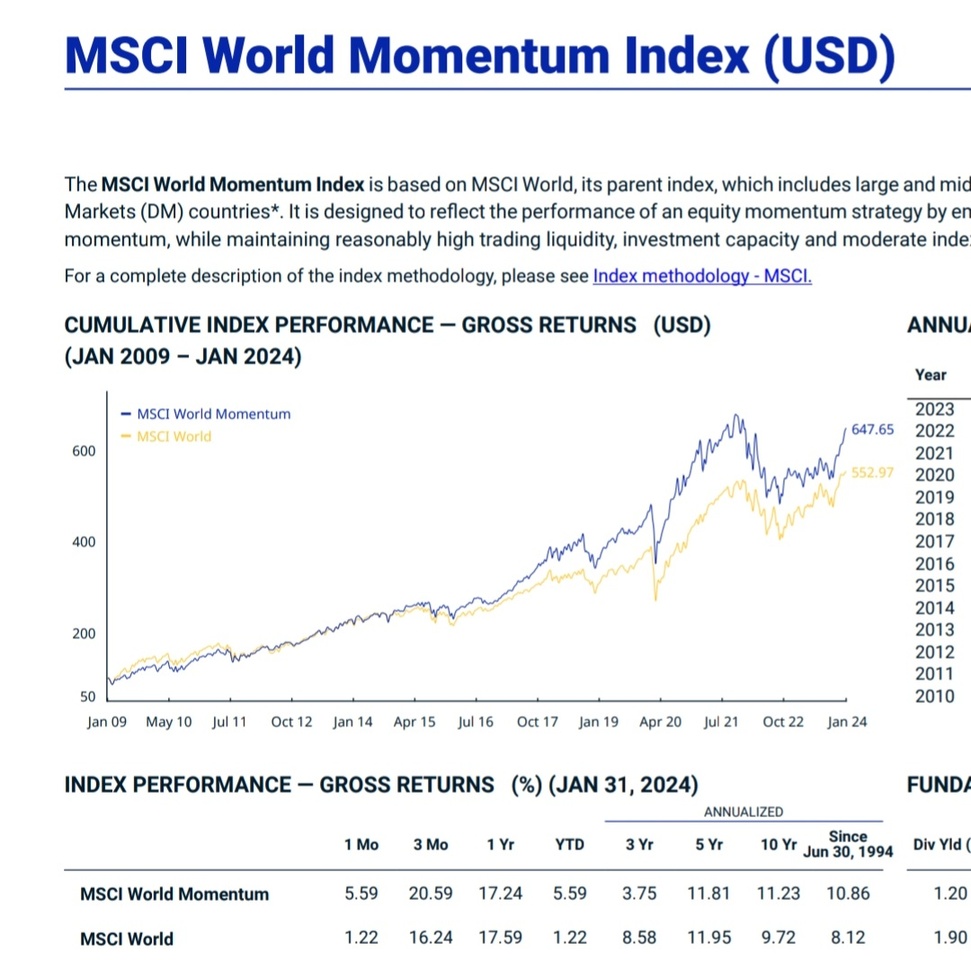

$IS3R (+0,55 %) Momentum 0.3TER

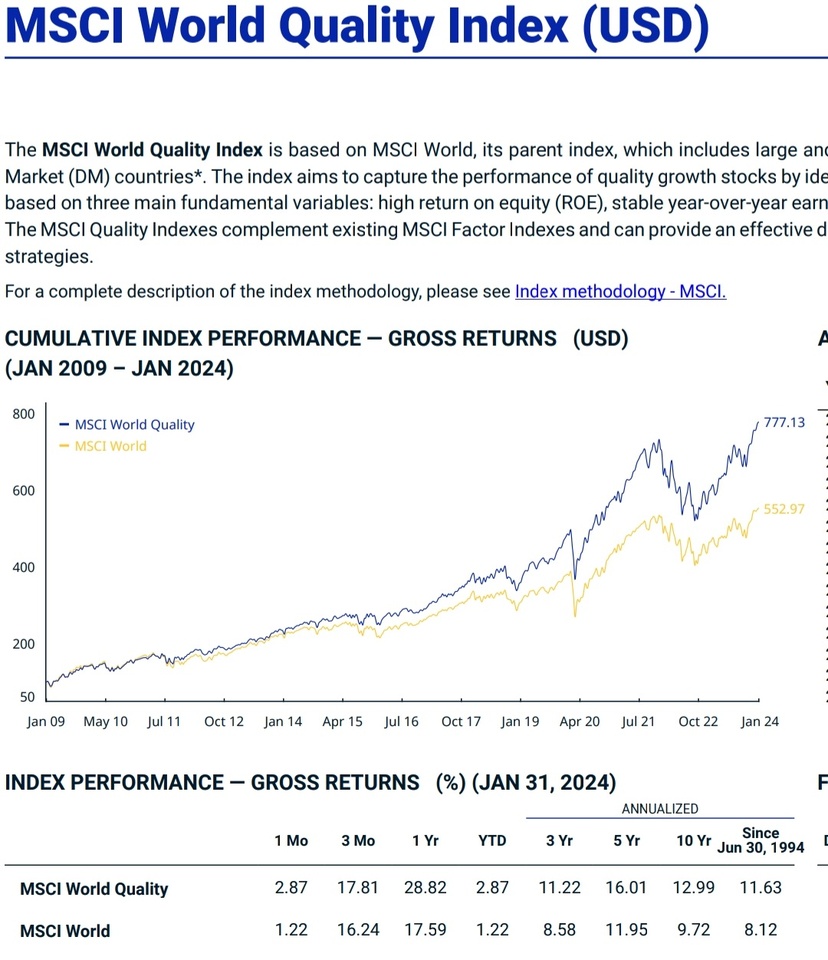

$IS3Q (+0 %) Quality 0.3TER

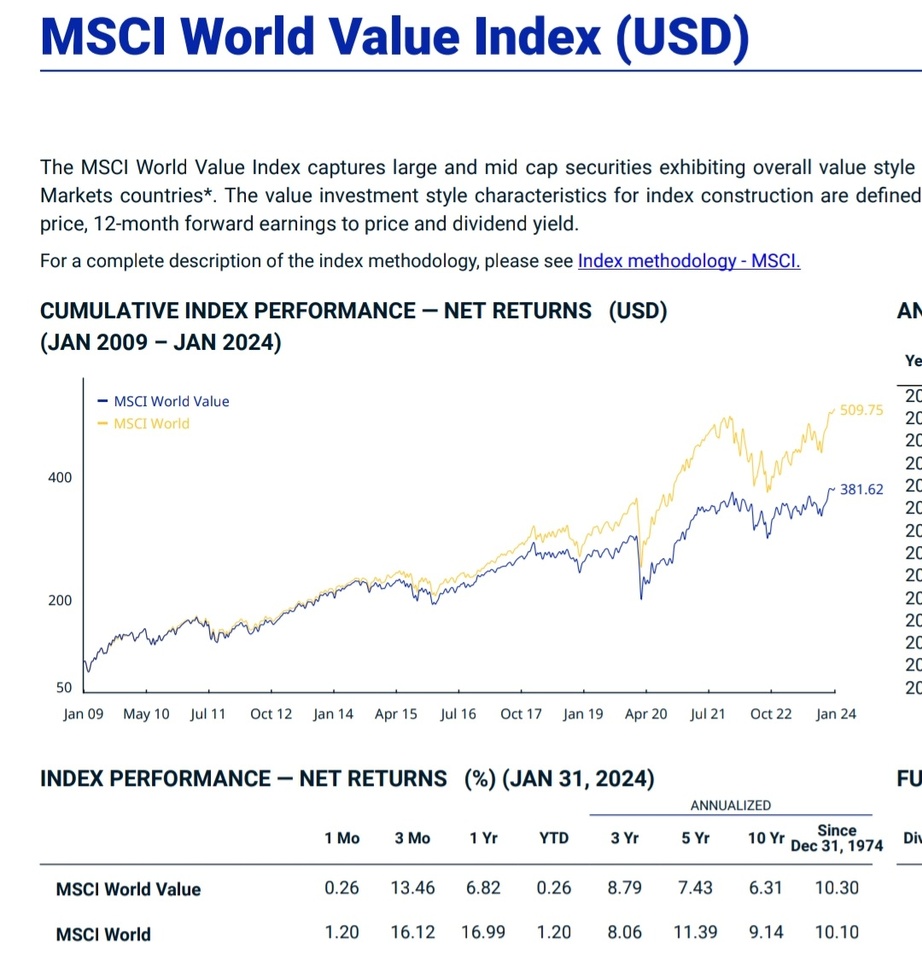

$IWVL (+0,3 %) Value 0.3TER

$IWDA (+0,23 %) World 0.2 TER

According to MSCI, the Momentum and Quality ETFs perform better than the World ETF. The positions are smaller and more concentrated than in the World ETF.

A world option for you?

What do you think?

Since I don't own an ETF and otherwise hold quality stocks, I can well imagine a momentum ETF as an addition.

But I'm not sure whether I would choose one of the ETFs if I only had to bet on a single ETF.