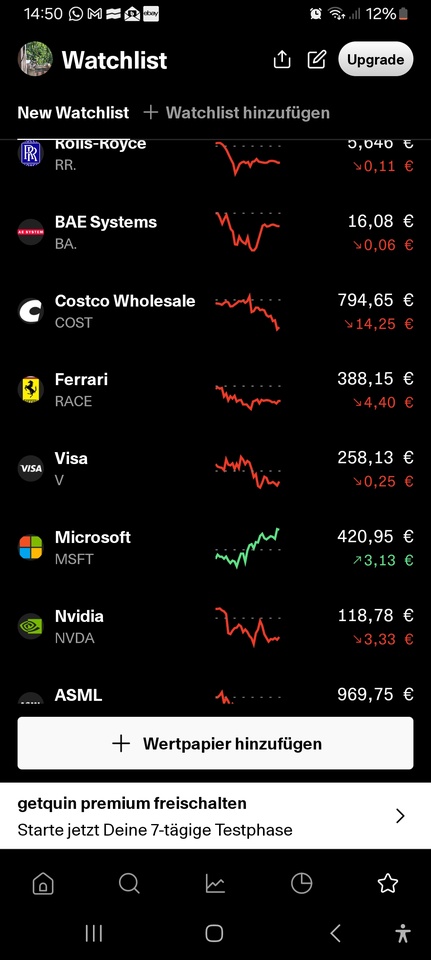

Hello everyone! I'm in my mid-20s and would like to start investing and would like some feedback on my planned portfolio. In addition to the planned shares, I have the main amount in the FTSE All World $VWCE (-0,32 %)

I also plan to add (buy and hold!):

BAE Systems $BA. (-2,44 %)

Visa $V (-0,55 %)

Ferrari $RACE (-0,96 %)

ASML $ASML (+0,43 %)

Rolls Royce $RR. (-0,59 %)

Costco $COST (-0,73 %)

Microsoft $MSFT (-0,65 %)

Nvidia $NVDA (-1,11 %)

- What do you think?

- Would a value or quality ETF be an alternative?

- Should any of these be left out?

I would appreciate any constructive suggestions/feedback.

Many thanks in advance!