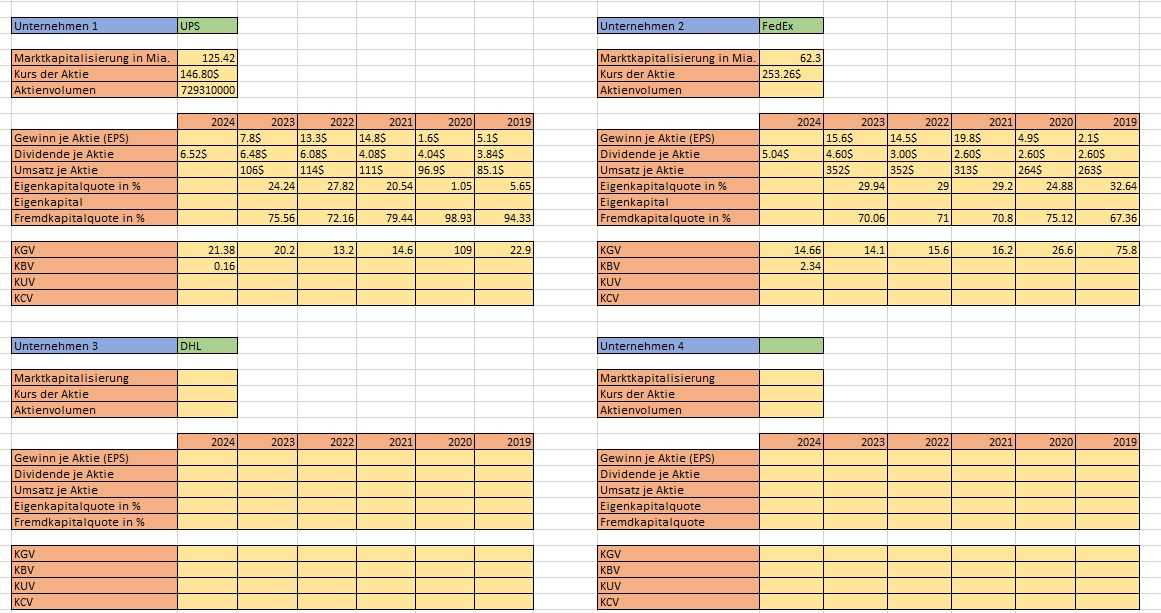

Hello everyone. I've been working on my first stock analysis for hours now, comparing the CEP services with each other, and it's really hard to figure out which company is the best. $FDX (+1,25 %) FedEx has $UPS (-0,55 %) as the market leader, but FedEx's earnings per share are also higher than those of UPS. However, FedEx's equity ratio has always remained stable, while UPS has only been able to reduce its debt ratio for two years. In terms of dividends, FedEx did not raise its dividend from 2019 to 2021, which is the case with UPS. FedEx is also not as well represented in Europe as UPS. The P/E ratio is more attractive at FedEx, but the share is currently overvalued according to the P/B ratio. However, the takeover of TNT means that FedEx can now secure even more market share.

As you can see, I am completely overwhelmed by so many figures. Then there is $DHL (-0,17 %) which should not be underestimated. But that's somehow too much for me😅 How do you do your analysis? What key figures do you look at?