Hi together,

last week there was a new addition to the portfolio, which has been on the watchlist for quite a while, Exchange Income ($EIF).

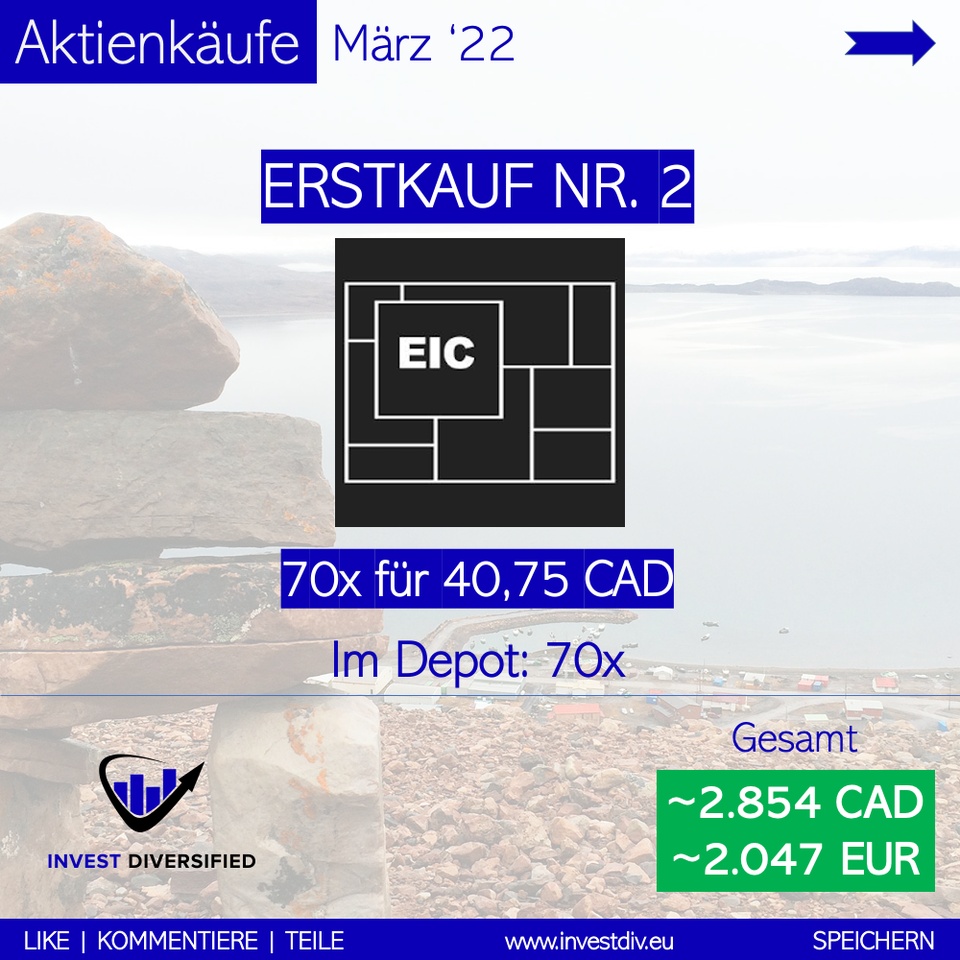

A total of 70 shares of Exchange Income have been added to the portfolio as the first tranche. If the share price weakens, further tranches will follow. My dividends in CAD should be increased a little bit.

Exchange Income is a diversified company that focuses on the acquisition of already profitable companies with strong cash flows in niche markets in the aerospace, aviation and manufacturing sectors.

EIF is a monthly payer! Currently paying out $0.19 CAD monthly. Dividend yield is therefore about 5.6%.

Risks should of course be considered. Here I see e.g. For example, a risk that future acquisitions can go wrong, so rather "what if?!"

Currently Exchange Income has a weighting of 0.67% in the portfolio. I could imagine a total of about 2%.

Do you know Exchange Income or are you already invested?