𝑫𝒓𝒐𝒑𝒃𝒐𝒙

It's a lot of text, but only the most important.

Tried to leave out everything boring.

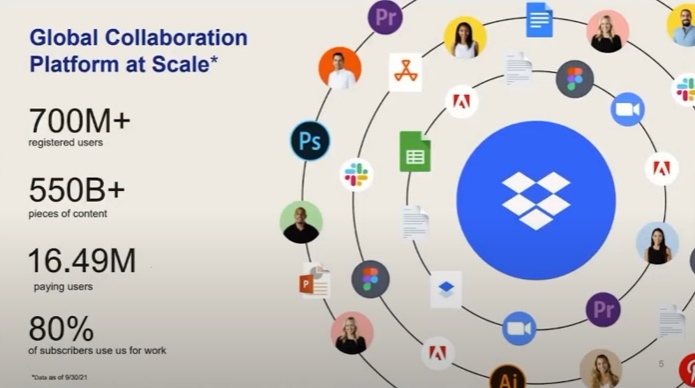

Dropbox was the first major cloud storage sharing provider for individuals, most should know the bumms. Have many collaborations across the market, see picture.

𝐊𝐨𝐧𝐤𝐮𝐫𝐫𝐞𝐧𝐳

Quite a few smaller players but all not so exciting, worry me immediately though: Google Drive and Microsoft OneDrive. Both companies have long-term goals in this area and attack exactly the business model of Dropbox, arebiten but at the same time with you.

Google Drive:

240 million users, documents can be edited and created directly over the web... so improvement over Dropbox.

Should also come for Linux (does anyone actually use it).

Google implies Drive as everything else on smartphones as an app, so for new customers it's already there and doesn't have to be downloaded first like Dropbox. Advantage Drive.

Companies that rely on this Google corporate program, "Google Apps for Work" get advantages that are worthwhile (30GB per employee, blah blah).

Microsoft One Drive:

Features like Google, comes with Office 365 or for companies for 4,20€ p.m. (ha, funny)

User numbers I didn't find but that it's included with the 365 package and that really everyone uses Lelek should be some.

In search of the numbers I slipped into so funny computer science forums that have all raved about the switch to One Drive, does not really speak for Dropbox.

So let's summarize: doesn't sound so cool for Dropbox for now, big companies with deep pockets have way too much buck.

𝐆𝐞𝐳𝐞𝐢𝐬𝐜𝐡𝐭𝐞 𝐙𝐚𝐡𝐥𝐞𝐧:

(Over 700 million users, nearly 17 million numbers of them).

13% increase in revenue to $550m, net profit was also quite fine, all minimally above analyst expectations.

Free cash flow from $491m in 2020 to $715m now.

In 2017 5% of users upgraded to premium, in 2020 it was 20%

We look at the chart and think whoops, not everyone was that happy with the numbers, although they weren't bad at all.

To save you a lot of unnecessary: the CEO sold shares 2 weeks before, there was too much red in the numbers (I'll get to that in a moment) but above all the shareholders also read my paragraph on the competition.

𝐈𝐧𝐡𝐚𝐥𝐭𝐥𝐢𝐜𝐡𝐞𝐫 𝐁𝐮𝐫𝐠𝐠𝐫𝐚𝐛𝐞𝐧?

I read some stuff but found it all a bit weak

Growth: nope, it's not a moat

Customer base remains: maybe, but from my informatics forums experience rather no.

𝐂𝐄𝐎: 𝐃𝐫𝐞𝐰 𝐇𝐨𝐮𝐬𝐭𝐨𝐧

Reminded me of Musk from the face,

Seems to know Mark that's why he helps out at Facebook, owns 25% of Dropbox. But has sold a mini-share, as well as all other insider purchases in the last half year.

𝐀𝐀𝐀𝐀𝐀𝐁𝐄𝐑:

There is a nice line in this pile of numbers that reads "Asset writedown". Dropbox noted during Corona that they could just do away with office buildings and send people home. (Additionally, they terminated a few by the way, gosh, my structure here is so awesome again).

So they were able to sublet offices, or had the idea to do so, and now comes the reason why studying business makes sense: They had to write off the differences between real and "fair" value of these buildings, big shit, whole idea in the ass like end result red, shareholders pissed.

And that's not exactly a small sum, 398 million USD (is only 155% of the 2020 net incomes 🤡).

If you take the shit out of it, the net income of the last two years was actually positive and would have increased significantly from 2020 to 2021.

Question that remains; that always remains: Is. That. Priced in?

No. A reasonable discount in the valuation is quite justified, but due to the risk of competition with Google, in a market comparison and before the prospect of rising interest rates, a price of 24 USD is already quite low. Therefore continue with ->

𝐁𝐞𝐰𝐞𝐫𝐭𝐮𝐧𝐠

Fun math fun with Moritz, episode 1:

If I assume 0.8 EPS for Dropbox based on past values (very conservative), and a growth rate of 16% per year (supposedly also conservative, but I think it's already decent for the competition) the intrinsic value of the stock according to the Graham formula is 32.40 USD.

Financial metric tells us EPS so 0.8 x (1+growth) x PE ratio (profit is not there only because of depreciation, without depreciation profit of approx. 280 Mio so PE ratio of 0.69 by current price). Price)

So = 0.8 x (1+ 0.16) x 34.39 = 31.91392 USD

Unbelievable but true, the result makes sense in terms of content, I don't believe it, probably I just made a mistake 2 times in the same place.

My fair price calculation (without including the much more expensive valued competition, I find comparison difficult here and with the only condition that the annual growth remains at 16%): 32 USD, exactly what we had 4 weeks ago. And that brings us to:

𝐂𝐡𝐚𝐫𝐭𝐭𝐞𝐜𝐡𝐧𝐢𝐤

We are currently running along the support at 23.73 USD, should this break we will go down to 21.70 and then possibly even below 18.

Next resistance is at about 26.25 USD if we get into a bullish movement, currently lurking. Neither buy nor should. Some son investor has bought something, but do not know the.

𝐙𝐮𝐬𝐚𝐭𝐳: 𝐈𝐧𝐟𝐥𝐚𝐭𝐢𝐨𝐧!

As we all have noticed expensive stocks are getting quite a bit of fear lately, I made it easy for myself now and always looked at the chart on Fridays, pretty much no movement on those days, so Dropbox is just smearing like that and not because of inflation. Yay✨

𝐅𝐚𝐳𝐢𝐭

Conservative potential of exactly 33%, but will continue to exist even if Google makes eye, only then we do not want to own the stock. Growth must remain, should it go down the drain, this speaks for even stronger competition and I am sure we will see the 15$.

Typical case of risk/potential, since my values in the calculations were conservative but TA grad does not necessarily point to buy, 33% is realistic. I'm in with a trade soon, but not long term, as the competition is pushing too hard.

[Update : https://www.tradingview.com/x/OmWtoh29/ ]

If you want to buy Dropbox because of this post be aware that you are trading random numbers from the internet, I don't recommend anything. The hook does not automatically verify everything I say, even if my comments are always at the top.

Sources

https://dropbox.gcs-web.com/financial-information/earnings-reports

https://www.youtube.com/watch?v=pEQ-AjEmmv c

https://www.fool.com/investing/how-to-invest/stocks/intrinsic-value/

https://www.onvista.de/aktien/DROPBOX-INC-Aktie-US26210C1045

https://www.macrotrends.net/stocks/charts/DBX/dropbox/pe-ratio

https://www.finanztrends.de/dropbox-aktie-uebertraf-die-geschaetzten-gewinne-um-571/

https://ycharts.com/companies/DBX/pe_ratio

https://www.itreseller.ch/Artikel/94982/Dropbox_mit_soliden_Quartalszahlen.html

https://www.gruender.de/software-tools/dropbox-alternativen/

https://www.tradingview.com/x/G92Biah3/