In this article, I provide a detailed insight into the company Uber, including its growth, relevant financial figures, its products, competitors and the economic risks.

I have used the service regularly in the past, especially in vacation regions.

Company overview

Uber Technologies Inc., founded in 2009 by Garrett Camp and Travis Kalanick, has grown from a start-up with a vision to make ride services easier and more accessible to a global technology giant. With its innovative platform, Uber has revolutionized the mobility and logistics industry and redefined the way people and goods move.

Today, the company operates in more than 900 cities worldwide, connecting millions of drivers, passengers, restaurants and businesses in over 69 countries.

A company that rethinks mobility

Uber sees itself not only as a mobility service provider, but also as a driver of global transformation.

Whether ride-hailing, food delivery via Uber Eats or the optimization of freight transport with Uber Freight - the company uses state-of-the-art technologies to make movement more efficient, sustainable and accessible.

Uber stands for flexibility, convenience and innovation and is creating a digital ecosystem that challenges and redefines traditional structures.

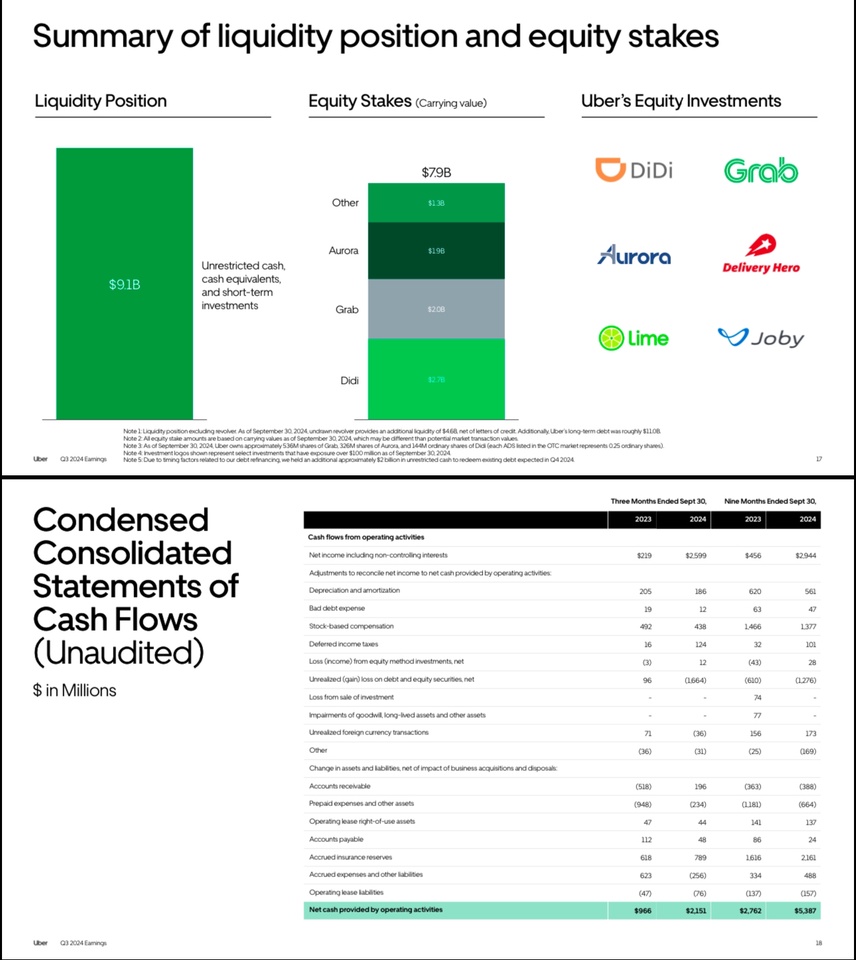

Key financial figures of Uber Technologies Inc.

Company valuation

Uber is currently valued at a market capitalization of around USD 138 billion.

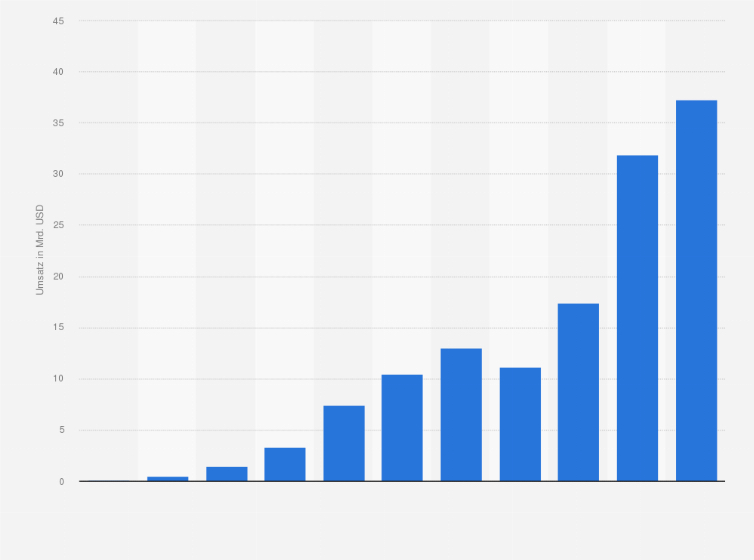

Turnover and gross bookings

-Turnover

Sales increased by 20 % compared to the previous year to 11.2 billion USD.

-Gross bookings

Gross bookings - the total transaction volume generated via the platform - reached 41 billion USDan increase of 16 %.

Profitability and margins

-Gross profit

Gross profit amounted to USD 4.7 billionwhich corresponds to a gross profit margin of around 42 %.

-Net profit

Net profit amounted to USD 2.6 billionstrongly influenced by a one-time tax benefit of USD 1.7 billion due to the revaluation of investments.

Without this effect, net profit would have amounted to around 900 million USD million.

-EBITDA (adjusted)

Adjusted EBITDA (earnings before interest, taxes, depreciation and amortization) rose by 82% to USD 1.7 billion.

Key operating figures

-Number of trips

Uber recorded a total of 2.9 billion ridesa growth of 17 % compared to the previous year.

This corresponds to around 32 million rides per day.

-Active users

The platform had 134 million monthly active usersan increase of 14 % compared to the previous year.

-Members of Uber One

The number of paying members of the premium program Uber One increased to 25 million.

Segment analyses

Mobility (Ride-Hailing)

-turnover: USD 5.6 billion (+23% YoY).

-Gross bookings: USD 15.5 billiondriven by higher demand and fare adjustments.

Delivery (Uber Eats)

-Revenue: USD 3.8 billion (+18% YoY).

-Gross bookings: USD 13.6 billionan increase of 14 %.

Freight (logistics solutions)

-Turnover: USD 1.8 billiona decline of 2% due to macroeconomic challenges in the logistics sector.

Costs and investments

-Cost structure

Sales and marketing costs: USD 1.3 billion (+12 % YoY).

-Research and development costs: USD 500 millionmainly in autonomous technologies and sustainability projects.

-General administration costs: USD 700 million (+9 % YoY)

-Cost per trip

The average operating costs per trip remained at 1.2 USDwhich indicates efficient scaling of the platform.

-Customer Acquisition Cost (CAC)

The costs for customer acquisition (CAC) are estimated at 5-8 USD per new customerdepending on the region.

Forecast for Q4 2024:

-Expected gross bookings: USD 42.75 to 44.25 billion (+16-20% YoY).

-Expected adjusted EBITDA: USD 1.9 to 2.1 billion.

-Long-term growth strategy

Uber plans to increase gross bookings to over 200 billion USD with a target of at least 25% EBITDA margin.

Uber products and services

-UberX

Uber's standard service where users can book an affordable and reliable ride with a driver.

UberX is ideal for individuals and small groups.

-Uber Comfort

A premium option for users who want more legroom and more comfortable vehicles. Drivers have a high rating and are guaranteed a pleasant driving experience.

-Uber Pool (currently partially suspended)

A cost-effective way to share rides with other users traveling in the same direction.

This model reduces costs for users and is more environmentally friendly.

-Uber Black and Uber Black SUV

Luxury rides with high-quality vehicles and professional drivers.

This option is aimed at business travelers or users looking for a more exclusive driving experience.

-Uber Green

A sustainable ride-hailing service that uses only electric or hybrid vehicles to reduce CO₂ emissions.

Uber Eats: food deliveries

Uber Eats was launched in 2014 and is now one of the world's largest food delivery platforms.

The service seamlessly connects restaurants, delivery partners and customers.

-Food delivery on demand

Users can choose from a variety of restaurants and cuisines and have food delivered directly to their doorstep.

-Marketplace for restaurants

Uber Eats provides a platform for restaurants to expand their reach and generate additional revenue streams.

-Integration of drones (pilot projects)

In some regions, Uber is testing the use of drones to shorten delivery times and increase efficiency.

-Food and retail

In addition to food deliveries, Uber Eats also offers delivery of groceries and household items in some regions.

Uber Freight: logistics solutions for companies

Uber Freight was launched in 2017 to digitalize the logistics industry and make it more efficient.

The platform seamlessly connects shippers and carriers.

-Freight brokerage

Companies can book trucks for the transportation of goods via the platform.

Uber Freight provides real-time data on availability, routes and prices.

-Increased efficiency

The platform uses algorithms to minimize empty runs and maximize vehicle utilization.

-Extended functions

Uber Freight offers tools for shipment tracking, price prediction and cost control to optimize companies' logistics processes.

Uber for Business: Solutions for companies

Uber offers specialized services for businesses to simplify business travel and other transportation needs.

-Company rides

Companies can centrally book and manage Uber rides for their employees.

This option is ideal for business trips or guest transportation.

-Employee programs

Uber for Business also offers programs for daily transportation of employees, e.g. for commuting or flexible working hours.

-Uber Eats for Business

Companies can use Uber Eats to organize food delivery for meetings, events or as an employee perk.

Mobility of the future: sustainable and autonomous solutions

Uber is continuously developing new technologies and services to make mobility more sustainable and future-proof:

-Micromobility (e-bikes and e-scooters)

In some cities, Uber offers e-bikes and e-scooters that can be rented via the app.

These options are ideal for short distances and are more environmentally friendly than conventional vehicles.

-Uber Air (pilot project)

Uber is testing the use of air cabs for passenger transportation.

This futuristic project aims to take urban mobility to a new level and relieve traffic on the roads.

-Uber Green

A ride-hailing service with a focus on electric and hybrid vehicles. Uber offers incentives for drivers to switch to low-emission vehicles and prioritizes such trips on the platform.

Uber Air: A detailed look

Uber Air, Uber's aviation project, aims to usher in a new era of urban mobility by introducing flying cabs to cities worldwide.

With this initiative, Uber has ambitious plans to revolutionize transportation in urban areas through the use of electric-powered vertical take-off and landing aircraft (eVTOLs).

Background and vision of Uber Air

Uber Air's vision is to relieve traffic in congested cities with a new form of air mobility.

Instead of being stuck in traffic jams in traditional cabs or cars, passengers are to travel through the air in futuristic flying cabs in a short time.

Uber Air is intended to offer a cost-effective, fast and environmentally friendly alternative to conventional means of transportation.

Uber Air was originally launched in 2016 as "Uber Elevate".

Since then, Uber has worked in partnership with various companies to develop the technology for the flying cabs.

Some of the biggest partners are aircraft manufacturers such as Joby Aviation, Lilium and Bell Helicopter.

Technology and vehicles

Uber Air relies on so-called eVTOLs (electric Vertical Take-Off and Landing Aircraft), which enable the vehicles to take off and land vertically as well as fly horizontally.

This technology is based on electrically powered aircraft, which are quieter and more environmentally friendly than conventional airplanes or helicopters.

-Joby Aviation

Uber has partnered with Joby Aviation, a leading company in the field of eVTOL development.

Joby's eVTOL vehicle has a range of around 240 km and can reach speeds of up to 320 km/h.

Joby is one of the companies that will support the first commercial Uber Air services.

-Lilium

Another notable company that Uber is working with is Lilium from Germany.

Lilium is developing an eVTOL aircraft that can reach a range of up to 300 km and fly at a speed of 300 km/h.

Lilium is capable of transporting up to six passengers in one aircraft.

(ImportantInfo 20.12.2024 - The air cab developer Lilium from Wessling near Munich tried to restructure itself through insolvency proceedings, but this plan was not successful.

The company has now ceased operations and laid off around 1000 employees)

Planned goals and time frame

Uber has ambitious plans to launch Uber Air globally.

Initial test flights have already been conducted and Uber is working with various cities to evaluate potential markets.

-Test markets

Uber has already identified several cities as potential test markets, including Los Angeles, Dallas and Melbourne.

These cities were chosen because of their traffic problems, high urban density and willingness to support innovative transportation projects.

-Commercial introduction

Uber aims to launch Uber Air from 2023 to go into operation.

However, the timeline for commercial launch has been delayed several times as the technology continues to be tested and regulatory hurdles need to be overcome.

It is expected that Uber Air will be available by 2026 Uber Air is expected to be regularly available in some selected markets by 2026, with the cost per ride likely to be high initially, but could fall as success and scaling increases.

-Pricing

Uber has announced that Uber Air will initially be similar in price to a helicopter ride, with prices ranging from USD 200 to USD 300 per ride.

In the long term, however, prices are expected to fall in order to appeal to a broader customer base.

It is expected that after a few years, Uber Air will be offered at a lower price to compete with traditional means of transportation such as cabs and Uber's normal ride services.

Market potential and profitability

According to a study by Morgan Stanley the market for urban air mobility could grow by 2040 could be worth over 1.5 trillion USD by 2040.

This estimate includes not only Uber Air, but also similar initiatives from other companies.

Morgan Stanley estimates that over the next two decades, more than 430 million passengers could switch to flying cabs in the next two decades, which would profoundly change the transportation sector.

Uber itself stated in its presentation of Uber Air that the company expects a market capitalization of up to market capitalization of up to USD 500 billion for the entire urban air mobility market.

These estimates are based on the potential benefits of the technology, which would be able to significantly relieve urban traffic, shorten travel times and reduce the environmental impact of emissions.

Regulatory hurdles and challenges

Although the technology behind Uber Air is promising, there are numerous challenges that need to be overcome before flying cabs are commercially available:

-Aviation regulations

Uber Air must adhere to strict aviation regulations set by various national and international authorities, such as the Federal Aviation Administration (FAA) and the European Aviation Safety Agency (EASA).

These regulatory requirements relate to both the certification of eVTOL vehicles and the operating licenses for air traffic.

-Infrastructure development

For the operation of Uber Air, so-called skyports specially developed landing sites for the eVTOLs.

This infrastructure requires considerable investment and close cooperation with cities and municipalities to find suitable locations.

-Safety and reliability

As flying cabs are a new technology, Uber and its partners need to ensure that the vehicles are reliable and safe.

Flight testing and validation of the technology by independent testing bodies is crucial to gain public confidence and encourage wider adoption.

Current figures and funding status

Uber has made significant investments in Uber Air and related technologies to date. The company has worked with various partners and investors to advance the development of flying cabs.

In 2020, Uber announced that it had raised $75 million USD invested in the field of urban air mobility.

It is important to note that Uber also restructured its air mobility business in 2020 by creating the Uber Elevate Division to Joby Aviation has sold.

This partnership was seen as a strategic move to implement Uber Air more efficiently while increasing focus on its core ride-hailing and Uber Eats businesses.

Safety and service functions

-In-app security functions

These include real-time tracking, an emergency call button and the ability to share driving details with friends and family.

-Uber Reserve

Users can book rides in advance to ensure a driver is available at the desired time.

-Feedback system

Uber uses a rating system for drivers and passengers to monitor and improve service quality.

Technology at the heart of Uber:

The driving force behind innovation and efficiency

Uber's strength lies in its technological platform, which combines advanced innovation with real-time solutions. Through the use of big data, algorithms and artificial intelligence (AI), Uber has revolutionized the way mobility and logistics are managed.

Technology is not only the backbone of the business model, but also a key factor in the company's scalability and success.

Platform and algorithms: Intelligent control in real time

-Matching technology

Uber's platform uses complex algorithms to connect drivers and passengers in fractions of a second.

Factors such as distance, traffic, availability and current demand are taken into account to provide the most efficient solution.

-Dynamic pricing

The platform uses AI-powered models to adjust prices in real time.

This is based on the analysis of supply and demand, traffic patterns and other variables.

This dynamic approach ensures optimal use of resources while providing flexibility.

-Route optimization

Uber integrates traffic data and historical patterns to optimize routes.

This not only shortens the journey time, but also reduces fuel consumption, which contributes to sustainability.

Big data and machine learning

Personalization and efficiency

Uber generates huge amounts of data from millions of rides, deliveries and user interactions every day.

This data is used to continuously improve the platform:

-personalization

Based on user data, Uber suggests customized services, such as preferred routes or food options at Uber Eats.

-Predictive models

Using machine learning, the platform can predict demand and proactively direct drivers to areas of high demand to reduce waiting times.

-Fraud prevention

Uber uses AI models to detect and prevent suspicious activity such as fake bookings or irregular payment attempts.

Autonomous technology and strategic partnerships at Uber

Uber has been focusing on autonomous technologies for years to help shape the mobility of the future while reducing costs, increasing efficiency and improving safety on the roads.

Investments in self-driving vehicles and partnerships with leading technology companies are key components of the company's long-term strategy.

Autonomous technology

The road to driverless mobility

-Vision for autonomous mobility

Uber is aiming for a future in which autonomous vehicles play a significant role in its platform.

This technology should not only reduce operating costs, but also improve access to mobility services, especially in areas where drivers are scarce.

-Test drives

Uber has been testing autonomous vehicles in several cities, including Pittsburgh, Phoenix and San Francisco.

These tests focus on safety, integration into urban environments and interaction with other road users.

Advantages of autonomous technology:

-cost reduction

Drivers account for a significant proportion of operating costs. Autonomous vehicles could drastically reduce these costs in the long term.

-Availability

Self-driving cars can be used around the clock without being limited by human factors such as breaks or fatigue.

-Safety

Autonomous systems are less prone to human error, which is the main cause of road accidents worldwide.

Partnerships to promote autonomous technologies

These strategic alliances allow Uber to focus its resources on integrating and optimizing technology.

-Aurora Innovation

Following the sale of the ATG division to Aurora Innovation in 2021, Uber has entered into a long-term partnership with the company.

Aurora is a leader in the development of autonomous systems for various types of vehicles, including trucks and passenger vehicles.

Uber remains an investor in Aurora and plans to integrate the technology into its platform.

-Volvo

Uber and Volvo jointly developed an autonomous SUV specifically designed for ride-hailing services.

This vehicle was equipped with Uber's self-developed sensor system.

-Toyota

Uber has partnered with Toyota to test autonomous technologies for minivans.

Toyota also invested USD 500 million in Uber to advance the development of self-driving cars.

-Waymo

Although Waymo, a subsidiary of Alphabet (Google), is a competitor in the field of autonomous vehicles, Uber has announced a partnership with Waymo in 2023.

The aim is to make Waymo's autonomous vehicles available on the Uber platform in selected cities, which will enable an expansion of service options.

The collaboration with Tesla

Background to the collaboration

Uber and Tesla have intensified their collaboration in recent years, particularly in light of the increasing importance of electric vehicles (EVs) in the global automotive market and the need to reduce CO2 emissions in the transportation sector. Uber has committed to operating an all-electric fleet by 2040, which will be accompanied by the introduction of Tesla vehicles into the Uber network.

Introduction of Tesla vehicles at Uber

In 2020, Uber began adding Tesla electric cars to its fleet, initially in selected cities.

The goal was to offer drivers the opportunity to drive Tesla Model 3 vehicles via Uber.

-Promotion of electrification

Tesla is known for its advanced electric car technology, and Uber wanted to use this technology to accelerate the transition to a more sustainable vehicle fleet.

Providing Tesla cars to Uber drivers will encourage the uptake of electric vehicles, helping to reduce CO2 emissions across the Uber network.

-Increased efficiency and profitability for drivers

Tesla cars, especially the Model 3, offer potentially higher profits for Uber drivers due to lower operating costs - no gasoline costs, less maintenance.

These savings can increase the attractiveness of electric vehicles for Uber drivers, which in turn could lead to a faster transition to an electric fleet.

Tesla as a preferred partner for Uber drivers

Uber has developed special offers for drivers with Tesla to facilitate the purchase of Tesla vehicles.

Some of these offers include leasing options where Uber drivers can lease Tesla Model 3 vehicles at favorable conditions.

This is particularly important as the purchase cost of a Tesla car is higher than for conventional vehicles.

By creating affordable leasing options, the aim is to enable more drivers to use electric vehicles without having to make the high initial investment.

The future of collaboration: autonomous driving and technology integration

Another dimension of the collaboration between Uber and Tesla could lie in the development of self-driving cars. Tesla is a pioneer in the field of autonomous vehicle technology and has integrated the "Autopilot" system into its vehicles, which already enables partially automated driving in some situations.

Challenges and progress

-Regulatory hurdles

Many countries and cities lack clear regulations for autonomous vehicles, which makes their use more difficult.

-Technological complexity

The development of fully autonomous systems that function safely in all road conditions is technically demanding and requires continuous investment.

-Public acceptance

Many people are skeptical about self-driving cars, especially with regard to safety and data protection.

Uber's competitors: market analysis and competitive situation

Uber faces intense competition from global and regional companies in the mobility, delivery and logistics sectors.

Competition varies depending on the market segment and geographical region.

Uber's most important competitors are analyzed below and divided into categories:

Global competitors in the ride-hailing market

Uber is one of the largest providers of ride-hailing services worldwide, but is under pressure from local and international providers in various markets.

Lyft (USA)

Lyft is Uber's biggest competitor in the United States and Canada.

The company focuses exclusively on ride-hailing and does not have diversified business segments like Uber.

-Market shareLyft holds about 30 % of the US ride-hailing market compared to Uber's 70 %.

-Strengths: Focus on service quality and sustainability, including through partnerships to promote electric vehicles.

-ChallengesDependence on North American markets and lack of diversification.

Didi Chuxing (China)

Didi is the market leader in China and one of the largest ride-hailing providers in the world.

Uber withdrew from the Chinese market in 2016 and holds a minority stake in Didi.

-Market shareOver 80 % of the Chinese ride-hailing market.

-StrengthsEnormous customer base and strong integration in the Chinese digital payment and app ecosystems.

-ChallengesStrict regulatory requirements and political uncertainties in China.

Bolt (Europe and Africa):

Bolt (formerly Taxify) is a European provider of ride-hailing services with strong growth in Europe and Africa.

-Market shareBolt is aggressively expanding into markets where Uber is less present, particularly in Eastern Europe and Africa.

-StrengthsLocal market adaptation and competitive pricing.

-Challenges: Limited capitalization compared to Uber.

Competitors in the food delivery sector

Uber Eats is one of the leading food delivery services worldwide, but faces intense competition from regional and global platforms.

DoorDash (USA)

-Market leader in food delivery in the USA with a market share of 65 %compared to Uber Eats with 25 %.

-StrengthsStrong operational efficiency and diversified product offering, including food and retail delivery.

-Challenges: High competitive pressure and dependence on North American markets.

Just Eat Takeaway (Europe and international)

-Leading provider in Europe and other international markets.

-Market shareJust Eat dominates in countries such as the UK, Germany and the Netherlands.

-StrengthsStrong branding and broad market presence in Europe.

-ChallengesIntegration problems following acquisitions and low market share in the USA.

Meituan (China)

-Market leader in China with a dominant position in the food delivery sector.

-Market shareover 70 % of the Chinese food delivery market.

-StrengthsIntegration into a broad ecosystem of services, including travel and retail.

-ChallengesDependence on the Chinese market and regulatory uncertainties.

Deliveroo (Europe and Asia)

-A strong competitor in the UK and Asia, with a growing market presence in other regions.

-Strengths: Focus on premium delivery services and cooperations with restaurants.

-Challenges: High dependence on a few markets such as the UK.

Competitors in the logistics and freight sector

Uber Freight competes with traditional logistics companies and digital platforms.

Convoy (USA)

-A digital freight broker that uses similar technologies to Uber Freight to connect shippers and carriers.

-StrengthsStrong market presence in the USA and innovative technologies to increase efficiency.

-Challenges: High competition and limited geographic reach.

C.H. Robinson (global)

-An established provider in the logistics sector with a wide range of services.

-StrengthsGlobal reach and strong network in traditional logistics.

-Challenges: Less focus on digital transformation.

Flexport (global)

-An emerging provider in the field of digital logistics with a focus on international trade.

-Strengths: Technology-driven solutions for global supply chains.

-ChallengesCompetition from established players such as Uber Freight and C.H. Robinson.

Regional competitors

-Ola (India)Strong competitor in the ride-hailing market in India.

-Grab (Southeast Asia)Market leader in Southeast Asia, combining ride-hailing, food delivery and financial services.

-99 (Latin America)Local provider in Brazil and other Latin American countries.

Core markets of Uber Global

United States and Canada (North America)

-Importance

North America is Uber's largest and most profitable market, generating the majority of revenue and gross bookings.

-Products

Uber offers a wide range of services in North America, including Ride-Hailing, Uber Eats, Uber Freight and Uber Green.

-Market share

Uber dominates the US ride-hailing market with a share of around 70 %followed by Lyft.

In the food delivery sector, Uber Eats has a market share of 25 %behind DoorDash.

-Challenges

Intense competition (especially from Lyft and DoorDash) and regulatory uncertainty in some cities such as New York.

Brazil and Latin America

-Significance

Brazil is Uber's second largest market after the USA and a key growth market in Latin America.

The company has a strong presence in countries such as Mexico, Colombia, Argentina and Chile.

-Products

Mainly ride-hailing and food delivery via Uber Eats. In Brazil, Uber also offers Uber Moto (motorcycle cabs) and Uber Flash (package deliveries).

-Market share

Uber dominates the ride-hailing market in Brazil with a share of over 75 %.

-The challenges

Competition with local providers such as 99 and regulatory requirements in various countries.

Europe

-Meaning

Europe is a strategic market with high demand in urban areas.

Important countries are the UK, France, Germany, Spain and the Netherlands.

-Products

In addition to ride-hailing and food delivery, Uber also offers car rental and e-bike services in some European cities.

Uber Green (electric rides) is heavily promoted in cities such as London.

-Market share

Highly fragmented market with intense competition from Bolt and FreeNow (formerly MyTaxi).

In the UK, Uber is the market leader in the ride-hailing segment.

-The challenges

Strict regulatory requirements and high competition, particularly in Germany and France.

India and Southeast Asia

-Significance

India is a growing market with huge potential for ride-hailing. In Southeast Asia, Uber is focusing on countries such as Singapore, Malaysia and Vietnam, although it withdrew from some markets in 2018 (e.g. by selling to Grab).

-Products

In India, in addition to traditional ride-hailing services, Uber also offers Uber Auto (for motorized tricycles) and Uber Moto.

-Market share

In India, Uber is in direct competition with Ola, which has a comparable market share.

-Challenges

Intense price competition and regulatory barriers in terms of local regulations.

Australia and New Zealand

-Significance

Uber has a strong market presence in Australia and New Zealand and is the market leader in the ride-hailing segment.

-Products

Uber offers traditional ride-hailing services, Uber Eats and sustainable options such as Uber Green.

-Market share

Uber has a market share of around 80 % in the ride-hailing sector.

-The challenges

Competition with local providers and increasing sustainability requirements.

Middle East and Africa

-Significance

The Middle East and Africa offer great potential for growth in urban centers. Uber is active in major cities such as Dubai, Cairo and Johannesburg.

-Products

Ride-hailing services, including special offers such as Uber Bus in Egypt, which was developed for lower-income commuters.

-Market share

Uber is the leader in several African countries, but competes with Bolt and local providers in the Middle East.

-Challenges

Weak infrastructure, regulatory uncertainties and price sensitivity of customers.

China and Russia

-Significance

Uber is only indirectly active in these markets. After withdrawing from China in 2016, Uber holds a minority stake in Didi.

In Russia, the business was merged with Yandex.Taxi.

-Products

Uber benefits here through equity investments and partnerships, but no longer offers direct services.

-Challenges

Limited influence and dependence on partner companies.

Economic risks for Uber Technologies Inc.

Macroeconomic risks

-Inflation and recession

Higher cost of living and economic uncertainty may affect demand for ride-hailing and food delivery services as customers switch to cheaper alternatives or reduce their spending.

-Interest rate increases

Higher interest rates increase financing costs for Uber, especially for investments in new technologies such as autonomous vehicles or expansion into emerging markets.

-Exchange rate fluctuations

Uber's revenues come from different countries with different currencies. Exchange rate fluctuations, especially in emerging markets, could affect profits.

Regulatory and compliance risks

-Labor law regulations

Uber faces regulatory challenges worldwide with regard to the classification of its drivers.

In many countries and regions, there is pressure to treat drivers as employees rather than independent contractors, which could significantly increase operating costs.

-Local regulations

In some cities and countries, Uber is subject to strict regulations regarding operating licenses, price controls or access restrictions for certain services such as ride-hailing.

-Antitrust risks

As a dominant player in several markets, Uber could be scrutinized by competition authorities, which could lead to fines or operating restrictions.

Competition and market dynamics

-Intense competition

Uber faces strong competition in all its business areas from global and local providers, including Lyft, Bolt, DoorDash and Grab.

This pressure could lead to price cuts and falling margins.

-Market entry of new players

The entry of new competitors, especially technology-oriented start-ups, could threaten Uber's market share.

-Customer loyalty

Customers have low switching costs, which makes it difficult to retain them for Uber's services.

Losing customers to competitors could reduce revenue.

Technological and operational risks

-Investments in autonomous technologies

Uber's investments in autonomous vehicles and drone technologies are capital-intensive and entail significant risks, as these technologies are still in the development phase.

Delays or technological setbacks could affect profitability.

-Cybersecurity risks

As a technology-driven company, Uber is a potential target for cyberattacks that could cause data loss, business interruption or damage to brand reputation.

-Platform dependency

Uber's success depends heavily on the performance and reliability of its platform.

Technical failures could affect the customer experience and damage trust in the brand.

Risks in emerging markets

-Economic instability

In emerging markets such as Brazil, India and South Africa, Uber faces risks such as high inflation, political instability and uncertain legal frameworks.

-Access to markets

Local providers often have a competitive advantage due to better knowledge of market conditions and regulatory support.

-Payment risks

In regions with limited access to banking services, it can be difficult for Uber to generate revenue efficiently and process payments.

Sustainability and environmental risks

-Pressure to reduce CO₂ emissions

Governments and customers are increasingly demanding more environmentally friendly solutions.

Uber is forced to switch to electromobility and sustainable alternatives, which requires high investments.

-Regulatory pressure on emissions

In many cities and countries, there are regulations that restrict the operation of emission-intensive vehicles, which could increase Uber's operating costs.

Financial risks

-High indebtedness

Uber has taken on significant debt to finance its business.

This could limit its financial flexibility, especially in times of economic uncertainty.

-Capital requirements

Uber's expanding business model requires continuous investment in new markets and technologies, making access to capital markets essential.

Risks due to dependence on drivers and partners

-Driver availability

In some regions, there are challenges in recruiting and retaining drivers, especially with rising fuel costs or legal uncertainties.

-Dependence on restaurants and carriers

Uber Eats and Uber Freight rely on strong partnerships with restaurants and logistics companies. Conflicts or churn could affect the performance of these segments.

A summary of Uber's strengths and weaknesses

Uber's strengths

Global market leadership

-Uber is present in over 69 countries and 900 cities and has established a dominant market position in the ride-hailing sector.

-In the USA, Uber has a market share of 76 % in the ride-hailing sector, which underpins its leading position.

Diversified business model

-Uber offers a wide range of services, including Ride-hailing, Food delivery (Uber Eats), freight solutions (Uber Freight) and subscription services (Uber One).

-Diversification reduces dependence on a single business area and opens up new sources of revenue.

Technological innovation

-Uber uses advanced technologies such as artificial intelligence, big data and machine learningto make services more efficient and user-friendly.

-Examples include dynamic pricing, intelligent route planning and autonomous technologies such as the partnership with Waymo for robotaxis.

Strong brand awareness

-The name "Uber" is known worldwide and is often synonymous with ride-hailing services.

This brand awareness helps with customer acquisition and retention.

Flexibility and ease of use

Uber offers a user-friendly platform with various options such as UberX, Uber Comfort, Uber Green and Uber Poolwhich are tailored to different customer needs.

-The ease of use of the app and the availability of services around the clock make Uber attractive.

Economies of scale

-With millions of drivers and users worldwide, Uber benefits from economies of scale that reduce operating costs per unit and improve margins.

Successful customer loyalty programs

-The subscription service Uber One with benefits such as discounted rides and delivery fees, has a growing number of members (over 25 million) and promotes customer loyalty.

Sustainability initiatives

-With services like Uber Green and plans to become emission-free by 2040, Uber is positioning itself as a sustainable company, which is particularly well received by environmentally conscious customers.

Weaknesses of Uber

Dependence on drivers

-Uber's business model relies heavily on independent drivers, making it vulnerable to labor and regulatory challenges.

-There are moves in many countries to classify drivers as employees rather than independent contractors, which could significantly increase operating costs.

High competition

-Uber faces intense competition in all business areas, e.g. from Lyft (USA), Bolt(Europe), Didi (China) and DoorDash (food delivery).

-The strong competition exerts price pressure and can reduce margins.

High operating costs

-Uber's operating costs, particularly for marketing, driver acquisition and investments in technologies such as autonomous vehicles, remain high.

This makes it difficult to achieve sustainable profitability.

Dependence on core markets

-The majority of sales are generated in the USA, Brazil and other established markets. Fluctuations in these regions could have a significant impact on financial stability.

Regulatory uncertainties

-Uber faces regulatory challenges around the world that could restrict or increase the cost of its operations.

-Examples include license requirements, price controls and local restrictions on ride-hailing services.

Loss of market share in some regions

-In Asia, Uber has lost market share to local providers such as Grab (Southeast Asia) and Ola (India).

-Uber is also under strong pressure in Europe from competitors such as FreeNow and Bolt.

Vulnerability to economic fluctuations

-Economic uncertainties, inflation and recession may reduce demand for Uber's services as customers switch to cheaper alternatives.

-In the food delivery segment in particular, consumers' reluctance to spend could lead to a decline in orders.

Risks associated with the introduction of autonomous technologies

Uber's investments in autonomous vehicles and drone technologies are capital-intensive and entail considerable risks. Delays or setbacks could impact profitability.

Critical perception

-Uber is often criticized for poor working conditions for drivers, privacy issues and increasing fares when demand is high.

-Such perceptions can affect brand reputation.

Current developments and initiatives

Partnerships and expansion

-Autonomous vehicles in the United Arab Emirates: In September 2024, Uber entered into a partnership with WeRide to introduce autonomous vehicles in the United Arab Emirates.

This collaboration aims to strengthen the presence of autonomous driving services in the region.

Data protection and regulation

-Penalties for data protection violations: In January 2024, Uber was fined €10 million by the Dutch Data Protection Authority. 10 million euros for providing insufficient information about the storage and protection of its drivers' personal data.

This was followed in August 2024 by a further fine of 290 million euros for transferring driver data to US servers, which violated the General Data Protection Regulation (GDPR).

Working conditions and driver protests

-Strikes and demands for better working conditions: In February 2023, Uber drivers in the US and UK went on strike to protest against low wages and high fees.

They were supported by drivers from other platforms such as Lyft and DoorDash.

Advertising within the app

-Integration of advertisements: In March 2024, the Wall Street Journalreported that Uber is increasingly integrating advertising into its app in order to increase profitability.

This involves displaying personalized content based on user data.

Uber is careful to strike a balance between additional revenue and user satisfaction so as not to annoy customers with excessive advertising.

Legal disputes over passenger safety

-Class action lawsuits for sexual assaultIn February 2024, a class action lawsuit was filed against Uber in the Northern District of California involving numerous cases of sexual assault against passengers.

The plaintiffs accuse Uber of prioritizing growth over safety and conducting inadequate background checks on drivers.

The lawsuit seeks damages and changes to Uber's safety policies.

Criticism of the business model

The fact that Uber drivers are considered self-employed and not employees is a major point of criticism of the company's business model.

-Lack of social benefits

Since Uber drivers work as independent contractors, they are not entitled to basic social benefits such as health insurance, paid vacation or retirement benefits.

This poses a significant problem, especially for drivers in precarious employment, as they are responsible for their own coverage.

-Unclear income security

Self-employed drivers do not have a fixed salary, but are dependent on the number of journeys they can make.

This leads to income uncertainty and makes it difficult to make stable financial plans.

In times of low demand or unforeseen events (e.g. bad weather or an accident), income can fluctuate greatly.

-Lack of labor rights

Self-employed drivers are not entitled to the same employment rights as regular employees.

This means that they have little legal protection in the event of disputes with Uber or regarding working conditions.

They also cannot form a union or engage in collective bargaining to achieve better working conditions or pay.

-Insufficient transparency in pay

Many Uber drivers criticize the fact that the calculation of earnings is not transparent.

Although the app shows the price per ride, many factors such as Uber's commission, the processing fees or the exact conditions for dynamic pricing are not openly communicated.

This lack of clarity makes it difficult for drivers to understand their actual earnings and make a reliable calculation of their income.

-Increasing precarization of work

The business model of Uber and similar platforms is making work increasingly precarious, as it is characterized by constant uncertainty and flexibility.

The idea of flexibility is seen as deceptive by many drivers, as they are constantly dependent on the platform to generate enough rides and thus income.

In many cases, they have to invest a lot of time to operate in profitable areas or during high-demand periods.

-Lack of say and freedom of decision

Uber drivers have no influence on decisions that affect their working conditions.

The platform sets all important rules and changes without giving drivers the opportunity to shape them. This includes adjustments to pricing, changes to commissions or new regulations on the use of the app. These top-down decisions can undermine drivers' sense of control and autonomy.

-Monopolization of the market

Uber is accused of pushing smaller competitors out of the market through aggressive market growth and price undercutting.

This market dominance can lead to higher prices for consumers and less competition in the long term.

For drivers, too, this often means that their pay will fall if Uber continues to expand its market power.

-Lack of support in the event of accidents and conflicts

In the event of accidents or conflicts during the ride, the driver is often left without sufficient support from Uber. Even though Uber offers insurance for drivers, many drivers feel that this is not sufficient in the event of an emergency or that the claims settlement process is unnecessarily complicated and lengthy.

This leads to frustration and a feeling of being at a disadvantage.

-Unclear liability issues

Since Uber drivers are considered self-employed and not employees, liability issues also arise in the event of accidents or problems.

It is not always clear to what extent Uber is responsible for incidents during the ride and how the company deals with liability issues.

This leads to legal uncertainties for drivers and passengers alike.

-Displacement of public transportation

In some cities, Uber is accused of crowding out public transportation, as many passengers primarily use Uber instead of buses or trains.

This can lead to a reduction in public transport ridership, which in the long term could lead to a decline in public infrastructure and higher costs for the general public.

-Increasing automation and job losses

Another issue affecting Uber drivers is the potential automation of the platform.

Uber is investing heavily in self-driving cars, which could lead to a loss of jobs for drivers in the long term.

This uncertainty is causing further concern about the future of employment on the platform.

The share on the market

-Price targetsThe average target price is USD 90.89, with a range of USD 75.00 to USD 120.00.

Buy recommendations and analyst opinions

Of a total of 58 analysts surveyed, 51, i.e. around 88%, recommend buying Uber shares, while 7 analysts (around 12%) recommend holding the shares.

It is noteworthy that none of the analysts recommend the share as a sell.

This positive rating reflects the general confidence in Uber's long-term growth forecasts.

Personal assessment of the share

I have been fascinated by the UBER share for a long time, as I find both the growth and the platform business very exciting.

I find the company's long-term prospects extremely promising.

Although I have not yet found an entry point, I am convinced by the steadily growing customer base and the increasing revenue per customer, which underlines the long-term attractiveness of the company for me.

Graphics: Uber Technologies inc / Statista

$UBER (+2,2 %)

$GOOGL (+1,66 %)

$LYFT (+1,38 %)

$LILM

$JOBY

$TSLA (+2,64 %)

$DHER (+0,44 %)

$TKWY (-1,03 %)

$DASH (+0,52 %)

Best regards

Michael