From all-time high to all-time high - time to take a look in my cellar 📉

The stock markets only know one direction at the moment and even September, generally the worst month on the stock markets, is heading for a clear green result.

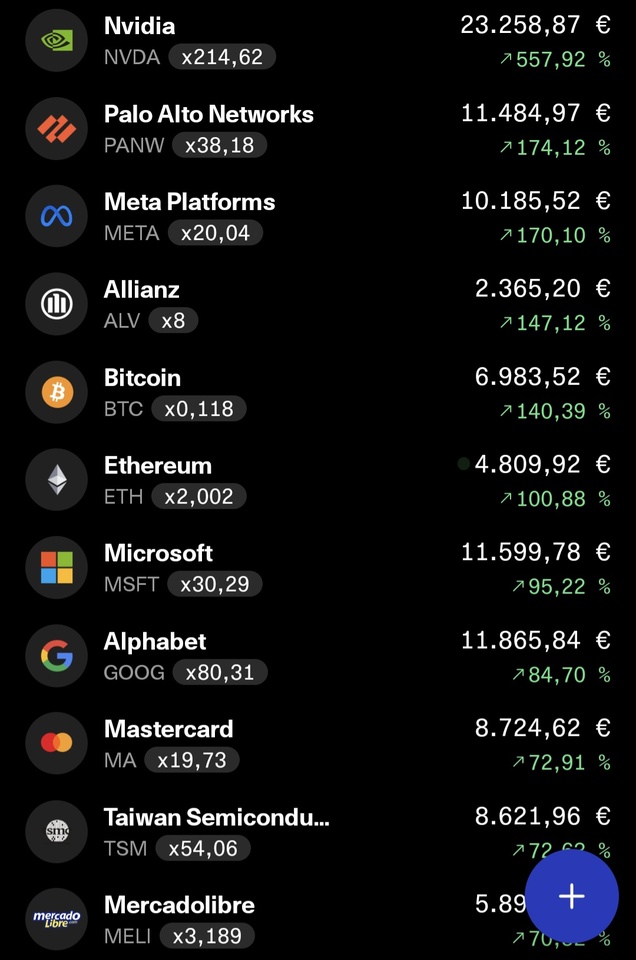

Of course, this can also be seen in my portfolio in the following picture. What I find much more exciting in such situations, however, is always the view to the very bottom, where it turns red and which is generally not shown here.

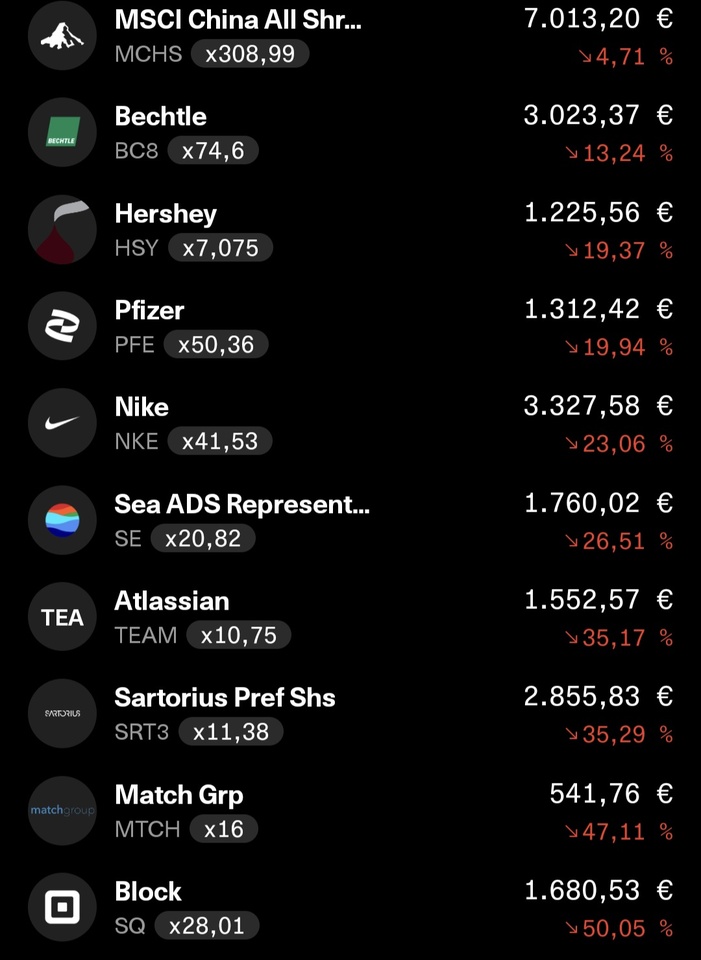

Now it turns red and negative:

Even though many things are going well, some things are not going well. For the most part, these are still the former corona winners like Pfizer $PFE (-0,37 %) Sea $SE (+1,35 %) Block $SQ (-0,69 %) or Atlassian $TEAM (+0 %)

However, Pfizer's overall performance is not quite as bad, as there has of course been a lot of dividend growth over the last few years.

Nike $NKE (+0,13 %) and Hershey $HSY (-1,01 %) are also not doing themselves any favors at the moment, but are still in the savings plan. Just like Bechtle $BC8 (-3,11 %)

My China ETF is currently the phoenix from the ashes, I was surprised myself that it has almost reached 0 😂

Towards the end of the year, I will analyze the losers again. Will they get another year of probation? Or will one stock or another be thrown out?

I usually look at this between Christmas and New Year's Eve.

What's your situation? What are your skeletons in the closet doing?