Hello GetQuin!

After I have now already since more or less beginning of GetQuin always secretly read along, it is probably also times for my first post ;).

Very briefly about me - I'm 23 years old, study business administration, like to invest in value stocks and currently work as a student trainee in a medium-sized IT/Tech company.

In the spring of this year, while searching for companies that I found interesting, I came across Carlisle ($CSL (+0,44 %)) came across.

Here now for you a small insight into $CSL (+0,44 %) since many have certainly not yet heard of Carlisle.

Carlisle Companies Incorporated is a US company based in Scottsdale, Arizona. The conglomerate offers a wide range of products that Carlisle designs, manufactures and markets, serving a variety of niche markets worldwide, including commercial roofing, energy, agriculture, lawn and garden, mining and construction equipment, aerospace and electronics, foodservice and food delivery, and healthcare. In addition, Carlisle has paid dividends for 46 consecutive years of dividends!

The company was founded in 1917 as Carlisle Tire and Rubber Company and began producing bicycle inner tubes. Over the years, Carlisle expanded its product line to include tires, brake pads, cables, coatings, plastics and other specialty products.

Today, Carlisle is organized into four business units:

- Construction Materials (CCM)

- Interconnect Technologies (CIT)

- Fluid Technologies (CFT)

- Weatherproofing Technologies (CWT)

The company employs around 14,000 employees worldwide - some of them even in Germany. Carlisle is listed on the New York Stock Exchange under the symbol

$CSL (+0,44 %) and is part of the S&P 400 Index. Carlisle has set itself the goal of reducing by 2050 net-zero greenhouse gas emissions. by 2050.

How does Carlisle plan to achieve its ambitious goals?

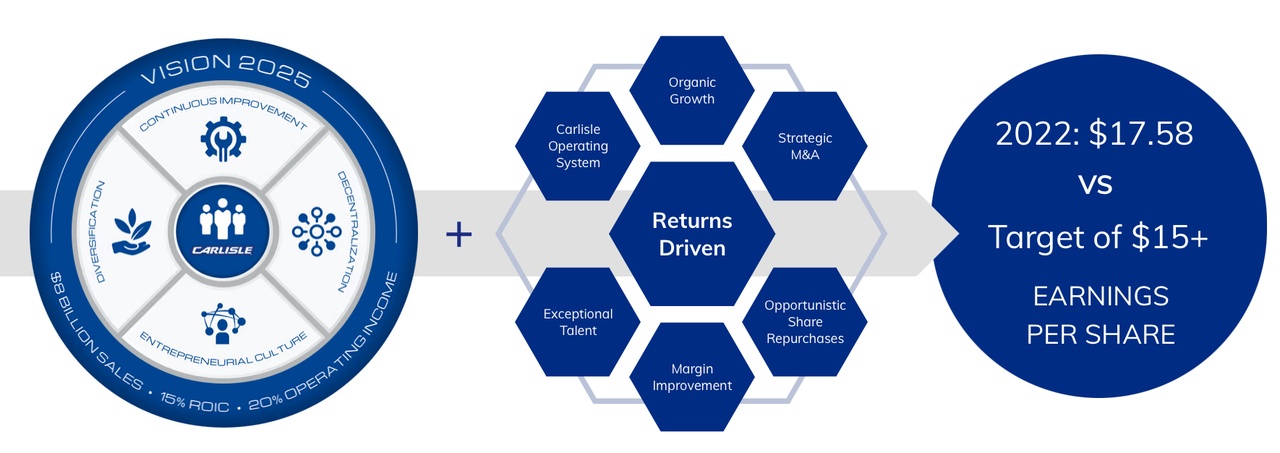

Carlisle has developed its own operating system (COS - Carlisle Operating System). Here, through Lean and Six Sigma methods are used to continuously improve existing processes. In addition, through Vision 2025 (see photo), the company is aiming for earnings per share of $15 in 2025 - but this was already achieved early on in 2022.

As investors, we should of course take note of some of Carlisle's key financials, such as:

- Gross margin: Increase of about 10% over the last 10 years, to currently about 32%.

- Earnings per share: EPS in 2022 was $17.56; in 2021, "only" $7.91 -> 122% increase

- Price-earnings ratio: currently at 18.5; peer average PE currently at 17.6

- Dividend yield: Currently at a low 1.2%, BUT the payout ratio at only a low 20%.

Carlisle is a diversified company with a strong market position in several industries. The company has a solid balance sheeta high profitability and a long-term growth strategy. Carlisle offers its shareholders an attractive return through increasing profits and dividends.

However, please do your own research before investing :) I would like to present here only the company and do not operate an investment advice...

Since this is my first post, please praise & criticize, only so I can optimize my possibly future following posts :)