Sector performance & weekly review S&P500 | $SPY (+0,55 %)

S&P 500 ends weekly winning streak as materials and utilities weigh

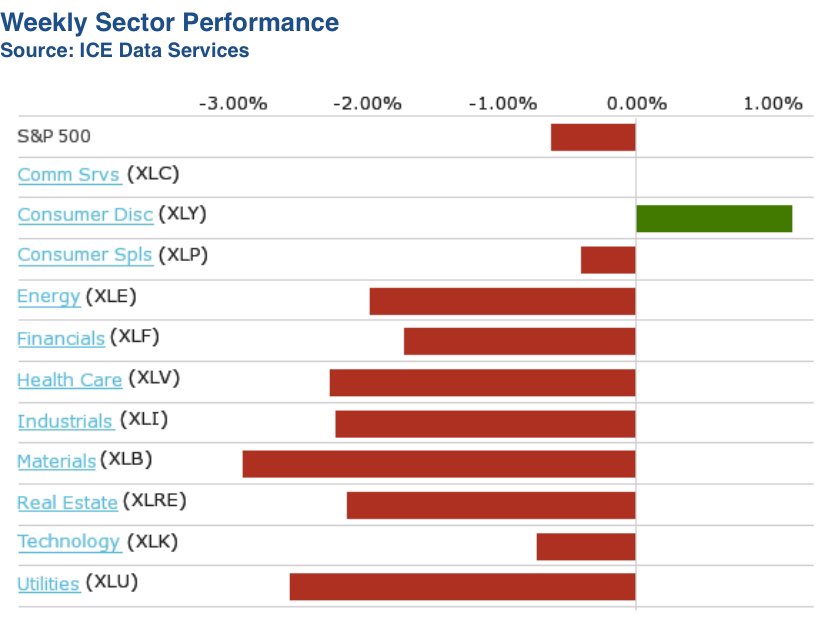

The S&P 500 index fell 0.6%, its first weekly decline since mid-November. The market index ended Friday's session at 6,051.09 points. This broke a three-week winning streak, but the S&P 500 is still well up for 2024 with a year-to-date gain of 27%.

This week, data showed that the US Consumer Price Index (CPI) rose by 0.3% in November after increasing by 0.2% in each of the previous four months. Year-on-year inflation accelerated to 2.7%, compared with 2.6% in October. Both figures were in line with the forecasts of a survey compiled by Bloomberg.

Producer prices for November, however, rose more than expected as wholesale costs for goods increased due to a rise in food prices. The US Producer Price Index (PPI) rose by a seasonally adjusted 0.4% month-on-month in November, compared to the consensus estimate of a 0.2% increase. Year-on-year, producer prices rose by 3%, exceeding the expected 2.6%.

Investors are watching the inflation figures closely as the Federal Open Market Committee (FOMC) of the US Federal Reserve will make its final interest rate decision of the year next week.

The materials sector posted the largest percentage decline among the S&P 500 sectors, with a weekly drop of 2.9%, followed by a 2.7% decline in the utilities sector and a 2.4% loss in the real estate sector.

In the materials sector, shares of Nucor (NUE) were the hardest hit, falling 12%. UBS downgraded the stock from "buy" to "neutral" and stated that there is "limited upside potential" for the stock in the short term. The company also lowered its price target for Nucor shares from USD 171 to USD 156.

In the utilities sector, Pinnacle West Capital (PNW) shares fell 4.4% after the company announced that Pinnacle West and Arizona Public Service Chairman and CEO Jeff Guldner will step down effective March 31. Ted Geisler will become Chairman, President and CEO of Pinnacle West and Arizona Public Service effective April 1.

Nevertheless, communication services increased by 2.4 %, while the non-cyclical consumer goods segment grew by 1.4 %.

In the communications services sector, shares of Warner Bros. Discovery (WBD) rose 13% for the week after the company announced plans for a restructuring. Warner Bros. Discovery plans to introduce a new corporate structure that will split its operations into two divisions: "Global Linear Networks", which will focus on profitability and cash flow, and "Streaming & Studios", which will target growth through streaming and entertainment.

The upcoming FOMC meeting will take center stage next week. Important economic reports are also expected, including the second revision of third quarter gross domestic product (GDP), US retail sales for November and data on housing starts and building permits.