Depot review June 2023 - And it keeps going 🚀🚀🚀

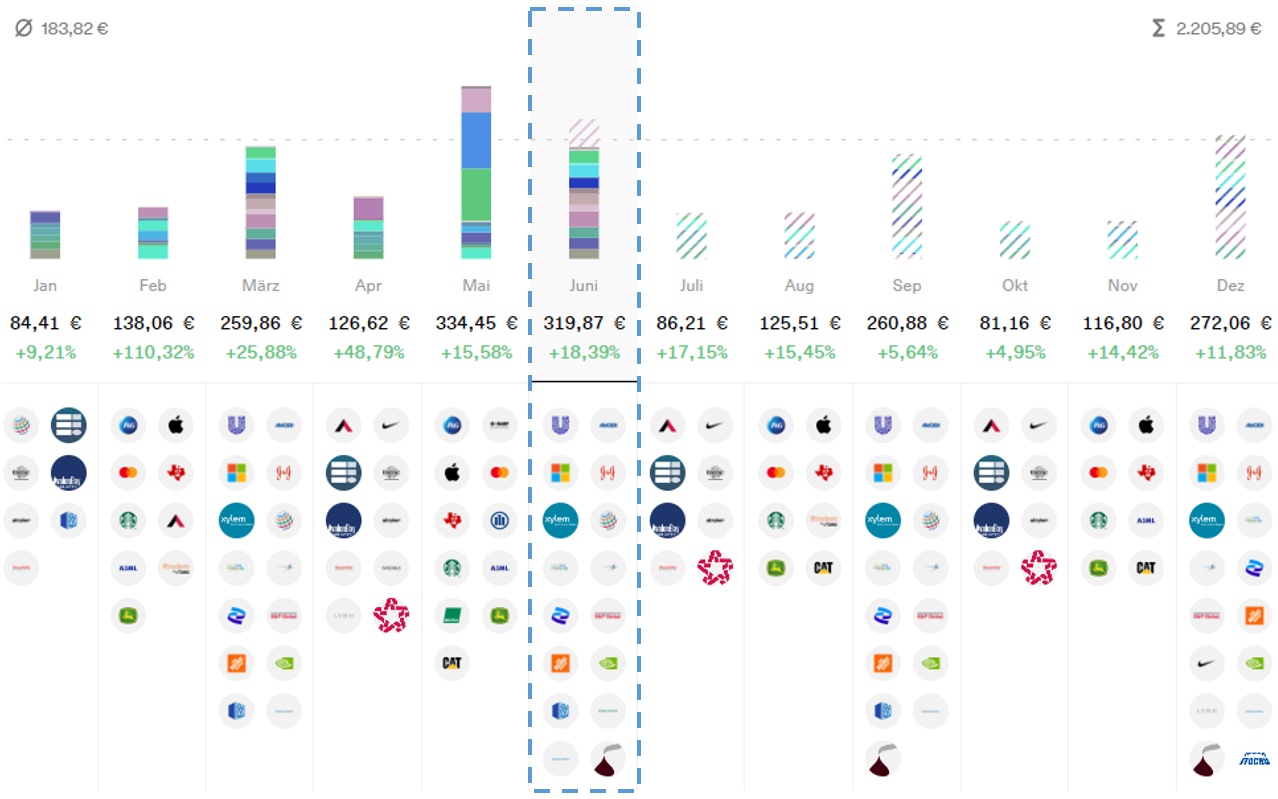

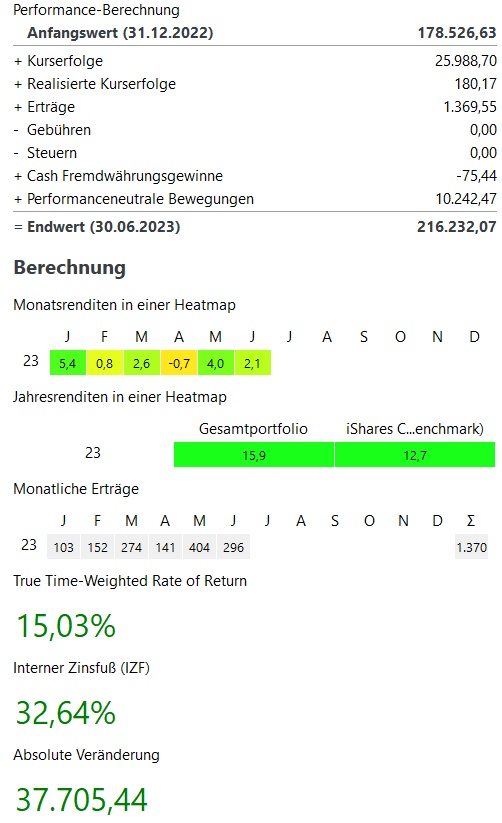

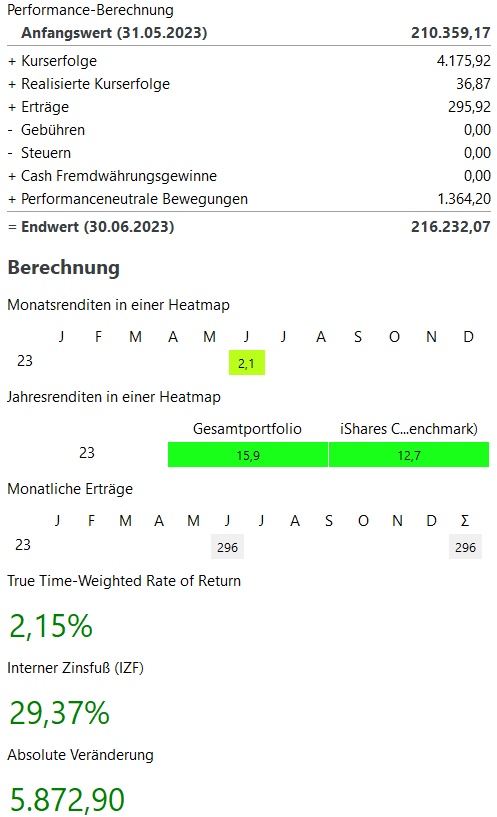

The year 2023 continues to go extremely well in my depot. In June, my portfolio was able to +2,1% increase. In contrast to June 2022 with -4,6% again a clearly different development.

In the current year, my performance is currently +15,9% and thus continues to outperform my benchmark (MSCI World +12.7%).

Still strongly driven by NVIDIA $NVDA with +7% / + 650€. Even stronger in the month of June was only Palo Alto Networks $PANW (-2,12 %) with +18% / +1,300€

On the losing side, there were no spectacular developments in June. With Alphabet $GOOG (+1,03 %) Synopysy $SNPS (-1,06 %) Salesforce $CRM (+0,69 %) Crowdstrike $CRWD (+2,85 %) and Mercadolibre $MELI (+2,5 %) the losers were more likely to be found in the tech/growth sector.

In total my portfolio stands at over 216.000€. This corresponds to an absolute growth of ~38.000€. in the first half of 2023. ~26,000€ of this comes from price increases, ~1,400€ from dividends / interest and ~10,000€ from additional investments.

Dividend:

- Dividend +9% compared to previous year

- At Encavis $ECV (-0,06 %) there was unfortunately a cancellation of the dividend this year. Despite the cancellation, my dividend was able to grow almost double-digit (On getquin, the Encavis dividend is still included as a forecast, which is why it shows an incorrect +18% vs. previous year)

- In the current year, dividends after 6 months are up +26% over the first 6 months of 2022 at ~€1,300

Purchases & Sales:

- Bought in May for ~4.000€

- Executed mainly my savings plans:

- Blue ChipsASML $ASML (-1,59 %) Alphabet $GOOG (+1,03 %) Deere $DE (+0,19 %) Lockheed $LMT (+0,94 %) Mastercard $MA (-0,34 %) Northrop $NOC (-0,09 %) Republic Services $RSG (-1,09 %) Thermo FIsher $TMO (+0,81 %) and as a new investment Itochu $8001 (-0,17 %)

- GrowthSartorius $SRT (+2,08 %) and Synopsys $SNPS (-1,06 %)

- ETFsMSCI World $XDWD Nikkei 225 $XDJP and the Invesco MSCI China All-Shares $MCHS

- Crypto: Bitcoin $BTC and Ethereum $ETH

- Sold with the BASF $BAS (-0,12 %) Share another part of my (very small) Germany share. For this I have created a standalone post on why I want to further reduce my Germany share.

Next month, another new share will probably follow with Novo Nordisk $NOVO B as I continue to see strong growth in the pharma sector and Novo Nordisk has an absolutely convincing track record in terms of profit and sales growth. Health, especially with regard to obesity, will remain an extreme challenge for the future in my eyes.

Furthermore, I am currently toying with the idea of changing my China ETF into a distributing ETF. I would like to remain invested in China, but I am also aware of the risks. In terms of dealing with Russian stocks (total loss of shareholders), a distributing ETF has a big advantage: you regularly get a portion back via dividends. In contrast to an accumulating fund, this reduces the risk of a total loss.

Furthermore, I am very curious to see what the second half of the stock market will bring. Will we continue to see an extremely strong recovery on the stock market and will the recession worries catch up with us at some point?

How did your portfolio perform in June? And what are your expectations for the second half of the year?