German automotive industry: crisis or entry opportunity? 📉📈

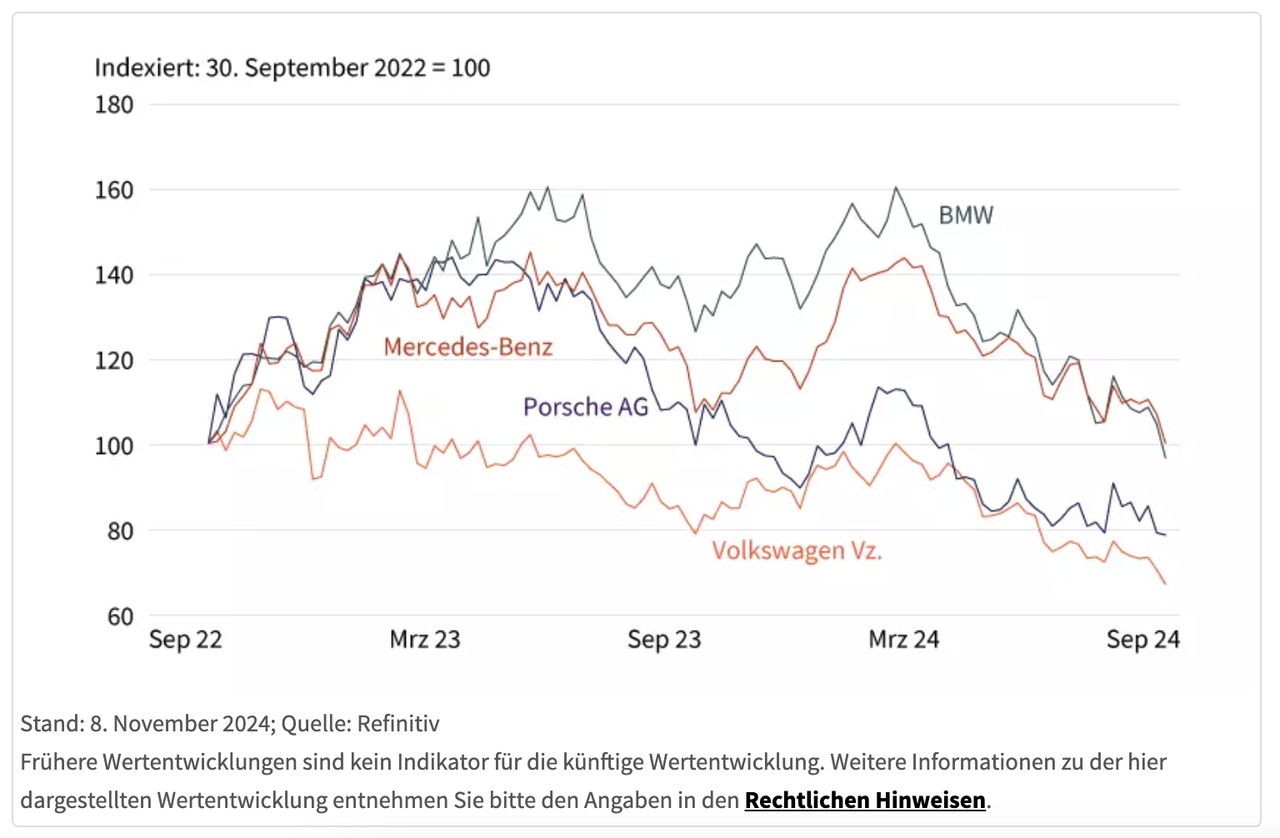

The German automotive industry is in a deep crisis. $VOW (+1,96 %) struggling with profit warnings, $BMW (+0,87 %) and $MBG (-0,07 %) reducing its margin forecasts and $P911 (-0,41 %) is suffering from weak business in China. Added to this are geopolitical uncertainties such as possible tariffs and a global shift towards electromobility, which continues to require more and more investment.

The figures therefore speak for themselves: profits are collapsing, sales figures are stagnating and the labor market is facing a transformation that could cost over 140,000 jobs by 2035.

But we all know that: Crises can be opportunities for us.

The sector is historically cheaply valued: many shares are trading near 25-year lows.

Experten We see the first rays of hope in 2025 - thanks to new models, a possible stabilization of demand and a gradual improvement in innovative strength, particularly in the premium segment.

So which brands look the best in relation to their valuation and where are the biggest problems?

To find out hier a new article - spoiler: It plays a significant role who has production sites in China.

#porsche

#volkswagen

#bmw

#mercedes

#emobilität

This article is part of an advertising partnership with Société Générale