Hello everyone,

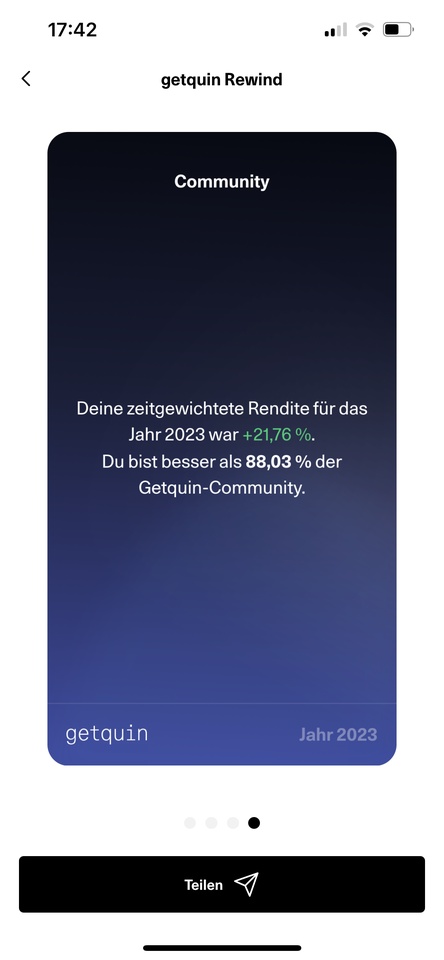

I am more than satisfied with the performance of my portfolio this year!

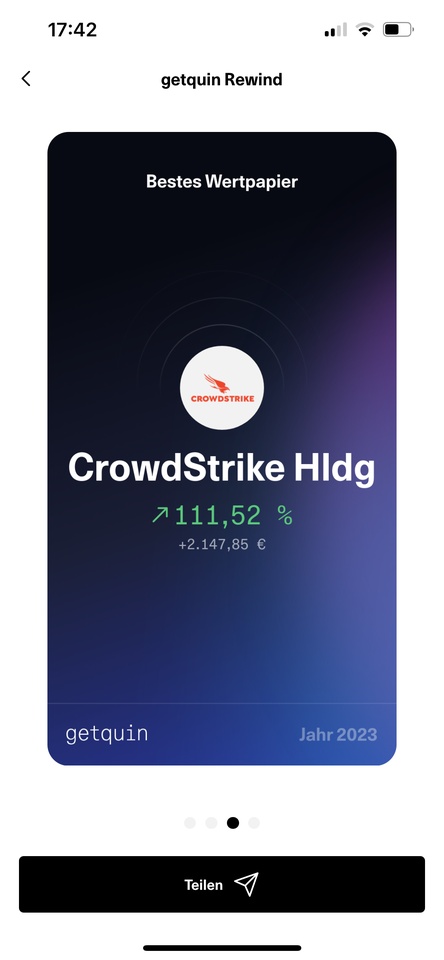

I was in the discovery phase for a long time as far as my strategy is concerned and I have certainly lost some returns due to some back and forth. The back and forth was mainly due to a steady increase in knowledge. I have learned a lot this year, particularly in the area of share valuation (DCF, fair value, trading comps) (and of course some gambling). With this additional knowledge, I also had to rethink some positions that I would certainly not have included in my portfolio today.

I am pretty sure that my approach of buying absolute quality companies at good prices will work out in the future.

That's why I want to focus my portfolio even more in the future!

For new additions to the portfolio I have $SNPS (-0,22 %)

$CDNS (+1,3 %)

$ANSS

$CPRT (+3,56 %)

$CTAS (+2,08 %) and $RACE (+0,57 %) at the top of my watch list. If something happens here that drives the valuation down significantly, I would like to buy it.

What are your top quality companies?

LG