Water - a finite resource

1. development of drinking water consumption

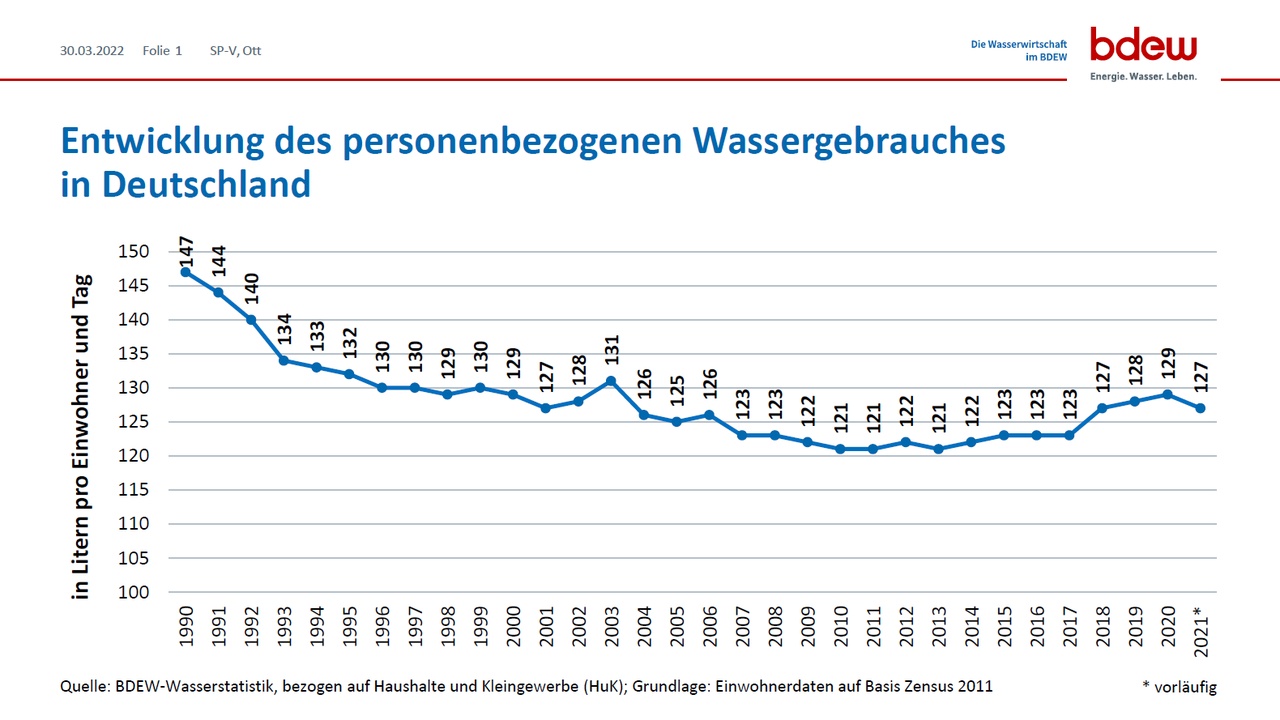

Before my research, I could have bet that drinking water consumption has steadily increased over the last 30 years. After all, we often hear in the news that we have to use our water resources sparingly. But the water statistics from the BDEW (German Association of Energy and Water Industries) show that personal water consumption in Germany has risen from 147 liters per inhabitant and day (year 1990) to 129 liters per inhabitant and day (year 2020) (see figure). There are several reasons for this positive development.

2. reasons for the positive development

- Technical progress (e.g. smart washing machines/dishwashers/shower heads)

- Social metering (Consumers save more water to protect the environment and reduce costs)

- Water conservation in trade and industry (Sustainable use of scarce resources of enormous importance)

- Regulation of the European Commission (Introduction of the Eco-Design Directive)

3. distribution of water

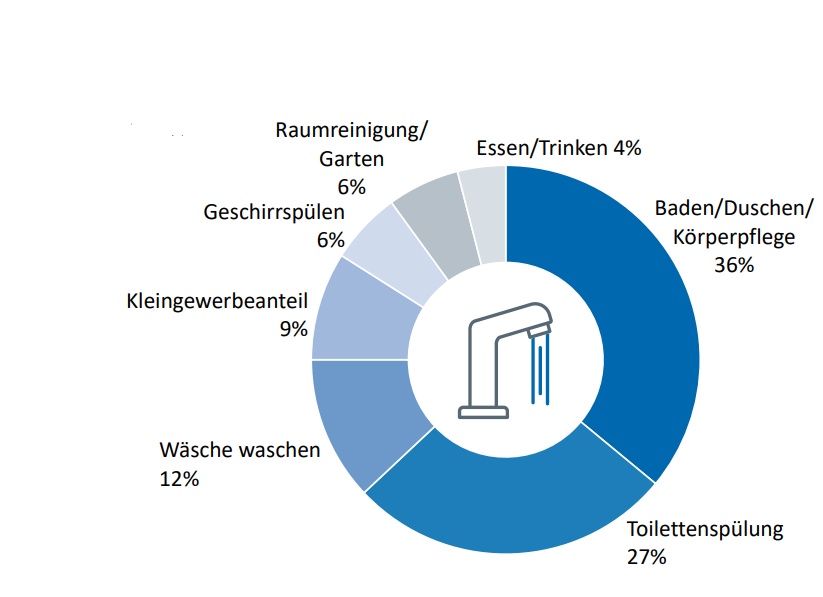

Surely you have wondered how a single person can consume 127 liters per day. In a second statistic from BDEW I found a breakdown of the consumption on the individual life situations. More than half of it is used for bathing/showering and flushing the toilet (see picture).

4. investment in water

You find the topic water so exciting and want to invest? I have some facts for you about the iShares Global Water ETF with you:

- WKN: A0MM0S

- TER: 0,65%

- Fund size: 1.89 billion €

- Fund launch: 16.03.2007

- Income appropriation: distributing

- Share of top 10 positions: 54.07

- Number of positions: 50

- Largest positions: American Water (9.73%) + Xylem (6.87%)

(More info on the ETF: https://de.extraetf.com/etf-profile/IE00B1TXK627) [unpaid advertisement]

Personal opinion on the ETF: I find the ETF far too specific and expensive. I also don't like that the largest 10 positions make up over 50% of the ETF. I can save the ETF and choose a few individual stocks (no investment recommendation).

Conclusion: Water is a very important issue. Technological progress has at least enabled us to reduce average water consumption. Nevertheless, we have to be economical with this finite resource. An investment can be worthwhile, as the topic is becoming more and more relevant. However, the ETF is not suitable for this (for me).