++Robinhood Markets, Inc.: A look at the innovations, strategies and growth prospects of a financial pioneer ++

Robinhood Markets, Inc. is a leading fintech company founded in 2013 by Vladimir Tenev and Baiju Bhatt.

The company is headquartered in Menlo Park, California.

Robinhood has fundamentally changed the financial world through its platform that enables commission-free trading.

The company offers investors the opportunity to invest in a variety of asset classes, including stocks, ETFs, options and cryptocurrencies.

Additionally, Robinhood offers innovative retirement accounts (Traditional and Roth IRA) specifically designed for long-term retirement planning.

Robinhood's mission is to make financial markets accessible to all and provide a platform that prioritizes simplicity and transparency.

By democratizing trading, Robinhood particularly appeals to young, tech-savvy investors and has established itself as a pioneer in engaging users who previously did not have access to traditional financial services.

Milestones in the company's development

-2013Founded with the mission to democratize access to financial markets and introduce commission-free stock trading.

-2018: Launched cryptocurrency trading, putting Robinhood at the forefront of digital assets.

-2021: Initial public offering (IPO) on the NASDAQ under the symbol HOOD and major enhancements to platform features.

-2024: Launch of new products such as the desktop trading platform Robinhood Legend and the expansion to futures and index options to appeal to professional traders.

Robinhood's business model and products

Robinhood pursues a business model based on innovation, user-friendliness and the democratization of the financial market. With a platform that offers commission-free trading and easy access to a wide range of financial products, the company has tapped into a new generation of investors.

Revenue streams

-Transaction-based revenue:

Robinhood earns fees from the routing of trading orders to market makers, so-called Payment for Order Flow (PFOF).

This remains a significant revenue stream despite regulatory challenges.

In Q3 2024, this revenue increased in particular due to the boom in options and crypto trading.

-Net interest income:

Robinhood earns interest on customer deposits and margin loans.

In Q3 2024, this income increased by 80% to USD 247 million, supported by rising interest rates and the growth of the Cash Sweep program, which offers customers cash interest rates of up to 5%.

-Robinhood Gold:

A premium subscription model with monthly fees ($5 per month).

It offers benefits such as free margin trading up to $1,000, higher APY interest rates on cash (currently 4.9%) and exclusive market data.

-Product diversification:

Revenue from new business lines such as cryptocurrencies, international expansions and the planned futures and index options.

Cash management account

Robinhood has expanded its product range with a cash management account which functions as a kind of modern bank account and is particularly attractive for users of the platform who want to integrate their financial activities.

Functions and features of the Robinhood Cash Management Account (2024):

-Interest income:

The Cash Management Account offers an attractive interest rate of approx. 4.5% per year on the balance, which is well above the interest rates of traditional bank accounts. This high rate of interest has made Robinhood a popular choice for users who want to park their savings in a flexibly accessible account.

-No monthly fees:

Like many other Robinhood products, the Cash Management account is free of chargewith no monthly account maintenance fees or minimum balance requirements.

This is particularly appealing to price-conscious users looking for a cost-effective solution.

-Debit card:

Customers receive a Robinhood debit cardwhich is issued in cooperation with MasterCard .

This card allows users to make purchases and withdraw cash from ATMs, making access to their funds even more flexible.

The Cash Management account is fully integrated with the Robinhood app, allowing customers to quickly and easily switch between their Cash Management account and their brokerage account (for stocks, options and crypto).

Restrictions:

-No full bank account:

The Robinhood Cash Management account is not a full bank account. It does not offer features such as check writing or personal loans, which limits its functionality compared to traditional banks.

-Availability:

The Cash Management account is only available in the US and is currently not accessible in some states.

This further limits the user base of the product.

The Robinhood Cash Management account is a useful addition to the Robinhood portfolio, characterized by its high interest rate and seamless integration with the existing brokerage account.

It is ideal for users who want to centralize their finances while benefiting from attractive interest rates. Nevertheless, it is not intended as a complete banking solution and does not offer the same wide range of functions as traditional banks.

Business development Q3 2024

Customer growth and wealth management

-Funded accounts24.3 million active accounts, +1 million compared to 2023.

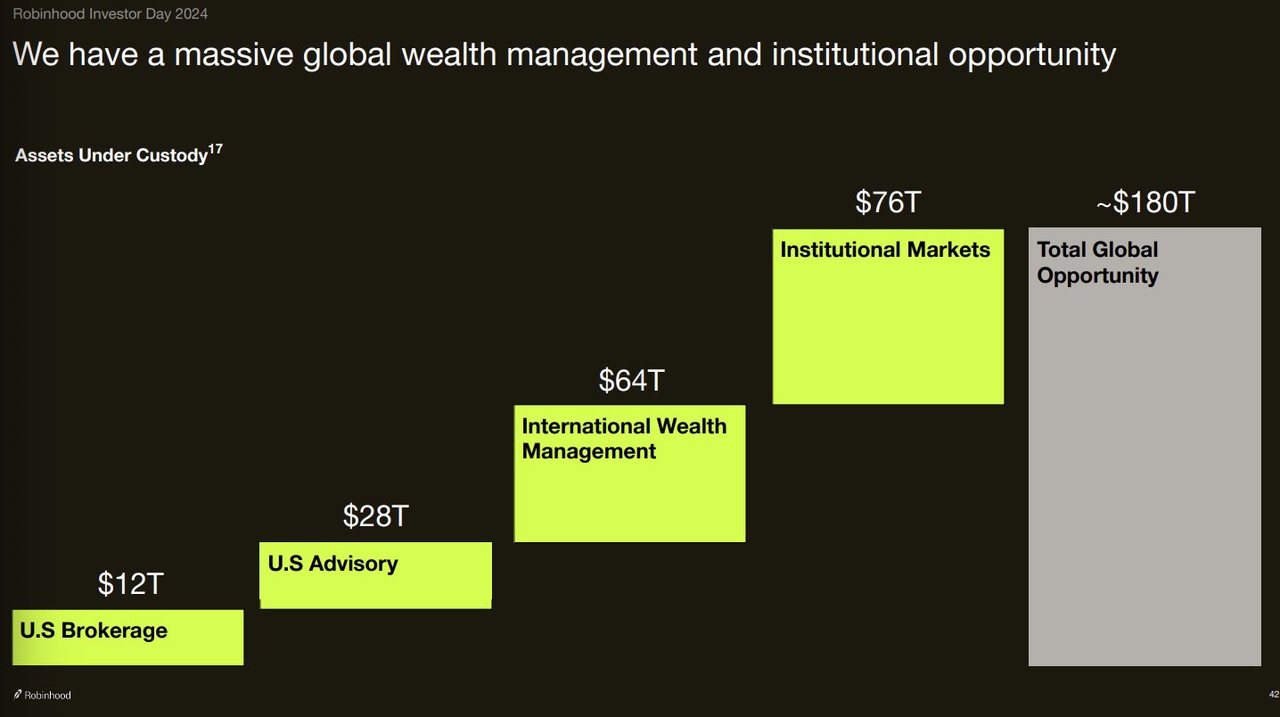

-Assets Under Custody (AUC)Reaching new record levels of 152 billion USD (+76 % YoY).

-Net deposits: USD 10 billion in the quarter (+45 % YoY).

Trading volume

-Share tradingVolume of 286 billion USD (+65 % YoY).

-Options: 443 million contractsa growth of 47 %.

-Crypto trading: 14 billion USDan increase of 112 % year-on-year.

Key financial figures

-Turnover: USD 637 million (+36 % YoY).

-Net profit: 150 million USDa significant increase from a loss in the previous year.

-Adjusted EBITDA: USD 268 millionwhich corresponds to an annual value of almost USD 1 billion.

Product innovations and customer benefits

Robinhood Gold

-Premium subscribers2.19 million users (+65% YoY).

-Features:

-3 % cashback with the new Robinhood Gold Card.

-Free margin services up to 1,000 USD.

-4.5% interest (APY) on cash.

New products

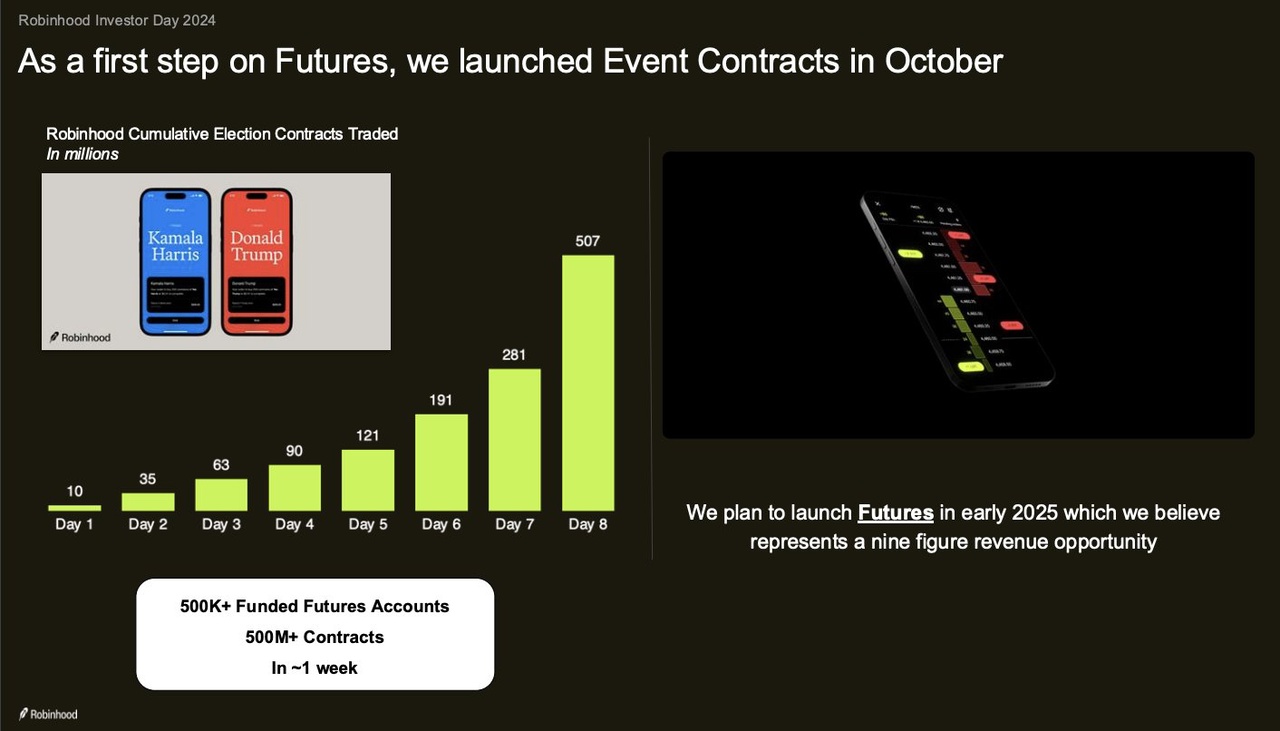

-Futures and index optionsCurrently in the beta test phase.

-Crypto expansionIntroduction of Ethereum staking and preparation for the EU market by 2025.

Banking services

-Cash CardCashback rewards and automatic investment options for small amounts.

Important operational progress

-Securities lending34% increase in revenue to 59 million USD.

-Cash sweep: Growth to 24.5 billion USD (+83 % YoY).

-Cash and cash equivalents: Over 5 billion USD available in cash and investments.

-Share buybackProgram worth 1 billion USD97 million USD invested in Q3.

Current institutional investors of Robinhood Markets, Inc. (as of 2024) include some of the largest and best-known financial firms in the world.

The top institutional shareholders are:

-Vanguard Group Inc. - Holds approx. 7,72 % of the shares, representing approx. 2.69 billion USD which amounts to.

-BlackRock Inc. - Owns 4,10 % of Robinhood's shares, which also represents a value of approximately 1.42 billion USD equivalent.

-Ribbit Management Company LLC - Also holds 4,10 % of the shares, which amounts to approx. 1.42 billion USD in total.

Customer-centric innovation

-Real-time analysis tools:

New features such as advanced chart analysis and automated trading signals were introduced in 2024.

-Educational offerings:

Interactive tutorials and investment trainings help investors to expand their financial knowledge.

-Social integration:

Planned features such as social trading and community interaction are under development.

Future outlook

Robinhood plans to further expand its product portfolio by introducing robo-advisory services and AI-powered investment solutions.

The combination of innovation and international expansion positions the company as a leading player in the digital finance industry.

Technological innovation and customer experience

Automation and AI:

-Robinhood implemented AI-powered trading algorithms and portfolio optimization tools designed specifically for users who want to rely on data analytics and automated decision making.

-Personalized recommendations:

Through machine learning, the platform provides clients with customized recommendations based on their trading activity and financial goals.

Improvements to the client experience

-User friendliness:

Robinhood relies on intuitive design principles. The platform offers simple navigation, easy-to-understand tutorials and interactive diagrams to make it easy for beginners to get started.

-Realized Profit & Loss Tool:

New tools that allow investors to better analyze profits and losses from previous trades and strategically optimize future decisions.

-Customer support and education:

Introduction of enhanced 24/7 customer support, including a chatbot for quick responses and an expanded help center.

-Educational offerings:

Interactive learning modules and videos are integrated into the app, covering topics such as long-term investment goals, crypto investing and risk management.

-Rewards and cashback programs:

With the new Robinhood Cash Card, customers can earn cashback rewards that can be reinvested directly into their favorite asset classes. This supports automatic wealth accumulation, even for small everyday expenses.

-Enhanced mobile and desktop functionality:

Synchronized trading platforms that provide clients with a seamless experience between desktop and mobile devices. Users can implement their trading strategies on the go without sacrificing functionality.

Current innovations and plans

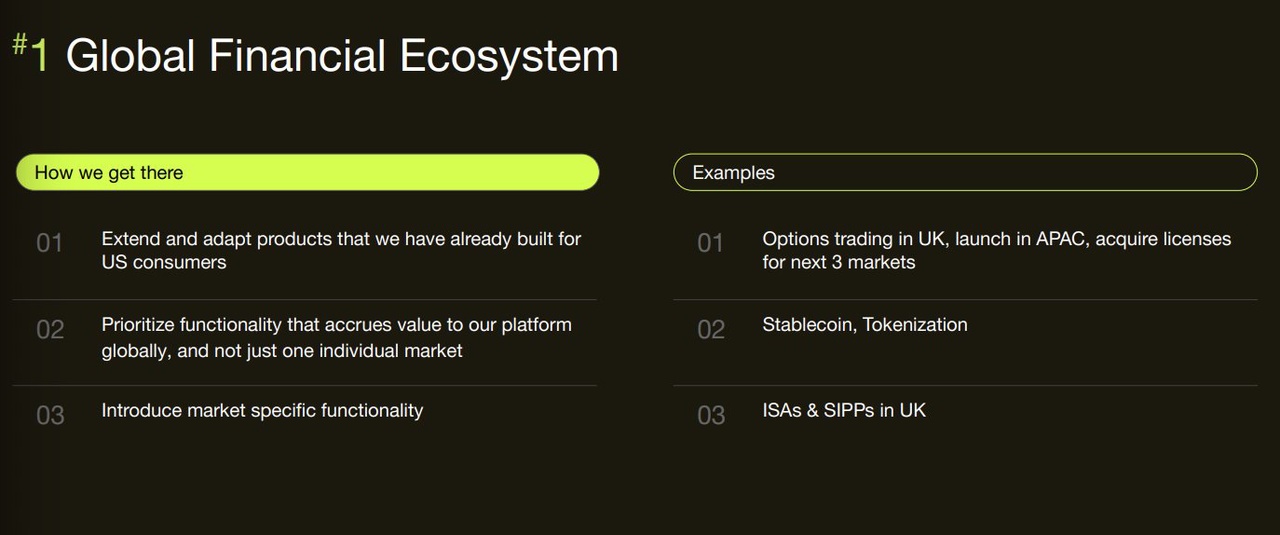

-International expansion:

Robinhood plans to launch its platform in Europe and Asia with localized features. Cultural and regulatory differences will be taken into account.

-Social Trading:

Features under development will allow users to share trading strategies and learn from the community.

-Expansion of index options:

There are plans to introduce specialized trading products for investors who want to benefit from market movements without investing directly in individual stocks.

Global expansion of Robinhood: target markets and client numbers

Robinhood has accelerated its international expansion in recent years in order to increase its market share outside the US and benefit from the growing demand for digital investment solutions.

Status of the expansion 2024

Robinhood is currently mainly focused on the US market, but is working hard to enter new markets:

-United Kingdom:

After a temporary withdrawal in 2020, the UK market was developed as the first international location in 2024. Robinhood offers brokerage, margin and crypto services there.

The focus is on commission-free trading and the introduction of the Robinhood Wallet.

-Europe:

Robinhood plans to expand into other European countries with a focus on crypto services and commission-free stock markets. Countries such as Germany, France and the Netherlands are seen as promising markets.

The introduction of stablecoins and new crypto services is intended to meet the needs of European customers, particularly through regulatory clarity in the EU.

-Asia and Australia:

Robinhood is exploring market entries in high-growth regions such as India, Southeast Asia and Australia, where interest in equities and cryptocurrencies is growing strongly.

Forecast of the number of customers

Robinhood recorded the following worldwide in 2024 24.3 million active financed customers and aims to reach over over 30 million users users by 2025.

As of Q1 2024, Robinhood has reported 24.3 million net-funded customer accounts, with 11.8 million monthly active users as of October 2024.

These figures show that Robinhood continues to have a growing customer portfolio, which is also supported by a strong expansion of its international presence. Most notably, the company is seeing clear demand from users with a strong interest in trading stocks, cryptocurrencies and other asset classes.

The increase in customer numbers is an important indicator of investors' growing confidence in the platform, especially in terms of ease of use and access to various financial products.

It should also be noted that Robinhood is expanding its reach into new markets such as the UK, which offers the potential for further growth.

Despite the stable growth, it remains a challenge for Robinhood to cover the high acquisition costs while remaining profitable.

The company must continuously develop innovative products and attractive pricing models in order to maintain competitiveness and expand in the long term.

According to estimates, entry into the European markets over the next five years could add a further 10 to 15 million more users over the next five years.

In Asia, a potential of at least 5 million new users expected in Asia in the period 2025-2028, based on the high acceptance of cryptocurrencies and mobile trading platforms.

Challenges and competition

-Regulatory hurdles

Regulatory requirements are a significant hurdle, especially for companies like Robinhood that want to expand internationally.

In Europe and Asia, Robinhood must adapt to local laws and regulations, which adds complexity and cost.

In the European Union, for example, financial services providers like Robinhood must comply with the strict requirements of MiFID II and the General Data Protection Regulation (GDPR).

While Robinhood has already successfully expanded into the UK market, adapting to different regulatory frameworks remains a challenge.

The company is therefore working closely with local regulators to facilitate authorization in new markets.

-Technological adaptation

Localizing the platform is one of the biggest challenges when expanding into new markets.

Robinhood must not only adapt its platform linguistically and culturally to the needs of new users, but also ensure that local currencies and trading habits are taken into account.

In Asia and Europe, investor expectations are often different in terms of functionality and user experience, which is another hurdle to scaling.

The platform must also ensure that it meets all local regulatory requirements, which may require additional technological adjustments in some markets.

Strategic initiatives

-Partnerships with banks and fintechs

Robinhood has actively sought partnerships with local banks and fintech companies to accelerate market penetration and facilitate access to new markets.

In Europe and other regions, it is critical to partner with local financial institutions to meet regulatory requirements and gain user trust.

Through strategic collaborations, Robinhood can leverage local infrastructure, increase brand awareness and improve customer service.

One example of this is the partnership with JPMorgan in 2021, which enabled Robinhood to manage and scale its accounts and payment methods more efficiently.

-Education and training

Robinhood invests heavily in interactive educational offerings to attract new customers to the platform and further engage the existing user base.

These initiatives are particularly important as Robinhood often recruits its users from the younger generation (Millennials and Gen Z), who often have less experience with investing.

The company offers extensive learning resources, including articles, videos and tutorials on various financial topics, from basic stock purchases to more complex investment strategies.

These educational offerings are designed not only to make it easier to get started in the financial markets, but also to boost users' confidence and build long-term customer relationships.

-Targeted marketing strategies

Marketing plays a key role in Robinhood's strategy for expansion, particularly in Europe and other international markets.

Robinhood relies on large-scale marketing campaigns to raise awareness of the platform and attract new users.

Especially in Europe, where competition is intense, the company is investing in digital advertising, social media campaigns and influencer marketing.

Robinhood has recognized that young, tech-savvy people who are active on social media in particular offer great potential for the use of trading platforms.

Promotional campaigns and referral programs are also among the marketing tools Robinhood uses to attract new users.

-Expansion of customer service and support infrastructure

Another of Robinhood's strategic focuses is on improving its customer service and support infrastructure.

The company is investing in the expansion of call centers, chatbots and other digital support options to improve the user experience and ensure faster access to help.

In new markets, it is particularly important to adapt customer service locally, both in terms of language and cultural specifics.

Robinhood has already started to expand its support services into localized service centers to cater to international users.

-Localized marketing campaigns and influencer collaborations

In addition to traditional marketing strategies, Robinhood is increasingly using influencer marketing to reach younger target groups.

This goes beyond traditional advertising efforts and relies on trusted brand ambassadors who use their reach on social networks to promote the platform.

Influencers who have established themselves in the financial and investment world help to position Robinhood as a modern and accessible platform, especially among a younger, tech-savvy generation.

-Improved user experience and app optimization

Another key element of Robinhood's strategic direction is the continuous improvement of the user experience.

The app is regularly updated to include new features and tools that simplify the investment process and give users a better overview of their financial portfolios.

This includes personalized notifications, automated portfolio management tools and new analytics to help users make more informed decisions.

Strategic priorities

-Expansion of the product range:

Introduction of new trading products such as futures and strategy tools.

-Global expansion:

Expansion into Europe and Asia with a focus on cryptocurrencies.

-Customer satisfaction:

Expansion of premium services to retain wealthy customers.

Costs and revenue per customer at Robinhood

Customer acquisition costs (CAC)

Robinhood's customer acquisition costs (Customer Acquisition Cost(CAC) varies according to market strategy and growth phase. Historically, the CAC has been in the range of 20 to 50 USD per customerespecially during aggressive marketing campaigns and promotions.

In the past, Robinhood invested heavily in digital advertising and rewards programs to expand its customer base.

However, with the planned international expansion and increased focus on new markets, the cost per customer may temporarily increase as awareness needs to be raised in new regions.

Average revenue per customer (ARPU)

The average revenue per customer (Average Revenue Per UserARPU) amounted to 3rd quarter of 2024 amounted to around USD 79an increase of 36% compared to the previous year.

This figure is the result of Robinhood's various revenue sources:

-Transaction fees:

Revenue from trading stocks, options and cryptocurrencies, although no direct commissions are charged.

-Interest income:

Robinhood earns from the funds clients hold in their accounts and from margin services.

-Robinhood Gold:

Premium subscriptions for 5 USD per month, supplemented by interest income from borrowed amounts.

Long-term profitability

-Profitability per customer:

ARPU is well above the estimated CAC, indicating a profitable business model.

-Diverse revenue streams:

In addition to core functions such as trading, Robinhood also benefits from subscription services and interest, which can increase revenue per customer.

-Lifetime Value (LTV):

Since Robinhood often retains its customers for the long term, the profit margins per user can increase significantly over the years.

Scaling challenges

Robinhood faces several scaling challenges, both technical and operational.

A key one is the need to continually expand infrastructure to accommodate increasing trading volumes.

This requires significant investment in cloud technologies and improving platform capacity as share trading and the number of users have grown significantly in recent years.

Another problem concerns the fluctuations in trading activities and the associated business results.

Robinhood is heavily dependent on the trading activity of its users, which means that volatility in the markets or a slowdown in trading can affect revenue growth.

Such fluctuations often depend on external economic factors and general market sentiment, which is difficult for the company to predict and manage.

Regulatory challenges also play a major role in scaling Robinhood. As a financial services provider, the company must ensure that it complies with all regulations, especially in the areas of exchange trading and cryptocurrencies. This includes requirements such as complying with SEC regulations and maintaining best execution when executing orders. Any deviation can not only result in high penalties, but also affect user confidence.

International expansion is another critical issue. Robinhood has recently started to enter the UK and expand its offerings in Europe, but the regulatory and operational requirements in these new markets are complex and need to be carefully managed.

This concerns both the adaptation of the product offering and compliance with local financial regulations.

Finally, Robinhood faces the challenge of continuing to scale its business model to meet the market needs of a broad user base while ensuring profitability.

Competitors in a growing market

-E*TRADE

Competitive factor:

Comprehensive product range and market experience

ETRADE is characterized by a broad portfolio of financial products, including not only equities and options, but also bonds, futures and fixed income products.

Most importantly, it has a strong presence in long-term investing and provides extensive investor support through educational resources and advanced trading platforms.

This attracts both novice and experienced traders.

ETRADE also offers access to robo-advisory services, which is of interest to investors who prefer an automated investment strategy.

-Charles Schwab

Competitive factor:

Strong customer loyalty and established brand

Charles Schwab is a market leader in online brokerage services with over 40 years of experience.

The brand is known for its comprehensive customer satisfaction and user-friendly trading platform. Schwab not only offers commission-free trading, but also customized financial advice and a wide range of products for all types of investors.

A major advantage is the integration of robo-advisory services and personal financial advice options that appeal to both individuals and institutional investors.

-Fidelity

Competitive factor:

Extensive investment opportunities and long-term advice

Fidelity is another major competitor that stands out for its comprehensive investment options, including stocks, ETFs, bonds, bond funds and financial advice.

Its strong retirement plan offerings (e.g. 401(k) plans) and established reputation in long-term investing provide a major competitive advantage.

In addition, Fidelity offers advanced trading platforms and strong portfolio management tools.

-SoFi Invest

Competitive Factor:

Versatility and expansion of the range of services

SoFi Invest stands out with its versatile product range, which includes stocks, cryptocurrencies, bonds and even P2P loans. Particularly noteworthy is its strong focus on a young, tech-savvy audience, who benefit from the attractive conditions and easy access to a wide range of financial products.

SoFi also offers loans, insurance and educational services, making it a one-stop store for financial services.

-Webull

Competitive Factor:

Advanced trading functions and analysis tools

Webull is known for its advanced trading features and tools that appeal to active and tech-savvy traders.

Unlike Robinhood, Webull offers deeper insights into the markets, including technical indicators, real-time market data and advanced charting tools. These features make Webull a preferred platform for day traders and advanced investors.

-Cash App Investing

Competitive Factor:

Ease of use and integration with other financial services

Cash App is a strong competitor as it allows users to seamlessly switch between payment functions, bitcoin and stock trading.

The integration of peer-to-peer payments and the ability to invest in Bitcoin provides users with a versatile platform for managing their finances.

The ease of use and low entry price make Cash App particularly attractive for newcomers and young investors.

-Trade Republic

Competitive factor:

Low fees and user-friendly app

Trade Republic is particularly known for its low fees and user-friendly trading platform.

The app offers commission-free trading and an easy way to trade stocks, ETFs and options.

For European users, Trade Republic offers a clear and transparent pricing structure, making it an attractive alternative for commission-free trading.

In addition, the company is well established in a number of European markets and focuses on strong customer loyalty through educational offers.

-Revolut

Competitive factor:

Global access and integration of multiple financial products

Revolut is not just a broker, but a comprehensive financial ecosystem that allows users to invest in a variety of financial products, including stocks, cryptocurrencies and commodities.

Revolut's competitive edge lies in its integration of international money transfers, multi-currency management capabilities and commission-free trading, making it particularly attractive to international investors and frequent travelers.

Revolut also offers easy access to crypto investments and an advanced mobile app that is seamlessly integrated with other financial functions.

Robinhood's strengths and weaknesses

Strengths:

-Commission-free trading:

Robinhood has revolutionized the market with the introduction of commission-free trading, appealing especially to young, tech-savvy investors. This has made the company a popular choice for beginners and price-conscious users.

-Ease of use:

The platform offers an intuitive and easy-to-use interface that allows even novice investors to invest without much prior knowledge. This is a key factor that sets Robinhood apart from other traditional stock market providers.

-Innovations and product offering:

Robinhood has continuously expanded its product portfolio, including the introduction of cryptocurrency and crypto options trading.

Also, the introduction of features such as Robinhood Gold and new trading products also strengthens the offering.

-Accessibility for younger investors:

The platform particularly appeals to younger investors who want to enter the financial market without paying large fees.

Robinhood uses a strong digital marketing strategy to reach its target audience.

Weaknesses:

-Regulatory challengesRobinhood has encountered regulatory hurdles in the past, particularly in practices around payments for order flows and the controversial trading halt at GameStop.

This has led to legal and regulatory investigations that could affect the company's confidence and long-term stability.

-Dependence on payment flows:

A significant portion of Robinhood's revenue comes from payment for order flow (PFOF), leading to concerns about transparency and potential conflicts of interest.

This revenue stream could become more regulated in the future, which could put pressure on the business model.

-Problems with infrastructure and customer service:

In the past, there have been recurring technical problems and outages on the platform that have affected user confidence.

For example, there was an incident in which thousands of users were unable to execute their trades due to technical errors.

Customer service has also been repeatedly criticized for often being overloaded and having difficulty responding quickly to requests.

-Security concerns:

Like many digital platforms, Robinhood has been the target of cyberattacks. Although the company has taken security measures, protecting customer data and funds remains a constant challenge. With the increasing importance of online trading platforms, companies like Robinhood must continually invest in security infrastructure to maintain user trust.

-Lack of diversification:

Robinhood has focused heavily on trading stocks, options and cryptocurrencies.

Compared to traditional banks or full-fledged brokerages, the company offers limited additional financial products, such as retirement options.

This lack of product diversification can make it difficult for Robinhood to capitalize on multiple revenue streams and limits its appeal to investors with more complex needs.

-Lack of customer loyalty:

Another issue that could affect Robinhood is the low retention of customers on the platform. Many users use Robinhood for short-term trading without making long-term investments.

This could jeopardize the company's long-term growth and profitability, as the platform may struggle to retain loyal customers.

-Controversies and legal risksRobinhood has repeatedly been at the center of legal controversies, mainly due to its business practices, such as the payment of order flows and the way it handles "meme shares". Such legal risks and controversies could not only affect customer confidence, but also lead to costly lawsuits and regulatory challenges.

Payment for Order Flow (PFOF)

Is a practice in which brokerage firms like Robinhood receive payments from market makers or other financial institutions to route their clients' orders.

These payments occur when Robinhood does not execute its users' trades directly on exchanges, but instead to market makers who pay a fee to Robinhood in exchange for the right to execute those orders.

How does Payment for Order Flow work?-Transparency and orders:

Instead of routing client orders directly to exchanges as traditional brokers do, Robinhood often sends these orders to market makers who are willing to pay a fee to execute the order.

Market makers can then profit from the difference between the buy and sell price (spread).

-Commission-free tradingRobinhood has structured its business model through PFOF so that users do not have to pay commissions. Instead, Robinhood earns through these payments, which is an incentive for many customers to use the platform.

About 75-80% of Robinhood's revenue comes from PFOF, which accounts for the majority of its revenue.

Criticism and regulatory challenges

-Conflicts of interest:

One of the biggest concerns associated with PFOF is that it can lead to conflicts of interest. Brokers like Robinhood could be tempted to pass orders to market makers who offer them higher payments instead of ensuring the best price for their clients.

-Regulation:

PFOF has come under increased regulatory scrutiny in recent years. In the US, there are ongoing debates about whether this practice compromises transparency and fairness in trading.

The Securities and Exchange Commission (SEC) has stated that it will continue to investigate the practice to ensure that investors are not disadvantaged.

Robinhood has also faced regulatory challenges in the past, including a increased oversight by the SEC for possible disregard of best execution of client orders.

Support for the practice

-Free trade:

Proponents argue that PFOF allows Robinhood to offer commission-free trading to its users. This structure allows smaller investors to trade on competitive terms without paying high fees.

-Efficiency and liquidity:

Market makers argue that PFOF allows them to bring more liquidity to the market and make trading more efficient. They claim that payments for order flow reduce trading costs for users by creating additional market liquidity.

Abstracts:

PFOF has greatly impacted the business model of Robinhood and similar platforms, allowing them to offer commission-free trading.

However, there are serious concerns about transparency and the potential impact on the best price for the customer.

The regulatory landscape around PFOF remains dynamic, and Robinhood, as well as other players, must continue to grapple with the regulatory challenges associated with this practice.

Share performance and analyst views

The share performance of Robinhood (HOOD) over the last 12 months shows a volatile but overall positive development.

The share price was around USD 40.20 at the beginning of December 2024.

However, compared to the 12-month average targets, the company has a slight downside expectation of around 5.14%.

Current analyst opinions on Robinhood are predominantly positive.

The consensus of 15 analysts gives the stock a rating of "Moderate Buy" with an average price target of USD 38.13. Some analysts, such as Patrick Moley from Piper Sandler and Michael Cyprys from Morgan Stanley, have raised their price targets recently to up to USD 55 .

While some analysts consider the share price to be undervalued, there is a wide range of target pricesranging from USD 21 to USD 55 .

This indicates that market sentiment is partly optimistic and partly cautious, with the growth potential still being recognized.

Overall, analyst sentiment on Robinhood is broadly positive as the company continues to capitalize on its market democratization strategy democratization strategy and new business opportunities in areas such as cryptocurrency and international expansion.

Planning, Robinhood in the first or second quarter of 2025 in my portfolio as I find the company extremely exciting in the long term.

I think it is possible that Robinhood similar customer markets and business areas as NU Banking in the future.

Or maybe I would just like to have Robinhood's classy bank card.

$HOOD (+3,38 %)

$FBK (-0,97 %)

$NU (-0,2 %)

Best regards

Michael

Graphics: Robinhood /Bank card Sam Altman